Kiwis were more optimistic about the state of the New Zealand housing market at the start of March than they were a year ago, but the spread of the coronavirus is a major concern, a new survey has found.

Colliers' latest quarterly survey of house price confidence found that Kiwi confidence in the housing market was down slightly from the previous quarter, but was above the results recorded in late 2018 and the first half of 2019.

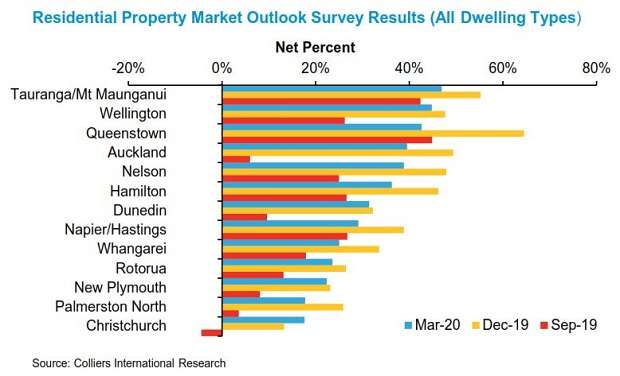

According to the survey conducted between March 4 to March 12, there was a net positive 34 percent of respondents who expected the median price to increase in the next 12 months - down from the net positive 41 percent recorded in the December 2019 survey but well above the net positive of 15 percent in the March 2019 survey.

The respondents were most confident about rising house prices in Tauranga and Mt Maunganui, followed by Wellington and Queenstown, and least confident about house price rises in Christchurch, Palmerston North and New Plymouth.

Start your property search

A net positive 39 percent of respondents were confident about Auckland house prices, down from 49 percent the previous quarter, but up from -10 percent in March 2019.

The survey also asked what could have the biggest negative impact on the market in 2020. Just under two-thirds of respondents answered Covid-19, the fast-spreading deadly virus that has led to economic and social upheaval around the world.

Chris Dibble, Colliers’ director of research and communications, says that while the world is in a fast-moving situation and sentiment may have changed in the past week, there are still key things to note.

“Net confidence has gone up in every region year on year. At the end of last year, there was a lot of confidence after months of improvement. It took off with a hiss and a roar, but now there’s a moderation in those expectations.”

He said the concerns about the coronavirus were a big switch. In the last Colliers survey the biggest worry was about election uncertainty.

“[The coronavirus] is affecting our health and our wealth. As people understand what’s happening, they will adjust.

“We’ve had a very positive and supportive mindset from the Reserve Bank and the Government shoring up holes in the market. There’s a lot of positivity to stem the flow of worse economic or financial [impacts] to get us back up and running."

This week the Reserve Bank cut the official cash rate to 0.25 percent and the Government announced a $12.1 billion rescue plan in a bid to support the health system and businesses and workers impacted by the virus.

Dibble says the balance of supply and demand of properties, and the immediate government support for income will help both residential and commercial tenants meet their obligations. He adds that the figures for Christchurch are a harbinger of what the rest of the country may learn.

Although it is at the bottom of the survey rankings, it is the only city where confidence increased this quarter, and net confidence there is now the highest it has been since the survey started in mid-2016. “People understand the market conditions [and] will focus on the fundamentals, and there is a lot of opportunity as the market recovers. The situation in Christchurch is changing from the past few years with a better balance between demand and supply which will prove important once more stable economic and financial conditions resume,” Dibble says.

For the first time Queenstown, where net confidence topped the country at 64 per cent in December, dropped to third place. It still has a net confidence of 43 per cent, but Dibble says the focus on employment, travel and tourism will no doubt be at the forefront of people’s minds.

However, for all of the reasons that have made Queenstown such a popular place to visit and live, property prices are still tipped to rise, according to the respondents. Many may also see this as an opportunity to buy in such a tightly held market.

“The Government package has been signalled as phase one, there’ll be more. That’s extremely important and comforting for New Zealanders and we expect this to help both business and the social environment.”

The survey results follow a flurry of expert opinion on what the future holds for New Zealand's housing market.

In a column for OneRoof.co.nz published this week, economics commentator Tony Alexander said that while the housing market outlook has shifted, there were factors that will insulate New Zealand’s main centres against the worst of the recession.

“The long-term fundamentals for our housing market are unchanged. There are shortages in the major cities, many young people eager to buy, and many investors increasingly disappointed with term deposit rates [who] may be now more wary of volatile sharemarkets.”

Alexander points to both the Government’s massive fiscal support package, with more to come in the May 14 Budget, and the fact that listings are still in short supply as factors that will support house prices. He notes the market's recovery following previous dips: a price rise of 45 percent five years after the Asian Crisis in 1997, and the 58 percent lift in Auckland property prices after the GFC in 2008.

Also writing for OneRoof.co.nz, Real Estate Institute of New Zealand chief executive Bindi Norwell says that Kiwis should give the market time.

“We don’t expect the market to come to a complete stop – the reality is that people always need to buy and sell houses. We’ll just have a ‘new normal’ for a few months while the country moves through what will be difficult times, but the reality is, we will come through this," she writes.