The Government will pour close to $4 billion into a scheme to accelerate the pace of new house builds, which is expected to help see "tens of thousands" of new properties built.

It is also doubling the capital gains tax-esque bright-line test from five to 10 years - meaning any gains on a residential property that is not a family home will be taxed if the property is sold within 10 years of purchase.

And first home buyers have also been given a lifeline – the First Home Grant caps have been lifted from $85,000 to $95,000 for single buyers, and from $130,000 to $150,000 for two or more buyers.

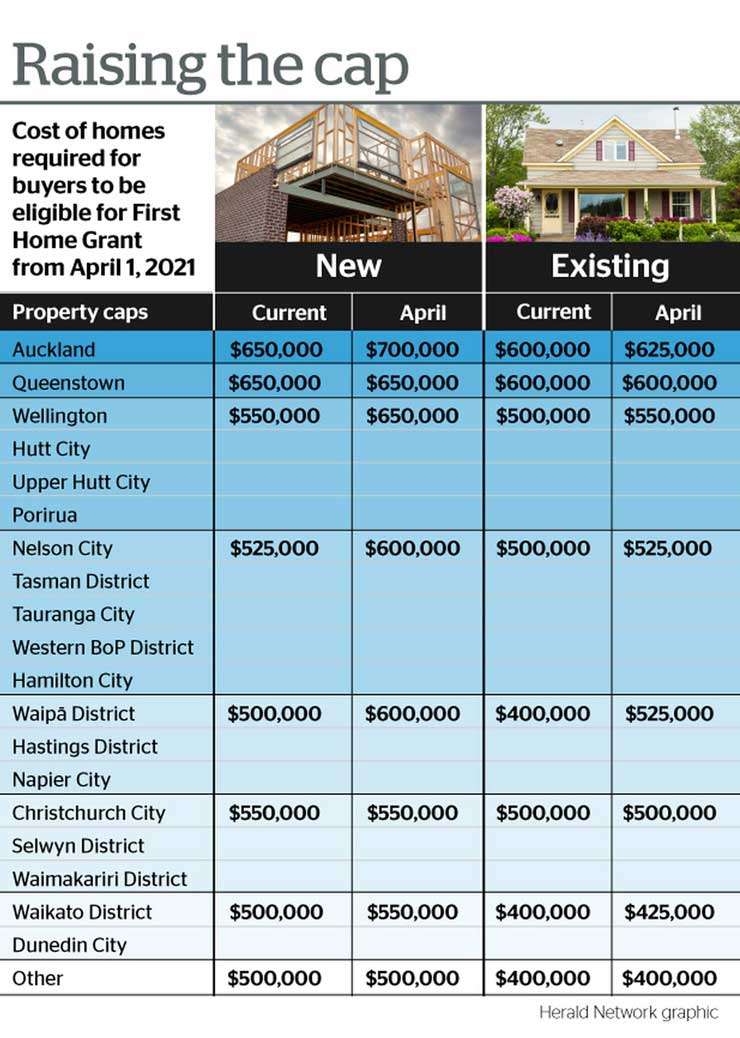

The cap on the value of the house those eligible for this grant are able to buy has also been lifted by up to $100,000 in some parts of the country.

Start your property search

Prime Minister Jacinda Ardern said this housing package would increase the supply of houses and remove incentives for speculators.

"This is a package of both urgent and long-term measures that will increase housing supply, relieve pressure on the market and make it easier for first-home buyers."

She said New Zealand's housing crisis is "long standing" and today's new measures will help to start fixing this issue. "The need for further action is clear - the last thing [we need] right now is a property bubble."

Today's announcement would help to dampen property speculation. It will make residential property "less lucrative" for speculators.

Ardern said it was her view that the announcement "will make a difference".

While the housing crisis was "complex", the Government was trying to "tilt" the market to first home buyers and "bring down the heat" in the market, she said.

The housing acceleration fund announcement will also help with supply - by helping to establish basic infrastructure, such as making vacant land ready to build on - and was the largest spend of this kind since the 1970s, Ardern said.

