Herald data journalist Keith Ng created a financial model of a rental property to test claims that investors pay their fair share in taxes, and see what they might pay if a capital gains tax is introduced.

Some property investors claim that a CGT is unnecessary because they already pay their fair share in taxes, but how much do they really pay under the present system? The web of expenses and deductions mean that it's hard to generalise, so we built our own financial model to look at how all these deductions add up, and where the tax advantages come from.

According to our model, a $600,000 investment property with a $200,000 deposit would pay around 12.1 per cent in taxes and rates over 25 years. If we only include taxes, this falls to 5.7 per cent.

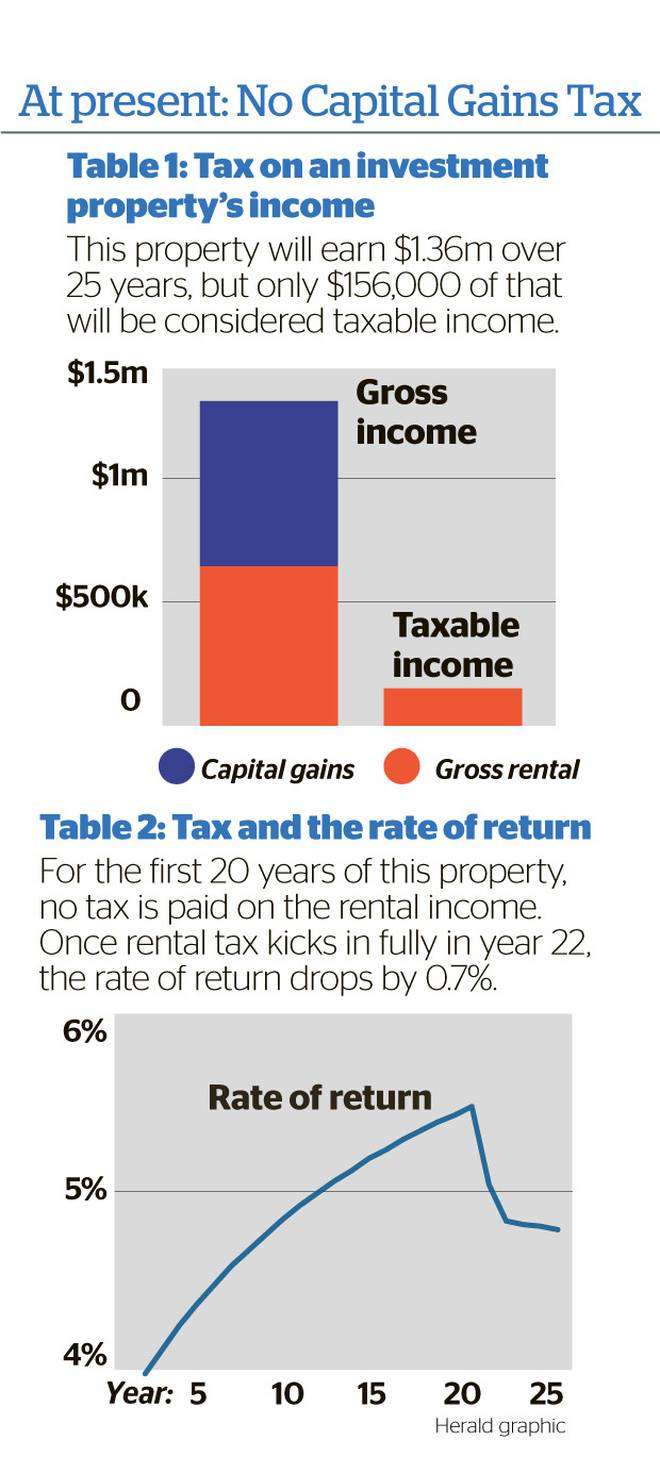

Why is it so low? The property in our example would earn $694,000 in capital gains and $670,000 in rent (after expenses) over its lifetime, while costing $456,000 in mortgage interest. In principle, the property has earned $908,000. But capital gains are not taxed at present, so the mortgage interest is deducted entirely against the rental income, leaving a taxable income of $156,000.

Start your property search

The total tax bill is $51,000 over 25 years, or 5.7 per cent of the $908,000 earned.

This is a double-dip tax advantage. The cost of the mortgage - which finances both the capital gains and the rental income - is deducted entirely against the rental income. This leaves the rental income undertaxed, in addition to the capital gains not being taxed at all. In the case of this model property, no tax is paid for the first 19 years.

We can see the impact of this tax benefit on the rate of return - how much profit you make from your investment each year.

Early on, tax deductions mean that the property pays no tax, but because the mortgage is large, the high cost of servicing the mortgage keeps the rate of return low. As the mortgage is paid off, the cost of servicing reduces and the rate of return gradually improves.

By year 11, the property is starting to move into its sweet-spot. Enough of the mortgage has been paid off so the property is cashflow positive, but the losses from the previous years are carried over, so that the property continues to pay no tax. This continues until the property reaches its most profitable point around year 20.

