New Zealand's property market has shifted quite dramatically in the last two months, with economists and real estate experts moving from forecasts of house price lifts to warnings of a downturn.

The spread of the coronavirus and the measures the Government is taking to battle it has changed the economic outlook for the country and brought uncertainty back to the market. OneRoof reached out to the heads of the major real estate agencies in New Zealand for their insights and predictions.

Bryan Thomson, managing director, Harcourts Group Limited

The real estate market and predicting its future are always popular topics in communities throughout New Zealand, never more so than right now amid the significant global challenge we all face.

Start your property search

Much of what we read and hear is, in my opinion, simply speculation driven by that person’s outlook or agenda. The wilder the prediction, the more “airtime” it seems to receive. When it comes to making predictions, the one truth that I hold on to, regardless of whether the situation is positive or negative, is that the best predictor of future behaviour is past behaviour within the same context.

What that means when it comes to the real estate market is that in order to make a prediction, we should look at past crises and how the market performed after those.

Our most recent experiences in that regard are the Global Financial Crisis and the Canterbury earthquakes, one a global man-made crisis and the other a horrific natural disaster to a regional New Zealand location.

The housing market recovered after the devastation of the Christchurch earthquakes. Photo / Getty Images

In both cases, the real estate market paused, people adapted, and the market returned to positive territory reasonably rapidly.

We have also seen throughout history and across the globe that after an economic shock investment flows to the haven of real property. Post Covid-19, there is no question that it will take some time for amateur share market investors to regain confidence in that form of investment. In the meantime, they are likely to look to New Zealand’s favourite form of investment, the real estate market.

Based on past behaviour, and the listing and buyer activity currently paused but “chaffing at the bit”, it is logical to suggest that we will see activity recommence reasonably rapidly when the current restrictions are eased.

When that happens, the doomsayers who yet again suggest a highly negative outlook will be forced to reconsider the basis of their predictions. Of course, that is just one man’s opinion, and it’s not sensational, so it’s not likely to receive much “airtime”.

-------

Peter Thompson, managing director, Barfoot & Thompson

Until Alert Level 4 is over housing market activity will tick over, being restricted to online marketing and selling.

Trying to predict where it goes in the short term once the lockdown is lifted carries too many imponderables to warrant speculating. However, when it comes to the medium term, the outlook is far from negative.

Family home ownership is all about taking a medium term view. Currently, as has been for many years, people who buy property as the family home tend to retain ownership on average for seven years.

Rather than focus on possible short-term price fluctuations, the real issue is what will be the value in seven years when you potentially come to upgrade, downsize or renovate?