The plan contains a plethora of new initiatives:

• $3.8b for accelerating housing supply

• First Home Grant caps lifted, as well as higher house price caps

• Bright-line test doubled from 5 to 10 years

• Interest deductibility loopholes scrapped

• Govt to offer Kāinga Ora $2b loan to scale up land acquisition

• The Apprenticeship Boost scheme extended

The lifting of the First Home Grant caps would help more people on to the property ladder, Finance Minister Grant Robertson said, adding that "housing bubbles are unstable".

Housing in Mt Victoria, looking across Te Aro to Brooklyn, Wellington. Photo / Mark Mitchell

The grant means those eligible can get $5000 to buy an existing property, or up to $10,000 for a new property.

By increasing the income caps from $130,000 to $150,000, approximately 9300 additional couples and 3700 additional singles who are currently renting will now newly qualify for the First Home Loan and Grant.

The Government has also announced it is upping the cap on how much a home has to cost, for someone to be eligible for the grant.

The changes to the house price and income caps will take effect on April 1, 2021.

Speculators hit by tax changes

Robertson said the bright-line test extension would help curb "rampant speculation" in the housing market.

The bright-line test is similar to a capital gains tax (CGT) on housing. It means people have to pay tax on any gains on the property if it's sold within 10 years.

There are, however, a number of exceptions – such as an exemption for a family home.

The Government has announced it intends to extend the bright-line period to 10 years for residential property except for newly built houses, which will stay at 5 years.

Ardern said extending the bright-line test was not breaking her no capital gains tax promise, adding that the Government had been "silent" on the bright-line test before today, but the problem has become "significant". Robertson said he was "too definitive" when he ruled out changes to the bright-line test.

Robertson ruled out the changes in September last year, saying at the time officials had advised that house prices would fall as a result of Covid-19; but he said the opposite happened.

He said the Government would monitor the impact of these changes on the rental market.

$3.8b to speed up infrastructure and land availability

Housing Minister Megan Woods said the new money for the housing acceleration fund – some $3.8b – will help greenlight tens of thousands of house builds in the short to medium term.

"This fund will jump-start housing developments by funding the necessary services, like roads and pipes to homes, which are currently holding up development."

Woods said it has become clear there is a "clear market failure" in New Zealand's "broken" housing market with the inaccessibility of infrastructure on vacant land.

"This package will accelerate the building of new houses, in the right place."

Prime Minister Jacinda Ardern arriving for her post-Cabinet press conference at Parliament. Photo / Mark Mitchell

Woods said the money she is dishing out will start to be spent in the second half of this year.

As well as this, the Government will allow Kāinga Ora, the Crown housing agency, to borrow a further $2b for it to buy land for housing.

Meanwhile, the Government will get rid of the interest deductibility loophole – a rule which allows property owners to claim interest on loans used for residential properties as an expense against their income from those properties.

Revenue Minister David Parker said this rule favours debt-driven residential property investment over more fully taxed and more productive investments.

"To reduce investor demand for these investments, the Government will remove the advantage investors have over first home buyers."

And in a bid to get more houses built, the Government is bolstering its apprenticeship scheme, the Apprenticeship Boost initiative

The scheme is being extended by four months to further support trades and trades training.

It means employers who have apprentices starting over those extra four months can get some Apprenticeship Boost support as well, which could see more than 5000 new apprentices able to benefit.

'This is crazy' - landlords react

Andrew King, NZ Property Investors Federation president was taken aback by the Government decision to eliminate interest rate tax deductions, which investors can currently claim on properties.

"What, so every other business in New Zealand can still claim tax deductions, but not landlords?" King asked. "You're joking! This is just bizarre, it's crazy."

The sums involved could be tens of millions of dollars, King said, and that would now be lost to landlords, already struggling under Residential Tenancies Act changes from last month which swung the power in tenants' favour.

The Government will now stop landlords claiming interest on loans for rental properties as an expense against their income from those properties and other forms of income such as wage and salary earnings.

King said: "We all know one of the major downsides for investors in property is that the rent doesn't cover the costs of running many places. in New Zealand, it's cheaper to rent than to buy a house.

"This change will make it almost impossible for people to provide new rental accommodation. This means the only people able to buy rental properties in the future will be those with almost all the cash to pay for the property."

- New Zealand Herald