The post-Covid housing boom has been great for sellers across the country but hard on those breaking into the market for the first time.

The latest OneRoof-Valocity figures show a market at full speed, with buyers hitting the market in the first two months of 2021 in force and investors rushing to beat the March 1 return of the LVRs and 40% deposits.

Start your property search

The demand side of the market continues to be driven by low interest rates, fear of missing out and a lack of new stock coming onto the market. Despite record prices being achieved in most markets around New Zealand, the dearth of new listings has put off would-be sellers, who are unwilling to list in the belief they’ll be unable to buy another home in their desired price bracket.

What are the numbers showing?

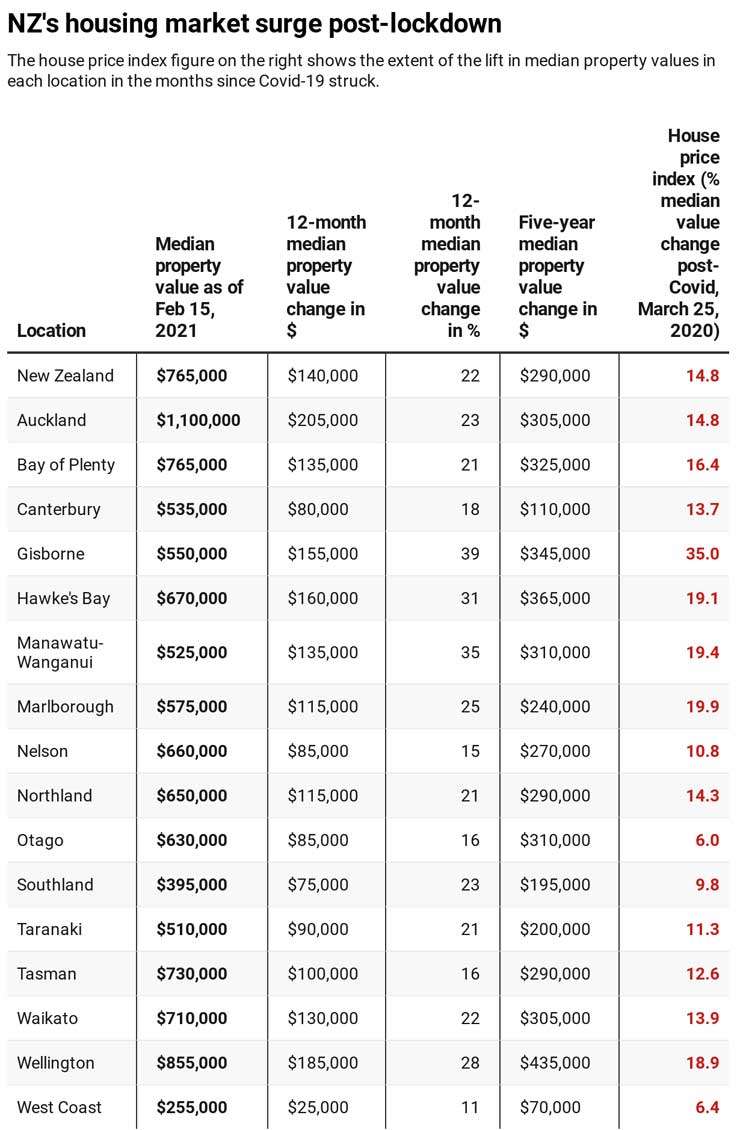

The OneRoof-Valocity house price index, designed to measures the changes in median property values post-Covid (from March 25, 2020 – the day before the country went into lockdown), shows the housing market was performing well in the months leading up to the pandemic’s arrival, driven by strong regional growth. Post-Covid, the nationwide median property value has jumped 14.8%, the result of increased buying activity by first home buyers and investors.

House prices in every region now are tracking above pre-Covid levels, a big improvement on the period immediately after the lockdown was lifted when house prices in eight regions were below or at the same level as they were before the pandemic struck.

Gisborne is the region that has done the best out of the post-Covid surge. Photo / Getty Images