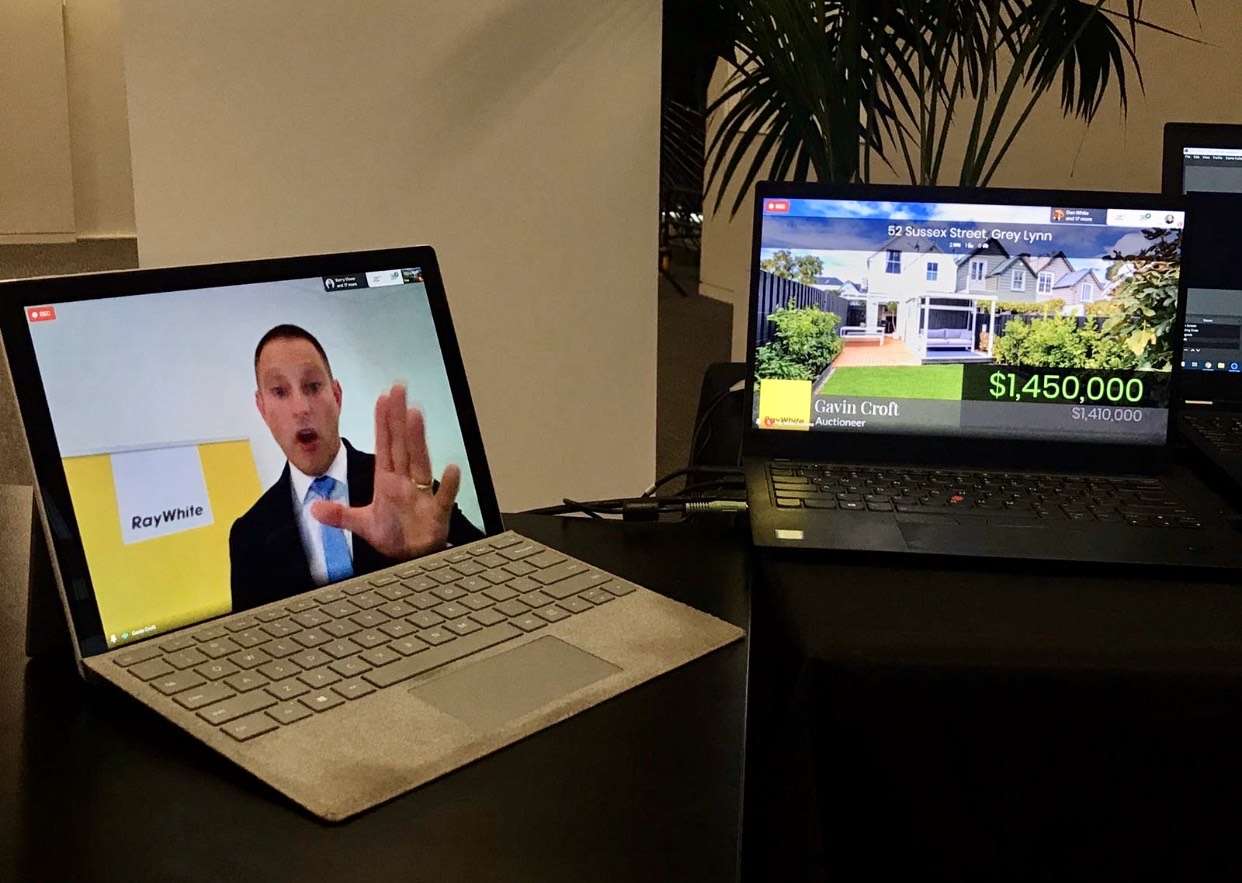

Real estate agencies have been finding new ways to keep the market going, such online auctions.

In the last three significant economic downturns – in 1987, 1997 and 2007 – the downturn in the average price of homes never declined by more than 5 percent and prices recovered within 12 to 18 months.

Income security is a major concern in economic downturns, but if your bank is prepared to give you a mortgage then they have assessed your risk profile as positive. Those that do act will have locked in a low mortgage for at least a year, and predictions are that interest rates after that will rise only slowly.

-------

Carey Smith, Ray White, NZ chief executive

As we enter week 3 of Level 4 for COVID - 19 the property market has come generally to a halt in regard to sales and new listings due to the restrictions imposed by the Government.

There have been many questions asked in respect to how COVID-19 will affect the property market. Like the questions, there are also many answers.

In regard to the residential property market, prior to COVID-19 activity was at a high level with sale prices reaching new highs. The depth of the market was strong with clearance rates for auctions at consistently high levels.

While money continues to remain at record low-interest levels, there is no doubt that while the economy re-establishes cash flow and employment opportunities there may be some lower volume of sales.

Prime Minister Jacinda Ardern at the daily coronavirus briefing. The Government put the country into lockdown at the end of March to combat the spread of the deadly virus. Photo / Getty Images

However, we do not believe that price will be affected given there will be genuine confidence in the New Zealand economy together employment levels will return. For the property market, we see a continuance of sales gradually upon the change of levels and have the expectation that prices will continue to hold.

In the area of property management, while there will be concerns for residential property owners, there should be overall confidence in the longer term that vacancy rates will be maintained at a low level, and while there is the possibility of individual tenancy circumstances overriding the market generally we see a positive environment for rents to continue to remain stable. This, linked with lower vacancy rates, should make purchasing investments for property management attractive.

There will be opportunities post COVID-19 for the property industry. The risk appetite of those entering the property market will be matched by their ability to finance property and gear at a reasonable level. Assuming there will be no further disruption to the economy as we come out of COVID-19, this should be an opportune time to consider real estate as a stable and appreciating asset.

-------

Mike Pero, Mike Pero Real Estate

We had the best start to the New Year just the last couple of months and everything was on a roll and then suddenly this hits us.

