Australians were addicted to debt. Now we're breaking the addiction. The new question is whether we can survive the withdrawal symptoms.

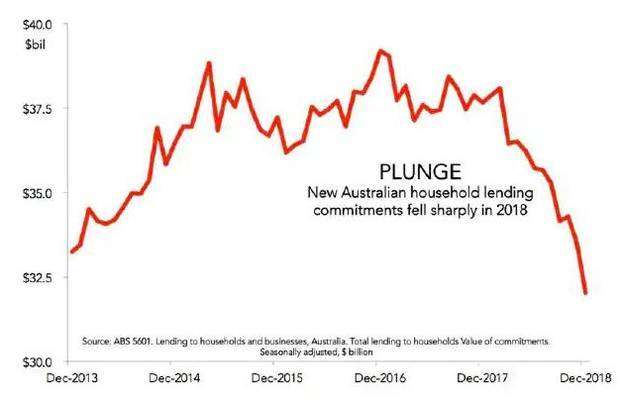

Australians are reducing debt in many places. We are cutting the value of loans but also the number of them. We are borrowing less for investment housing but also for owner-occupier. We're limiting housing debt and also personal debt. This is wide-scale change.

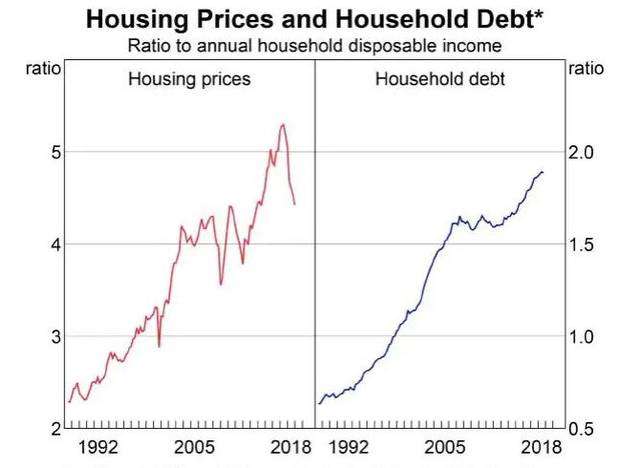

Australia's household debt levels got worryingly high. We have A$1.8 trillion ($1.87t) in housing debt, and it has been rising fast. So a bit of caution is good news. But going cold turkey on debt is concerning too.

Start your property search

We divide the economy up into three parts — households, government and business. Government and business debt are not especially high at the moment. The trouble is with households. The majority of that is mortgages. Our household debt levels have hit record highs as the next graph shows.

High debt is dangerous. If there is an economic shock — like a recession — people with high debt need to reduce their spending to meet repayments on the debt, sell their assets or even default on the loans. That amplifies the shock.

Debt makes our economy more like a Formula One car. It can run fast and tight so long as everything is going well. But it is more fragile with less buffer when things go wrong.

Reducing debt before there is a shock is good news but not like this. If we all stop borrowing at once the flow of money we call the economy could slow down.

This is the risk of deleveraging.

Debt can be good

Debt is best where it buys something that produces income in future. That income helps pay off the loan — like borrowing to start a successful business, or getting a qualification that helps you earn more.

Government debt is the same. If it's used to build infrastructure that grows the economy then the debt pays for itself.

The problem is Australia's household debt is largely invested in things that make no money. We are not invested in businesses. We are invested in housing.

Now that the value of houses is falling on a national basis, the risk of this kind of debt is becoming extra clear.

What is leverage?

They call debt "leverage". A lever is a thing that helps you use a little bit of your strength to move a large object. So the metaphor is that borrowing money helps you use a little bit of your own money to buy something big — a small deposit to buy a big house, for example.

Sometimes you will hear financial commentators say "households are highly leveraged" — meaning a lot of debt. It's a bad metaphor, though. If you use a lever you don't owe that lever anything. It doesn't follow you around for 30 years taking money out of your account every fortnight. Debt does. That's a problem.

What the Australian household sector is planning to do is called deleveraging. Reducing debt. Investment bank Morgan Stanley reckons Australia's deleveraging process is most likely to be "benign". But it notes that is not a sure thing. "Having said that, the risks are skewed to the downside."

One big downside risk comes from China. It is suffering from America's misguided trade war. If China has a recession and cuts purchases of our exports, the Australian economy could take a mighty blow.

Backup

The need to panic is limited for now. While Australian households have no more room for debt, the Federal Government's balance sheet is not looking too bad. We have government debt of around A$500 billion, but as a share of GDP it is less than in the past, and we are in far better position than many other countries.

If the economy did start to fall apart because households stopped borrowing, the government could borrow and spend instead. This is an example of fiscal policy — using government spending when necessary to strengthen the economy.

It could be a great time to take on the good kind of debt — to build infrastructure and other long-lasting assets that will make Australia stronger and wealthier in future.

- news.com.au