Kiwi homeowners worried that Covid-19 will result in huge losses shouldn't be disheartened, if history is any guide.

Research from OneRoof and its data partner Valocity show the majority of houses sold in New Zealand during and after the global financial crisis made a profit.

OneRoof wanted to see what pain there was in the housing market the last time New Zealand suffered an economic calamity.

Despite widespread turmoil in the share market and the banking industry, New Zealand house prices didn't crash during the 2007-2009 crisis, but generally held steady before climbing in the months and years thereafter.

Start your property search

While the drivers of the crisis New Zealand is facing now are different from those that caused the GFC, there are some parallels that should give hope to the housing market.

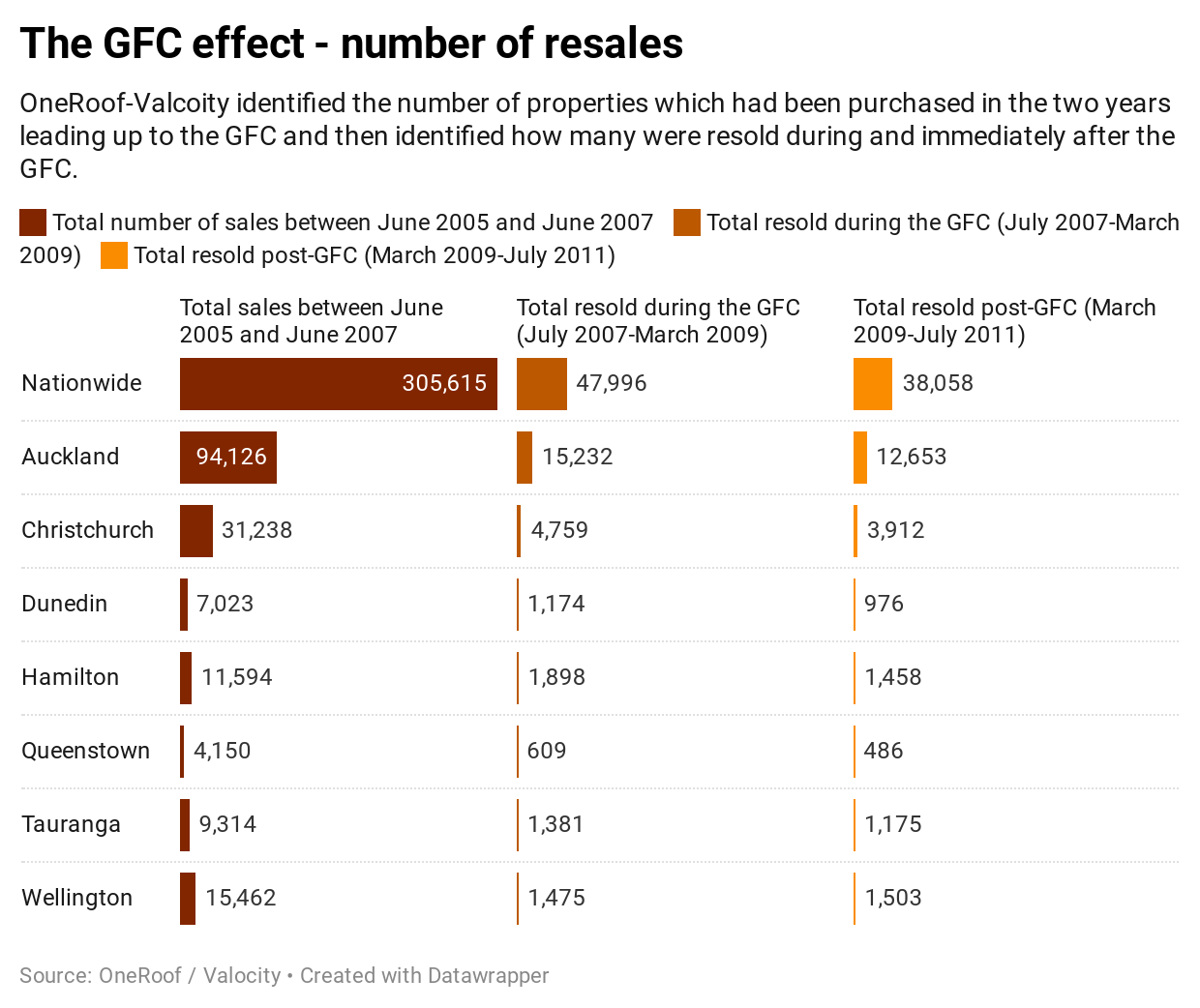

OneRoof and Valocity identified properties that had been purchased in the two years leading up to the GFC, and then looked at how many were resold during the GFC and after.

Homeowners who were most at risk of selling at a loss were those who bought at the height of the market, just before the GFC, and then sold soon afterwards, during the GFC or just after.

OneRoof and Valocity found that of the 305,615 properties bought between June 2005 and June 2007, 15 percent were resold between July 2009 and March 2009 and another 12.45 percent between March 2009 and July 2011.

Very few of those resales made a loss: 78.35 percent resold during the GFC turned a median profit of $52,000, while 65 percent resold in the two years after the crisis made a median profit of $45,000. For the properties that did take a hit, the median loss was $24,000 during the GFC and $22,000 in the two years after.

The cities that suffered the highest percentage of losses during the GFC were Dunedin and Queenstown, although Dunedin's median loss - $13,000 - was the lowest of all the major metros and Queenstown's was the highest, at $51,892.

Wellington had the highest percentage of resales making a profit during the GFC - a phenomenal 87.39 percent - and had the highest median profit, at $79,100.

Christchurch's had the second highest percentage of resales making a profit - 82 percent - but its median profit was just $48,125.

Auckland had the second highest median profit, at $62,500 while Dunedin had the lowest, at $33,000. Queenstown had the lowest percentage of resales making a profit - 59 percent - with its median profit coming in at $57,500.

There was a slight uptick in the percentage of properties that resold for a loss in the two years after the GFC, but for most of the major metros the numbers stayed relatively the same. Only Queenstown saw significant changes - the percentage of loss-making resales grew to 42.11 percent and the median loss was up 17 percent to $60,000.

Overall, the percentage of properties that were bought at the height of the market and resold during and after the GFC was relatively low, which suggests there were very few sales made under duress.

Most Kiwis had purchased property pre-GFC for long-term use and were therefore able to ride through the market disruption.

The fact that resale profits were relatively high in cities with stable job markets and economies should give hope to homeowners now. The only real disruption was in Queenstown, where then as now there was a higher share of investment properties or second homes, which would have been expendable as belts tightened.