The New Zealand housing market has started 2020 on the front foot, with the nationwide median property value up 3 percent year on year to $620,000.

Interest rates are still cheap, and there is no sign of this changing in the foreseeable future - a boost to first home buyers, who continue to be the country's most active buyer group.

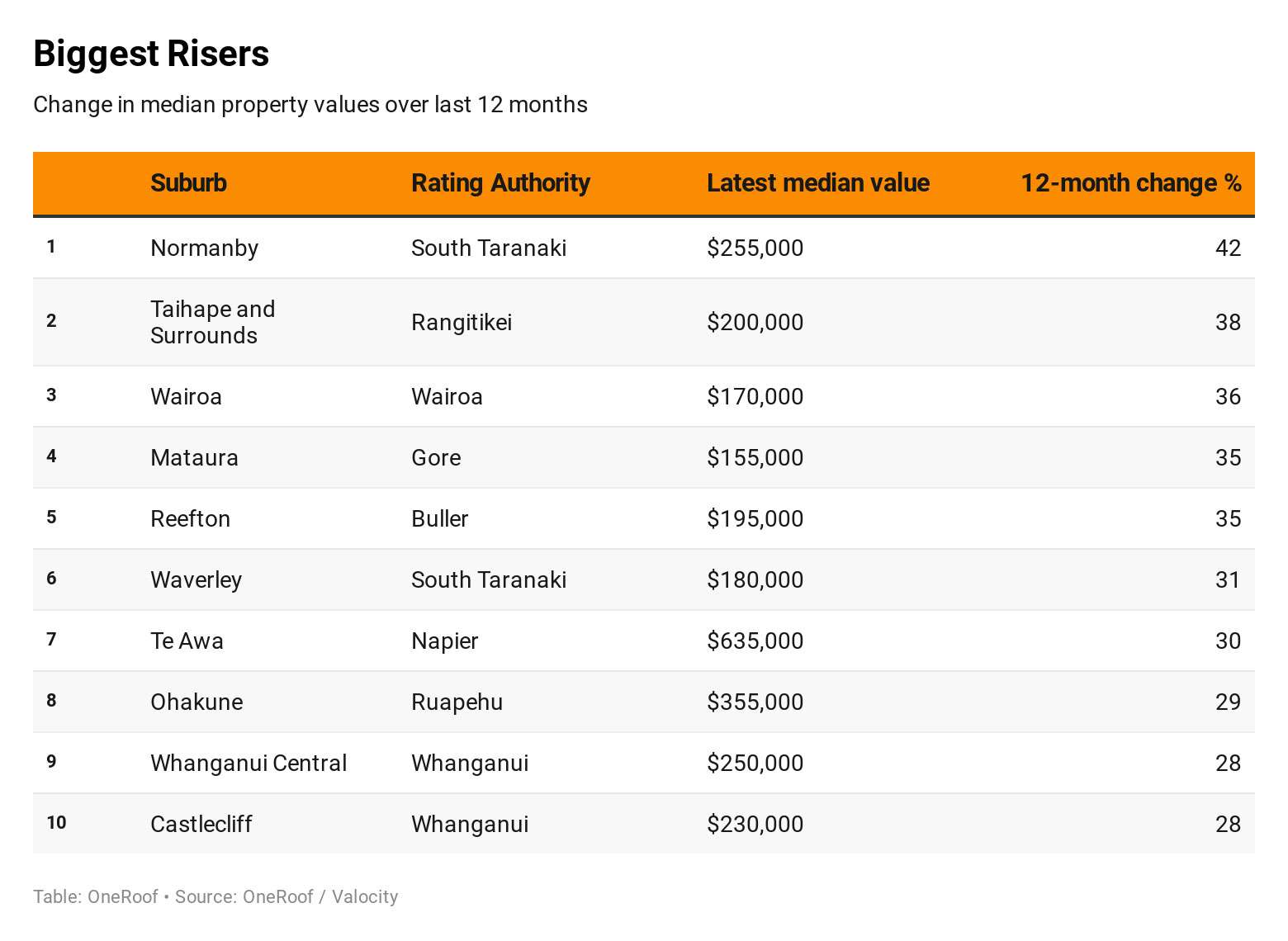

OneRoof's latest housing market report has identified 399 New Zealand suburbs that enjoyed double-digit growth in the median property value in the last 12 months. Once again the suburbs that enjoyed the most growth were in smaller regional towns and centres.