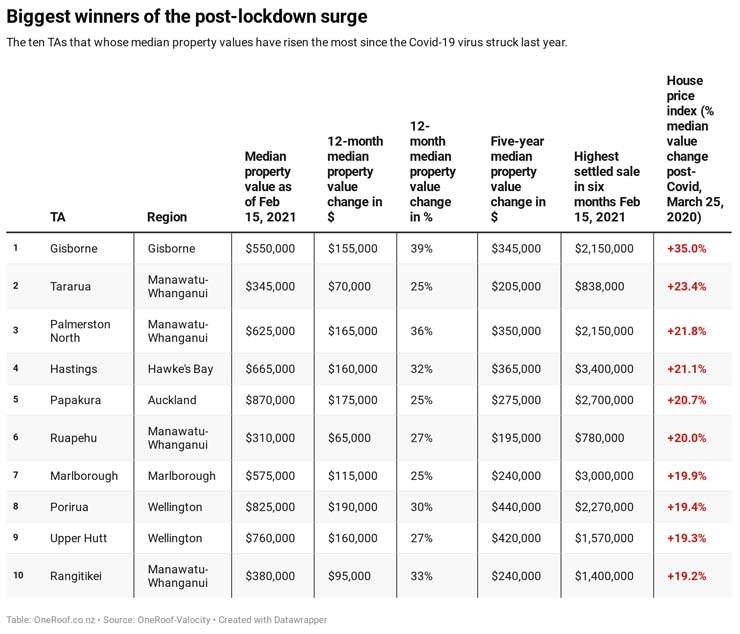

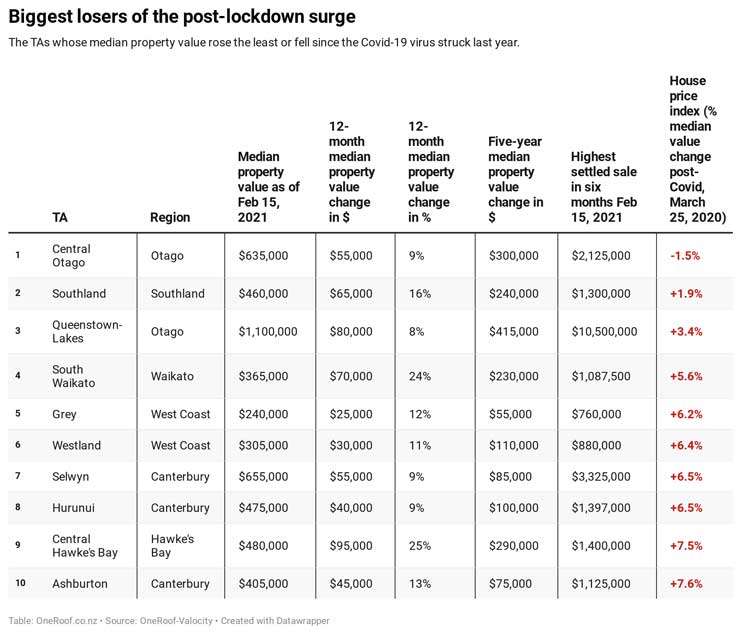

The boom can be seen clearly at a Territorial Authority level. Just one TA - Central Otago – is now in a worse position now than it was before the almost two-month-long shutdown of the property market starting on March 26, 2020. This is down from 22 TAs in July, 11 TAs in November and four in December. However, it does represent a slip on January’s figures when all TAs were in positive territory, and reflects that there is still a clutch of TAs – including Queenstown, Grey and Southland - that has yet to fully recover and feel the heat seen elsewhere in the market.

Clear winners and losers

House price growth in several TAs has been significantly stronger post-Covid than pre-Covid, with Gisborne leading the pack. Its median property value is 35% up on pre-Covid levels - a level of growth that's almost 14 percentage points ahead of the next best TAs: Tararua (up 23.4%), Palmerston North (up 21.8%), Hastings (up 21.1%) and Ruapehu (up 20%). Those TAs have benefited from increased activity from both first home buyers and investors, who have been seeking out affordable stock.

There are clear winners among the major metros as well:

• Wellington is now firmly a $1 million-plus city, with the median property value there jumping 18.3% post-Covid.

• All areas of Auckland are showing strong house price growth, with only Franklin, Waitakere and Papakura sporting median property values of below $1 million, although Waitakere is just $5000 shy of crossing that threshold.

• Christchurch, the worst performer before the lockdown, has enjoyed a post-Covid resurgence in its housing market, with first home buyers particularly strong.

• Queenstown Lakes is no longer bleeding but growth is slow.

• Dunedin’s strong run before Covid struck has spluttered post-Covid. It is second-worst performing major metro – seeing growth of just 9.5% since March 25, 2020. In the lead-up to the pandemic it was the best performing major metro, enjoying median value growth of 23.4% (number two and number three – Wellington and Hamilton – were way behind with 8.2% growth). This is likely the result of low listings and vendor reluctance driven by fear they have no home to move to if they sell.

Recovery time and price lifts

The majority of regions hit their lowest point during or immediately after the 2020 lockdown, with Auckland, Otago and Taranaki seeing the biggest value drops, of 4 per cent.

Bay of Plenty was the quickest to recover, with its median property value back to pre-Covid levels in early May. Much of the country bounced back to pre-Covid levels in June and July.

Queenstown suffered the biggest value drop as a result of Covid. Photo / Getty Images

Otago took the longest to recover, largely due to the hit Queenstown Lakes' housing market and economy suffered as a result of the Covid travel restrictions and ban on international visitors. And while Otago bounced back in September, Queenstown Lakes didn't climb back into positive territory until November.

West Coast was the last to reach the bottom of the market in August but recovered in a month. Otago was the last to recover to pre Covid level in late September.