My view is, I don’t feel the property market is going to hit the ground as hard as the aviation industry has globally and locally. I think it would be fair to say there are a lot of people who will be needing to make a transaction for different reasons now after this. Situations will change.

I don’t believe we’ll see a crash. I think there will be a lot of people changing homes for different reasons. Sadly, some people are going to have to tighten their belts. Some people may trade down and others might see it as an opportunity to trade up.

Auckland's housing market was on the rise before the virus hit. Photo / Getty Images

Plenty of people over this four week period will be doing a lot of naval-gazing. I guess it makes you think about the future and how many Kiwis have been living beyond their means. Former Prime Minister Sir John Key said recently there are two things that influence the housing market. One is job security and the other one is interest rates.

He’s spot on. Interest rates have never been lower and banks are even very sympathetic, after the last week. My thinking is that banks won’t want mortgagee sales (from late loan repayments). They and the Government will want to help people get back on their feet. The next thing is unemployment but if the Government pours the money back into the businesses they can slowly rebuild. I don’t think there will be too much downturn in the local housing market on the other side of this pandemic.

-------

Barry Thom and Grant Lynch, directors, UP Real Estate

If history has taught us anything about the housing market in times of crisis it is that “the experts” make best guesses about how things will play out. Right now, in our opinion, it is too soon to have any definitive position with regard to the housing market. Suffice to say the key is to make this lockdown work.

Yes, we continue to field enquiry. Albeit that we are in lockdown internet enquiry continues to be high. We are currently negotiating agreements, albeit from a distance, thanks to the virtual tours we supply for the homes we market. But really we are all on a journey into the unknown. We congratulate the government on the measures taken to date and are hopeful that as a country we will be world leaders in navigating our way to the other side. The speed of that journey is critical for the economy and therefore the housing market.

Wellington CBD - deserted during the lockdown. The coronavirus has seen restrictions placed on movements and the closure of non-essential services in New Zealand. Photo / Getty Images

Interest rates continue to promote high interest in property, particularly renters into home ownership. With the only limitation being the current Loan to Value Ratios (LVRs), it will be interesting to see if they are addressed.

If there is a silver lining it may well be that New Zealand is seen as the safe haven the many thousands of expat Kiwis now want to return to. In the meantime, our priority must be to use the balance of this lockdown responsibly to ensure victory at the end of it. In short, stay safe, stay home. That way there is every chance that the market will be safe as houses.

-------

Josephine Kinsella, CEO, LJ Hooker & Harveys NZ

Our property market is basically in hiatus for the duration of this lockdown. Many property sales have been simply deferred until the lockdown eases, rather than being lost altogether. Around the country real estate activity is already falling sharply, nevertheless, not all activity can be deferred and real estate enquiries have already been impacted. This week the appetite for property has certainly turned in a fasting diet with many just coming to terms with the adjustment of our environment.

Listings were already rising prior to quarantine - potentially we may head into a buyers market for supply on release. Our industry is well equipped for virtual appraisals to assist those potential considering coming to the market as we move through the lockdown. Technology has definitely been an advantage in our first weeks of quarantine. It’s certainly interesting how quickly the community has been to adapt to technology.

The economic issues we face will in time result in some sales simply never taking place. Forecasts currently envisage the economy potentially shrinking by 6-7 percent and the unemployment rate rising up to 8-9 percent. In that environment, people who don’t need to move won’t.

The Government's support package to aid businesses and Kiwis during the fight against the virus has been seen as a huge positive for the future of the economy. Photo / Getty Images

With the fiscal support measures in place this should help to limit “forced” property sales. It’s in nobody’s interest to have a wave of mortgagee sales. The mortgage repayment deferral scheme will help many households too.

While windows of not having to pay interest or principal will be a huge boost for many households, make sure you weigh up the flipside of this.

Landlords’ returns will likely to be affected by changing market structure. Employment and tourism downturn will see many short term and holiday properties shift into the long-term or they’ll be sold. Investors/landlords can also apply for a mortgage deferral under certain situations.

The market is certainly going to be interesting ahead with no-one truly able to forecast.

First and foremost is the safety of our communities and it’s amazing the level of connectivity with our industry to assist those in our communities, from grocery shopping to a simple check-in phone or video call. We are all here to keep spirits high in this unusual situation.