The finances of would-be home buyers are being stress-tested by banks at rates as high as 9%. Even though the bank might be charging 7% on the mortgage, they need to know that homeowners can still pay their mortgages if interest rates rise higher than they are now.

High test rates mean many buyers are pre-approved for lower sums than they were expecting. Those who let pre-approvals lapse this time last year are finding their spending power cut by $50,000 to $150,000 this year, mortgage advisers have told OneRoof.

Buyers are finding the sums they were pre-approved for by banks have fallen considerably since this time last year.

Aseem Agarwal, head of mortgage at Global Financial Services, says current bank test rates range from 8.75% to 9.1%, telling OneRoof they’ve moved hand in hand with rises in the Official Cash Rate and mortgage interest rates.

Start your property search

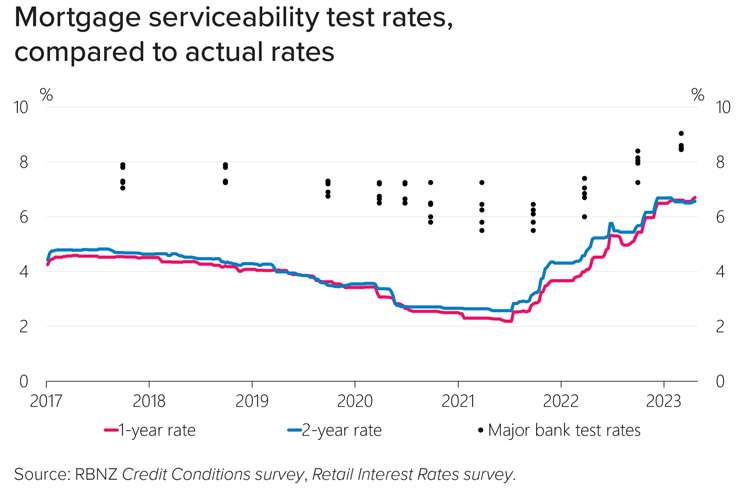

He says the gap between test rates and mortgage rates has narrowed in recent months, meaning that homeowners aren’t being tested at such a high differential as they were in 2020/21.

“When the [mortgage] rates were sitting at 2% we had banks assessing around 6%. That margin has now halved. It’s about a 2% gap,” he says.

The chart shows the difference between test rates and bank mortgage rates. Photo / Supplied

The reason for the narrowed differential is twofold, says Agarwal. “The first is banks don't expect the interest rate to hit 9% because everyone is saying the OCR has peaked domestically.”

The second reason is that anything over 9% would severely limit what buyers could pick up in the current market.

Rising test rates are a problem for people who were pre-approved previously, but didn’t buy, says Agarwal. When they go back to the bank to extend the pre-approval, they are finding what they can borrow has shrunk. “Previously they were searching for say a $900,000 property, but now they have to search for an $850,000 property,” he says.

“The first reaction is surprise. They’re like, ‘Why would the bank be doing [this]?’ The second reaction then is to either take a step back and postpone their search, or find something smaller within their budget, given that they don’t have the deposit to make up the gap.”

Read more:

- Risk that house prices could rise faster than expected

- Desperate buyers racing against the clock before banks pull their funding

- Homeowners having to find an extra $1200 a month

Agarwal predicts that come spring and summer, the banks will want to lift the volume of mortgages they are writing and could decrease the test rates.

“But it all depends on what the economic climate is like,” he says. “If, for example, unemployment rises and people start to lose jobs, then the banks wouldn't want to tinker with the test rates too much. They would want to make sure that people can really [make it] through that tough period.”

Jeff Royle, mortgage adviser at iLender, says test rates are having a real dampener on what buyers can pay. “I spoke to a senior person in a bank the other day and he said somebody who got a pre-approval a year ago, at $600,000, but didn’t [buy] and has come back with a salary increase of say 5% to 10%, can only borrow $450,000 to $500,000 because of test rates.”

House prices have come down but mortgage rates – and test rates – have gone up. Photo / Fiona Goodall

The painfully high test rates hit buyers at a time when other measures such as loan to value ratios (LVR) are being eased by the Reserve Bank. “Banks are now able to lend up to 15% of [their loans] at over 80%. There is definitely demand [for higher LVR lending]. However, generally the bank will charge a margin on the rate. That’s a double whammy.”

The Credit Contracts and Consumer Finance Act (CCCFA) is still getting in the way of some borrowers, says Royle. He has one homeowner who is currently paying 11.5% to a non-bank lender. The homeowner is unable to refinance with a bank because he failed to pass serviceability at a test rate of 9%. “Under the blinkin CCCFA (the client) doesn’t service, according to the calculator, whereas he is actually paying 11.5%. If we could have refinanced him, we would have saved him $600 a week in interest payments.”

Campbell Hastie, of Hastie Mortgages, says the narrowing of the gap between test rates and actual mortgage rates isn’t making borrowing easier. “In 2019 it was about 300 basis points. Now it’s more like 250. Does that mean borrowing has become comparatively easier? No it doesn’t and that’s because the stress test itself is only part of the affordability picture.”

The test rates differ by bank. They aren’t typically publicised, however mortgage advisers will be aware of the various banks’ test rates. There are other tricks in relation to test rates such as:

• With rental properties, only 75% of the rent will be taken in consideration as income against test rates.

• For owner-occupiers with boarders or flatmates, only half of the income is counted.

• The test rates assume principal and interest repayments. The banks will not test for interest only, even for investors.

Ray White chief economist Nerida Conisbee: “Even if [rates] come down a bit over the next couple of years, within five years’ time they could be up again.” Photo / Supplied

Test rates can jump about. Hastie points out that until recently Westpac had a 9.5% test rate, then pulled it back to 9.1%.

Mortgage holders may question whether mortgage rates will rise to 9%, with the OCR believed to be at near its peak. The issue, however, says Ray White chief economist Nerida Conisbee, is that a mortgage lasts for 25 or 30 years. Although rates are unlikely to hit 9% in this cycle, there is no knowing what will happen in the future.

“[Mortgage applicants] need to acknowledge the fact that you have a home loan for a long time. So even if [mortgage rates] do peak now, even if they come down a bit over the next couple of years, within five years’ time they could be up again. So it's important that people can service a loan at a higher rate because of how long they have a home loan for.”

She says some buyers would be able to pay 9% whereas others would be on the edge.

Use the search field to find out the best mortgage deals available today.