Herne Bay is close to setting a new house price record. New figures show the wealthy Auckland enclave is just $45,000 shy of becoming New Zealand's first $3 million suburb.

Research from property listing site OneRoof.co.nz and its data partner Valocity shows the full extent of New Zealand house-buying frenzy since the country came out of the Covid-19 lockdown seven months ago.

Find out if your suburb is rising or falling - use our interactive below

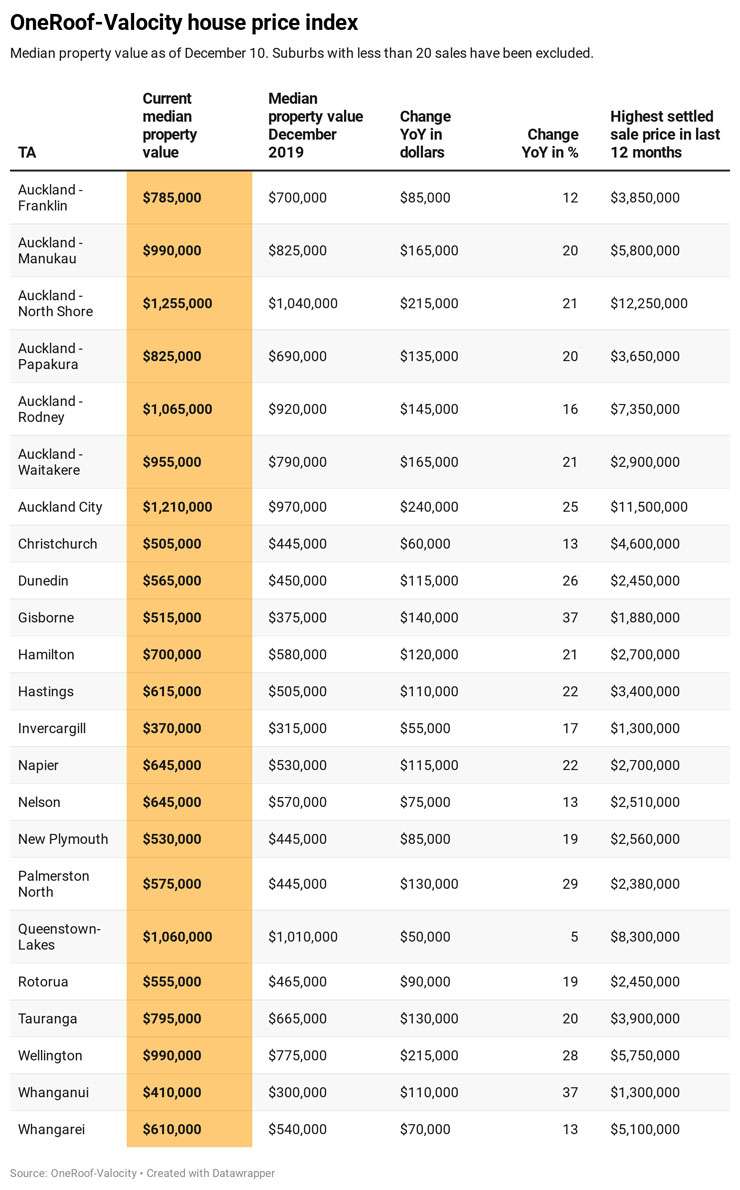

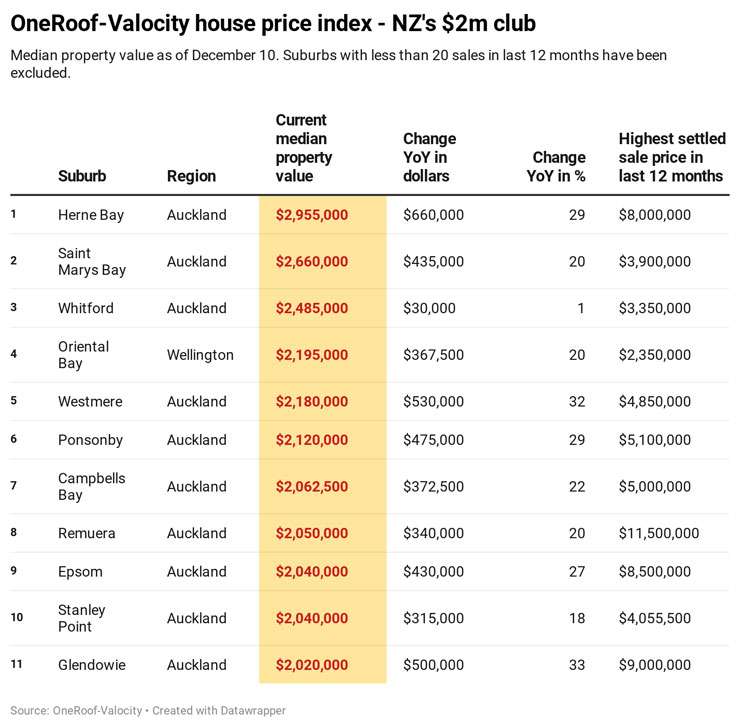

According to OneRoof-Valocity figures, there are now 10 Auckland suburbs with median property values of $2 million-plus, up from three a year ago.