The post-Covid lift has also delivered some big dollar gains to homeowners. In the last 12 months, nationwide house values have risen $140,000. Six TAs have seen gains of more than $200,000 and there are 52 suburbs that have enjoyed bumps of more than $300,000. One suburb’s $455,000 gain was enough to make history, with Herne Bay becoming New Zealand’s first suburb with median value of more than $3 million, almost six years after it was the first to break the $2 million barrier.

Too hot for some

The gains have made it harder for first home buyers, especially in Auckland and Wellington, where deposit requirements are between $40,000 and $51,000 higher than they were 12 months ago.

In Auckland, the number of suburbs where the median property value is $650,000 or less has shrunk in the last 12 months by two thirds to just eight, while the number of suburbs with a median property value of $1 million or more has jumped to 195 - representing 71 percent of the city.

Lesley Harris, from the First Home Buyers Club, says her members are absolutely the losers in this market of spiralling house prices.

“You require more deposit, you require more lending, so the flow-on effect is it becomes more out of reach for first-home buyers. If you’re buying in the same market it’s six of one, half a dozen of the other but, if you’ve got out of the market or you’ve yet to get on to the bandwagon, they’re the people that are going to be suffering from any increases.”

Mortgage broker John Bolton, owner of Squirrel mortgage company, says anyone who has stayed in the market has been a winner and that people who purchased last year are probably now feeling pretty lucky.

Other big winners are people who have been lucky enough to have won the ballot for a KiwiBuild home. “If you were to win the ballot, that’s amazingly good value for money. You’re buying a three-bedroom terrace house or apartment for $650,000 in Auckland and these things would have market values of close to $800,000 so you really are getting a massive leg-up with KiwiBuild at the moment,” he says.

Other first-home buyers, however, are facing a tough market to get into, although Bolton says there will be a lot of new builds coming on to the Auckland market soon which might help.

KiwiBuild homes have fixed prices which should make them attractive to first home buyers. Photo / Getty Images

“You’ve seen it with the spike in building consents over the last six months. I’m aware of a lot of development stock that will be coming to market this year and that’s exciting.

“I think for a first-home buyer realistically a lot of the existing stock is just too expensive for them now but this is where maybe a lot of this new build activity and buying off-plan could be a really good option — maybe some other winners are people who bought off-plan a year ago so they’ve got newly completed properties coming into fruition, where they’ve probably had a decent lift in value.”

As far as locations which have done well post-Covid go, Bolton says “everywhere. The whole country seems pretty strong at the moment.”

Lucky in land

Adam Thomson, director of Ray White Manukau, says in his patch, among those who have benefited most from the price boom are neighbours who have got together to sell properties.

This is such a good strategy he has adapted the way he is marketing property, saying if someone decides to list and has a bit of land, he will door-knock neighbours who also have a bit of land to see if they also want to sell.

That way, both parties make a lot more money from the competition between hungry developers who want to build terrace houses on the sections.

“If you ask, ‘Who’s been the winners?’ it’s been people with larger blocks of land — and by large, I just mean 800, 800, 1000, 1200sq m. We’ve probably seen 20 to 30 per cent growth on those in the last six months.

“People have really clicked on to what the new [Auckland Unitary] plan allows and they’re saying, ‘Well, we thought we could only put three on these sites but we can put six on so they’re worth a lot more than we thought.’”

Buyers either want to develop the land now or save it for later and when neighbours do team up they are fetching sometimes 20 to 40 per cent more than they would if they sold separately.

Thomson says a lot of buyers are looking at the future and thinking about not just buying their first property but their second or third, telling investors, for example, “If you bought this now you could put your second one on it and then your third.”

He says, “It’s quite a good strategy, I think, for an investor if they’re looking down the line.”

Developer buyers might be some of the big players, who have contracts with the likes of Kainga Ora, smaller companies or more inexperienced individual players.

“There are people that are doing it to build and sell as new homes like a business and there are other people building them to rent as an investment; and there are a few people who have moved from investing in a property to wanting to do a bit more and develop.”

Developers make hay

Others who have benefited from the boom are developers who had been at the end stage of a subdivision or property last year who may have been thinking each home would fetch around $800,000 to $900,000 only to find the home selling now for more than $1m.

People who panicked and sold when Covid first hit haven’t done so well, he says, nor have those who waited to buy.

Houses on big sections have been in demand post-Covid. Photo / Supplied

He remembers taking calls from people nearly a year ago saying they were going to wait to buy until after the wage subsidy ran out in the hope they would pick up a bargain from people forced to sell but that didn’t happen and now those buyers are having to pay 20 per cent more.

Agents from other parts of the country say it’s hard to define who are the winners and losers in the current market because there are people missing out in every price bracket.

David Platt, managing director of Tommy’s Real Estate in Wellington, says the market in the capital is still running hot and each property listed is receiving multiple offers.

And Simon Martin, managing director of Harcourts in Tauranga, says there is no specific buyer group missing out. “Demand is good. It’s not like excessive but if you’ve got four people who want to buy a property only one can buy it.”