While there is an expectation that property values will continue to rise, there are signs that the pace of growth is beginning to stall in the regions as affordability constraints take effect. However, in the last quarter only five territorial authorities suffered a drop in values – the Far North (-2.1 per cent), Ruapehu (-2 per cent), Westland (-1.8 per cent), Kaikoura (-1 per cent) and the Bay of Plenty (-0.7 per cent) – and just 16 saw no growth at all.

Start your property search

Mortgage registration data reveals that first home buyers continue to be the most active buyer group. This is further supported by recent Reserve Bank of New Zealand (RBNZ) figures that show an increase in low deposit lending. With mortgage rates remaining at historic low levels and no strong indications of any impending strengthening in the official cash rate, this trend is expected to continue.

Use the interactive below to see how house prices in your suburb compares to those in the rest of New Zealand. The interactive measures the growth in median values for every suburb in New Zealand and highlights each suburb's biggest sale in the last 12 months.

Auckland - are the boom times back?

After a three-year-long slump, Auckland’s property market has rebounded, with a new median value of $890,000 up 2.7%, but the big question on everyone’s lips is how high will prices go?

Westpac economists have revised their forecast from a 7 per cent jump this year to 10 per cent, and Real Estate Institute of New Zealand (REINZ) and OneRoof figures for January showed Auckland prices have hit levels not seen since 2016. Agents report queues at open homes and auctioneers say there has been an uptick in the number of bidders battling it out during the first few months of the year. The fear that houses brought to market in Auckland will sell below CV is a distant memory.

OneRoof-Valocity figures for the quarter showed growth in all of parts of the city bar one region –Rodney – but even so, values were flat. The reversal of fortunes for the country’s biggest housing market was evident in the strong finish to 2019. While a decline in sales volumes during the Christmas / summer break was evident, activity levels remained heightened.

Enhanced confidence and expectations that the low interest rates are here to stay have been the main growth drivers, but adding fuel to the market are several factors specific to Auckland: increased buyer demand within certain locations and price brackets and a shortage of listings within the $800,000 to $1.1m bracket within city fringe locations.

So who’s buying? Investors are starting to return to the city’s southern fringe but overall activity continues to slide, with their share of new mortgage registrations down 4.5 per cent year on year to 14.25 per cent. That has benefited first home buyers, whose share of new mortgage registrations has increased 6.9 per cent year on year to 27.8 per cent. Evidence of home owners capitalising on their equity growth remains evident in the fact that re-finance registrations continue to grow, up 3.8 per cent on the same period last year to 30 per cent of total registrations.

Overall, given current activity levels in Auckland, coupled with supply shortages within key submarkets, value growth is anticipated to continue throughout the first half of 2020.

Hamilton

Hamilton’s housing market remains relatively buoyant, with the median value of all properties in the city growing 0.9 per cent in the last three months – 6.4 per cent annually – to $580,000. Interestingly, this rate of quarterly growth remains the same as last quarter, which aligns with sentiment from buyers and sellers that the city has not seen the “surge” that neighbouring Auckland has enjoyed.

While the area experienced an increase in the number of sales between 2017 and 2018, volumes for 2019 were supressed, a trend which looks set to continue well into 2020.

However, agents are reporting slight upticks among certain buyer groups. The share of new mortgage registrations to investors is up 3.8 per cent year on year to 19.12 per cent. First home buyers are the most active buying group in the city, however, representing 27.14 per cent of new mortgage registrations last month.

