About 12 percent of Kiwi houses earned more than the average Kiwi in the last five years, new research from property website OneRoof shows.

OneRoof and its data partner Valocity looked at areas with the longest time between sales and biggest equity gains to identify where homeowners could be sitting on a goldmine.

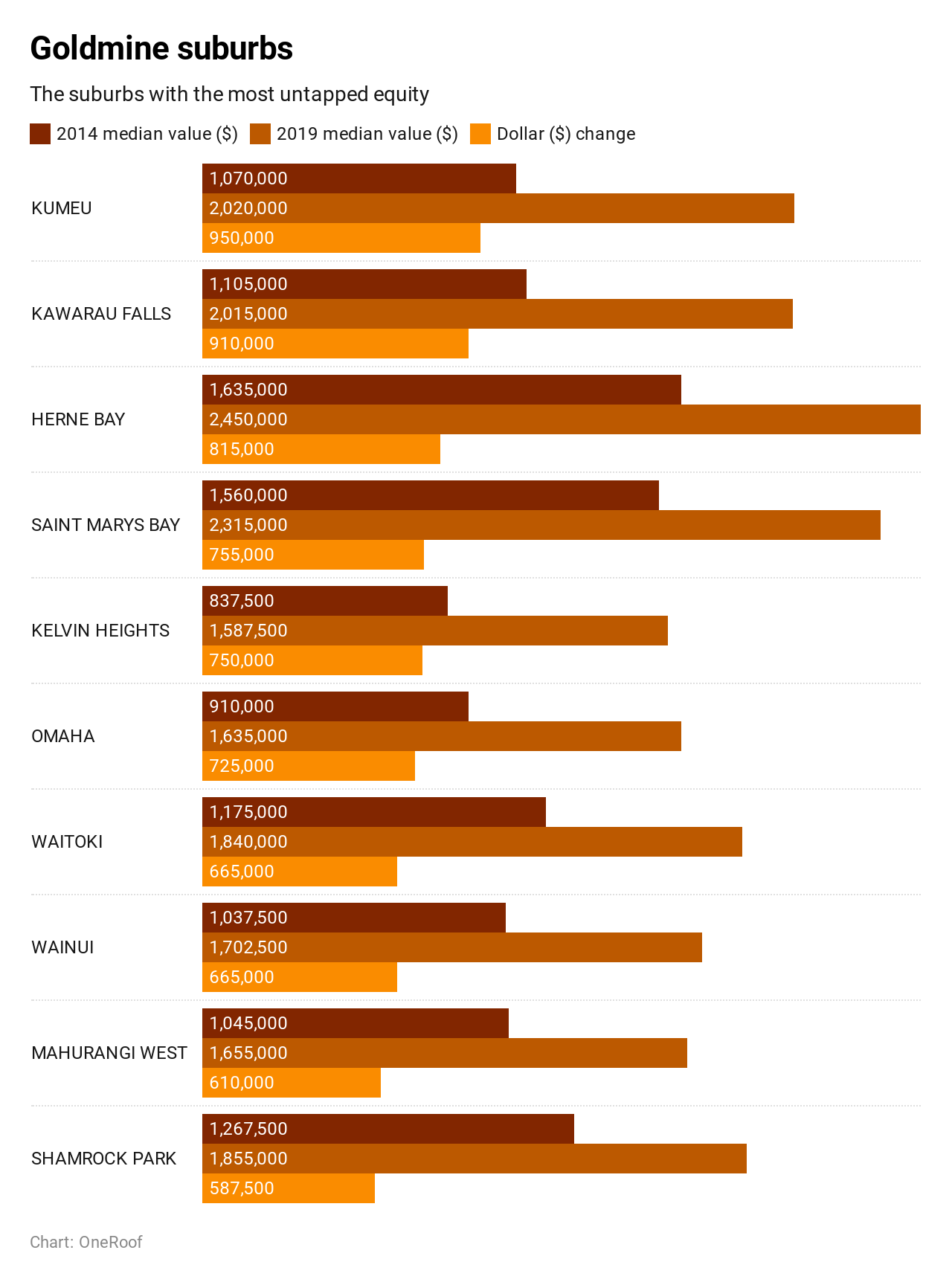

According to the figures, some suburbs had close to a million dollars in untapped equity, with Kumeu in north-west Auckland seeing the biggest gain, at $950,000, followed by Kawarau Falls in Queenstown with $910,000.