Start your property search

Herne Bay topped the list, with a median property value of $2.955 million, followed by Saint Marys Bay with $2.66 million and Whitford with $2.485 million. New members of the club include Westmere, Ponsonby, Remuera, Epsom and Glendowie, all which have had 12-month price increases of between 20 and 30 percent.

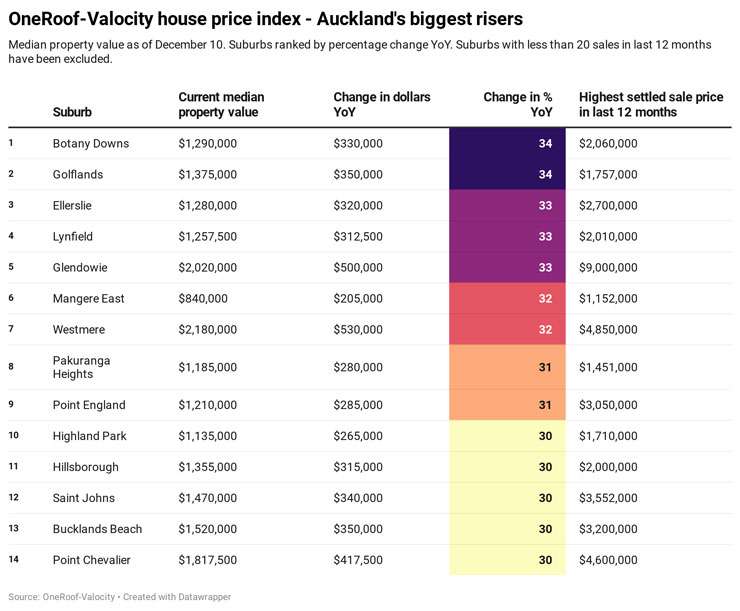

Across the country, 280 suburbs saw median value increases of $300,000 or more in the last year - 64 of them in Auckland.

James Wilson, director of valuations at Valocity, said: “Auckland’s housing market is grabbing all the headlines, and for good reason. The number of $1 million-plus suburbs in the city has jumped from 123 a year ago to 179 now – more than half the city.

“And just nine of the city’s suburbs are in worse place now than they were at the start of the Covid crisis. At the start of November, that number was 36, which shows just how fast the market is moving.”

Wilson said Herne Bay had long been tipped to hit the $3 million mark, but no one would have expected it to get close to the milestone so soon.

“Herne Bay shook up the housing market when it became New Zealand’s first $1 million suburb in 2004 but it took it another 11 years for it to become the country’s first $2 million suburb,” Wilson said.

“In the last 12 months, property values in the suburb have shot up more than $600,000 – almost $300,000 of which has been in the last month and a half. That surge has been the result of buyer demand at the top end of the market outstripping supply.

Auckland house sales have reached record levels in the last two months. Photo / Fiona Goodall

“Low interest rates have added rocket fuel to the fire, with buyers now able to stretch themselves by hundreds of thousands of dollars without crippling mortgage repayments.”

