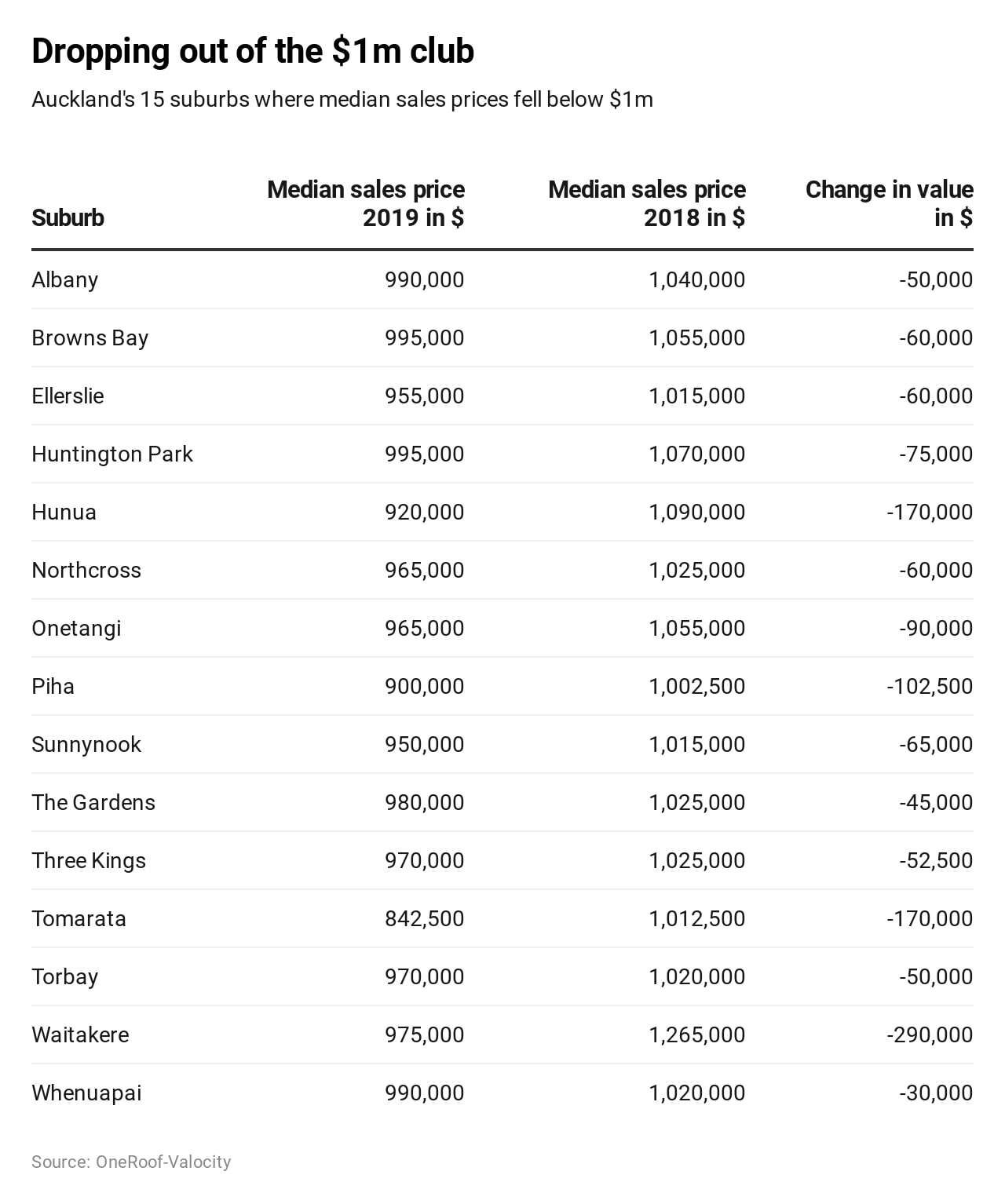

Fifteen suburbs have tumbled out of Auckland's "magic million-dollar club" after a year of sliding house prices in the country's biggest city, new figures from OneRoof.co.nz show.

Experts say first-home buyers and subdivisions are to blame for the falls.

It meant homes in inner city Ellerslie now typically sold for $60,000 less than a year ago after the suburb's median sales price fell from $1.015m to $955,000, according to the data in the latest OneRoof Property Report to be released on Monday.

Browns Bay homes in the North Shore were now also going for $60,000 less after its sales price fell to $995,000.

Start your property search

Other popular suburbs to drop below the $1m price tag included Torbay, Three Kings and Northcross.

James Wilson, from OneRoof's data partner Valocity, said the falls were because of more first-home buyers buying and fewer established homeowners - also known as movers - looking to sell and buy better properties.

"People wanting to sell and upgrade to larger homes are now often finding mainly first-home buyers in the market, meaning they may have to soften their sale price a wee bit to meet that demand," he said.

It comes as Auckland's house prices have now been on an 18-month fall. The latest $885,000 median value is down 1.7 per cent compared to a year ago.

The percentage of Auckland suburbs carrying a million-dollar-plus median value has dropped from about 50 per cent at the start of the year to 46 per cent now.

OneRoof editor Owen Vaughan said the fall in million-dollar suburbs would likely have a psychological impact on homeowners.

"The million-dollar price threshold has been a status marker in the New Zealand property market ever since Herne Bay first broke the barrier in the early 2000s," he said.

"Homeowners in Auckland tend to obsess about which price bracket their property is in and how it compares to the rest of New Zealand."

Among the forces pushing Auckland prices down recently was a dramatic drop in the number of luxury Auckland homes selling, as well as fewer movers looking to upgrade.

It meant the most common buyers were first-home buyers, who typically sought out cheaper homes.

Valocity's Wilson cautioned that the changes in median values were reflective of what houses had been selling for recently, rather than a measure of the individual value of homes in a suburb.

"By no means are all homes crashing in value. This data is just showing what kinds of stock is selling," Wilson said.

Some of the fallers

Torbay and Three Kings

North Shore's Torbay and inner city Three Kings - where prices are down about $50,000 compared to a year ago - highlighted the first-home buyer effect. Torbay prices were being dragged down by sellers' willingness to bargain with first-home buyers, Wilson said. Meanwhile in Three Kings, an "upcycling" had resulted in more new apartments and townhouses being built and snapped up by first-home buyers, while those owning more expensive properties in the suburb were choosing to sit still rather than sell.

Whenuapai and Albany

Whenuapai had once been home to lifestyle blocks but was now a first-home buyer hotspot as cheaper new builds hit the market, Wilson said. Similarly, Albany had been launched with a mix of larger and smaller new builds, and it was cheaper blocks doing the most sales at the moment.

Mission Bay

Mission Bay was one of eight suburbs that fell below the $1.5m mark. Expensive homes weren't selling in the suburb, but first-home buyers were "weeding through" the few cheaper units and apartments in the area. "First home buyers - who might have bought in Onehunga or Meadowbank - are now saying, 'well, actually we might prefer to live in a smaller home in Mission Bay now we can afford it'," Wilson said.

- New Zealand Herald