Start your property search

OneRoof editor Owen Vaughan says: “We found 402 suburbs that saw median value growth between 2014 and 2019 of more than $250,000 - the amount of money someone on the average wage would have earned in the same time period.

“That means that there are potentially at least 225,000 properties that earned more than a median wage or salary earner.”

However, James Wilson, head of valuation at Valocity, adds: “It’s important to remember that we are talking about median values and average incomes here, so the research does not reflect what has happened to every individual property.”

Other goldmine suburbs identified by the research were: Auckland’s Herne Bay, where homeowners could be sitting on $815,000 in untapped equity; neighbouring St Marys Bay, with $755,000 in untapped equity; and Kelvin Heights in Queenstown, which saw a median value gain of $750,000.

Omaha, north of Auckland, saw gains of three-quarters of a million dollars between 2014 and 2019. Photo / Getty Images

The wealthy beach suburb of Omaha to the north of Auckland amassed $725,000 in gains and was followed by the side-by-side Rodney suburbs of Waitoki and Wainui, which both saw gains of $665,000.

These were followed by Mahurangi West on the Matakana Coast with a $610,000 median value gain and then Shamrock Park in east Auckland with $587,500.

The data revealed homes in lower-priced areas also saw strong equity gains, with Wellsford, to the north of Auckland, for example, gaining an average of $220,000 in five years.

Wilson says for Auckland some of the largest value growth for properties that existed in 2014 has taken place on the outskirts of Auckland, in suburbs such as Kumeu, Puhoi, Coatesville and Whitford.

“This is mostly fueled by a change in the nature and property use in these areas as they transition from lifestyle to urban property types.”

Queenstown was another location where homeowners have benefited greatly. Photo / Getty Images

The lowest median time between the first two sales is occurring in areas of intense newer builds, such as, Flat Bush, Hobsonville, Takanini and Silverdale, which is to be expected as new areas are established.

Wilson says when the data was refined to focus only on established suburbs, the top five in Auckland with the most value growth and the least churn time between sales were all, perhaps not surprisingly, coastal, sought-after areas - Kohimarama, Mission Bay, Herne Bay, Mairangi Bay and Omaha.

“This reveals that on paper homeowners in these locations have some of the greatest dollar equity in their homes generated during the last property boom, with the suburbs earning a median value of $49,000 per annum during this time.

“This makes sense given the high value nature of these locations, but when we narrow the scope of this analysis to areas with a median value of under $700,000, the top five areas of largest value growth and highest number of years between sales are Papatoetoe, Papakura, Clover Park, Eden Terrace and Wellsford.”

The lower value suburbs also have a shorter time between sales which Wilson says is because these areas are popular among first home buyers and investors who typically adopt shorter holding periods as they either upsize or sell on their investment.

Reactions to the gains varied. In Omaha, known as “the Hamptons” for rich Aucklanders, a local agent said owners were so wealthy even an equity gain of $725,000 in five years wouldn’t have much impact on them.

In Wellsford, however, Bayleys agent Andrew Rumble said while a gain of $220,000 looks great on paper it wasn’t necessarily good sense for people to use it to upgrade their home as they might not be able to easily replace what they have.

“People will say things like ‘hell, we paid $300,000 four years ago and now it’s worth $500,000’ and it kind of gobsmacks them, but the downside is that it means ‘we can’t afford to move because if we sell it whatever we’re going to buy is now over-priced.”

And in once-rural Kumeu, which saw the biggest equity gain, an agent pointed out the property market in what had been an area of big development was now struggling because of traffic issues.

“We’ve got people that are renting out houses because they can’t get the price they want and they don’t want to take a loss on so they’re putting tenants in and waiting for the market to come right,” said Bob Howard from Harcourts Kumeu-North West Auckland.

Advice on what people should do with their equity gains, if anything, was varied.

John Bolton, Squirrel mortgage company founder, said the money could be leveraged in various ways, such as upsizing the family home or by buying an investment property, or by downsizing and freeing up equity.

Money makes money, Bolton says: “You build up all this equity, now your job is to get it working harder for you.”

Sharon Zollner, chief economist for the ANZ, cautioned that people taking their “wins” from property equity then faced the problem of what to do with the money as property is so expensive to buy and returns on investments are low.

“Everyone, from someone who’s got a $20,000 term deposit up to fund managers managing billions, are all facing variations of the same thing, which is ‘where on earth do I put my money?’”