Increased buyer confidence has resulted in strong growth in suburbs such as Whitiora, Burbush and Rotokauri, all of which saw property values rise more than 10 per cent in the last 12 months. In fact just three suburbs across the entire region suffered negative value growth: Gordonton (down 3 per cent in the last 12 months to $845,000, although up 6 per cent in the last quarter); Newstead (down 4 per cent to $1,070,000); and Puketaha (down 7 per cent annually to $1,020,000 but up 5 per cent in the last quarter).

Tauranga

Tauranga’s housing market was relatively subdued over the holiday period. The city’s median property value is sitting at $675,000 but there was no growth in the last three months and just 3.1 per cent growth annually.

Despite this, agents and valuers have reported an increase in activity in certain locations and among certain buyer groups. The share of new mortgage registrations to investors increased 4.5 per cent year on year to 17.23 per cent, outstripping the growth in registrations to first home buyers. First home buyers, however, remain the dominant buying group, accounting for just over a quarter of mortgage registrations in the last quarter.

At a suburb level, we see the impact of first home buyer demand for affordable housing stock, with the top five performers over the last quarter all boasting median values of less than $650,000.

Overall, given the current levels of buyer activity, combined with increased buyer confidence, Tauranga should expect stable to slow value growth over the next two quarters.

Wellington

A year ago Wellington was enjoying strong house price growth; now the market is showing signs of flagging, with the city’s median value up just 4.7 per cent year on year, and 1.3 per cent in the last quarter, to $785,000. Don’t expect to see resurgence any time soon, with value growth expected to soften further over the next few months.

First home buyers aren’t as active as they once were, with their share of new mortgage registrations up just 3.7 per cent year on year. Their pull-back from the market is in contrast to the increase in activity by investors, whose share of overall registrations grew to 17.28 per cent. It would appear that Wellington’s strong performance at the start of 2019 has given them the confidence to return.

Christchurch

House values were on the rise in the latter half of 2019, but over the last quarter the market died down again, with the city seeing no value growth in the past three months and only a 1.1 per cent increase year on year.

With the median property value sitting at $445,000, Christchurch remains one of the most affordable main urban centres in New Zealand. More than a quarter of sales in the city are for between $400,000 and $500,000; and another 25 per cent of sales are for between $300,000 and $400,000.

The attractive price point is why first home buyers represented a third of new mortgage registrations in the past three months – a rise of 2.9 per cent year on year.

On the other hand, investor activity continues to slide, with investors’ share of mortgage registrations down to just 16.85 per cent.

Interestingly, among the city’s top performing suburbs (those that have seen 5 per cent annual value growth) there are three suburbs with median values of above $500,000: Cass Bay, Spencerville, and Sumner. This indicates that movers, who accounted for 25.4 per cent of new mortgage registrations, are willing to pay a premium to secure a house in a desirable location.

Dunedin

Dunedin is still the best performing housing market among the major metros. Its median property value is $465,000, up 14.8 per cent year on year, and 2.2 per cent in the last quarter.

As is the case with Christchurch, affordability is driving the majority of market activity. First home buyers accounted for 28.45 per cent of new mortgage registrations in the last quarter, but their share of the market has shrunk in the last two quarters, while the share of new mortgage registrations to investors rose 3.3 per cent to 16.41 per cent. This is perhaps a result of rapid house price growth, with first home buyers in the city now looking further afield to more affordable markets.

You can see the strong appetite to secure a home at an affordable price at play in the 11 suburbs that saw more than 20 per cent growth year on year; all had median values of less than $550,000.

Queenstown

Queenstown continues to stall, with the median value of all properties in the city up just 0.5 per cent in the last 12 months to $980,000 and showing no growth at all in the last quarter. The slowdown in the market is evident across all buyer groups, with the share of new mortgage registrations to first home buyers, investors and multi-home owners this quarter all shrinking. Heightened global uncertainty, the foreign buyer demand and a drift by first home buyers to more affordable locations in Otago are fuelling the slump.