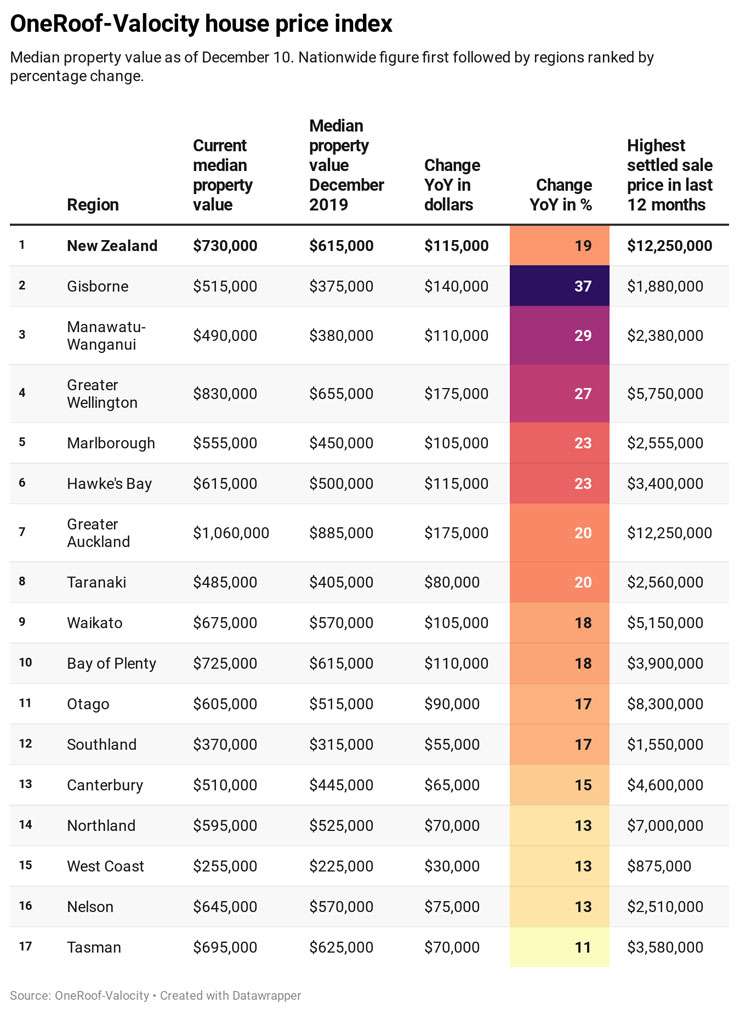

The OneRoof-Valocity figures also show huge lifts outside of Auckland:

- Wellington’s median property value has risen $240,000 in the last 12 months, and is now just $10,000 short of $1 million.

- Canterbury and Gisborne have crossed the $500,000 mark, and Manawatu-Whanganui is not far behind, recording a new median value of $490,000.

- Of the 72 territorial authorities measured, nearly half saw annual growth of 20 percent or more, with Wairoa, Rangitikei and Gisborne seeing the biggest increases.

Wilson said: “Nationwide, property values have risen 11 percent - $115,000 - since Covid struck at the end of March to a new median of $730,000. A lot of that has been driven by the relative low cost of housing in the regions, with first home buyers and investors highly active in recent months.

“The fact that only four TAs are in worse shape now than they were before Covid-19 struck shows just how strong the market is. Even Queenstown Lakes, the country’s worst hit market after Covid, has climbed back from a steep drop to being just 0.5 percent below its median value at the start of the year.”

Wilson said the heat in Wellington and Christchurch was notable. “The capital has been trailing Auckland for almost two decades, but it has rapidly gained ground in the last seven months, the result of buyers paying higher prices, and is now close to joining Auckland and Queenstown in million-dollar club.

“Christchurch house prices too have smashed an important psychological barrier. The city’s median property value had sat persistently below half a million dollars for five years, but first home buyers and investors upped their game there in recent months.”

Real estate professional aren’t surprised by the increase in property values, citing strong competition in the last two months.

Bindi Norwell, chief executive of the Real Estate Institute of New Zealand, said: “With a number of factors driving the market at the moment, including the fear of missing out, the low interest rate environment and the proposed re-introduction of the LVRs early in 2021, it will be interesting to see what happens to prices in the coming months.”

She said the institute's own figures had shown big jumps in Herne Bay's median sale price in the last four years. "Herne Bay properties often have expansive grounds, swimming pools and many have panoramic views of the Waitemata Harbour, so it’s not surprising that it’s one of Auckland’s most expensive suburbs."

Blair Haddow, from Bayleys Ponsonby, told OneRoof properties in Herne Bay rarely sold for less than $3 million. “Anything nice is $3 million-plus. Under $3 million is probably a do-up.”

He said he had a waiting list of people wanting to buy in Herne Bay and Ponsonby.

“The demand has been unprecedented and it’s being driven by lots of different factors like returning expats, people whose houses aren’t big enough or too big. I think it will carry on into next year, too - it may even get busier.”

Steve Koerber from Ray White Remuera, said houses had been flying out the door in his patch.

“There’s a real sentiment of people buying because they’re scared of missing out. All of the auctions have had one or two extra bidders on top of what we had at the same time last year and that’s just created incredible demand.”

But supply has been an issue. “There have been so many sales recently that Remuera’s dipped down to just over 100 listings, and many of those are apartments, new builds, off the plan sort of things.”

Derek von Sturmer, of Professionals Point Chevalier, said his office sold 20 houses last month, more than double what he’d expect in a normal November. “I’ve never seen anything like it. The inquiry has been around the clock, 24/7 - it’s pretty full on.”

“Every single sale we’re doing is setting a new benchmark.”