When the last of the carryover losses are used up, the property finally pays taxes on its rental income. The net return on equity falls by around 0.7 per cent.

Tax timing

The proposed CGT would tax capital gains at your personal tax rate, which is higher than what you'd pay if you invested in a portfolio investment entity (PIE). But even though the rate is higher, the difference in when the tax is collected matters.

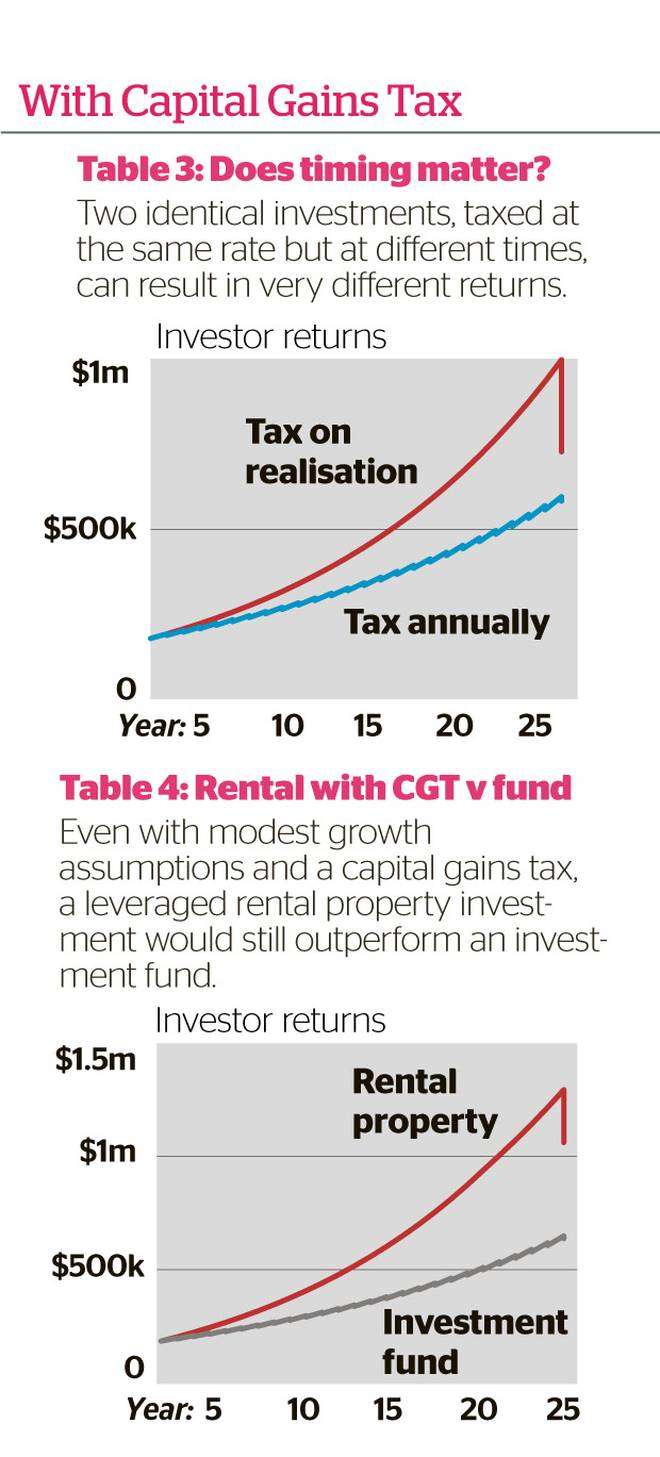

In these two examples we have two identical $200,000 investments growing at 6.67 per cent for 25 years. One line is taxed 33 per cent annually, while the other is taxed 33 per cent at the end.

They are taxed at the same rate, but they do not end up with the same returns. The investment that's taxed at the end earns compound growth on everything, while the line that's taxed annually loses part of its growth immediately, along with the compound growth that would've come with it. In this scenario, that amounts to a $142,000 difference.

The proposed CGT would be applied at the end, meaning that it has this timing advantage over investments which are taxed when gains are made.

Is property still profitable?

Our model assumes a modest after-expenses rental yield of 2.6 per cent and capital gains of 3 per cent, which is considerably lower than the assumed long-term yield for investment funds of 6.67 per cent. But despite the lower returns, rental property still outperforms investment funds by a large margin - even if a capital gains tax was added.

The key driver for this is leverage. The ability to borrow against a property means that a property investment could be earning rental and capital gains income on 2-3 times the value of the equity. The interest is then tax deductible, which reduces the cost of borrowing.

This borrowing advantage means that even if a capital gains tax is introduced, property investors can still come out ahead.

* Model assumes a $600k property paid for by a $200k deposit and $400k loan. Capital gains assumed at 3%, rental yield at 4%, loan interest rates 6.5%, and capital gains tax and rental income taxed at 33%.

** This is not financial advice.

- New Zealand Herald