Christchurch house prices have smashed an important psychological barrier, with a heated housing market propelling the city’s median property value to $505,000.

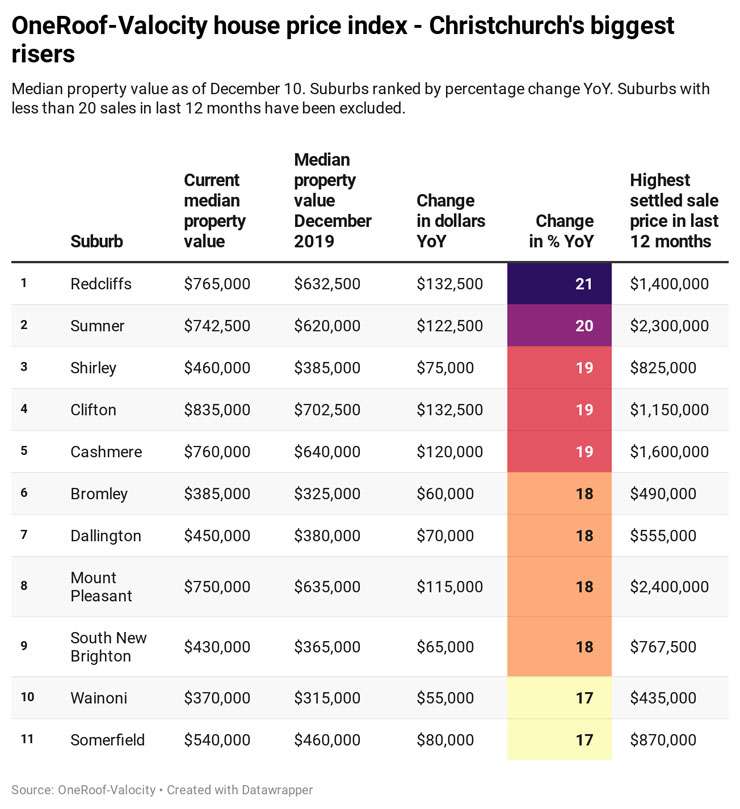

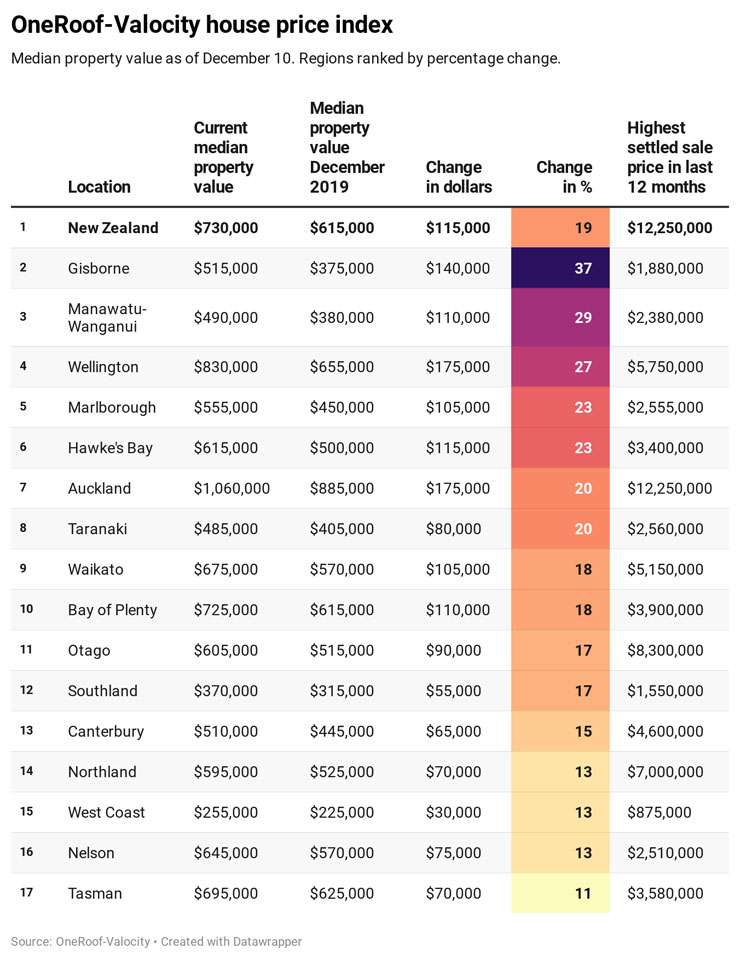

The latest OneRoof-Valocity house price index figures show house values in Christchurch jumped 8.7 percent in the almost eight months since Covid-19 struck, and 13 percent since December last year.

The city, whose median property value had been flat for almost five years, has become the focus of increased attention, with first home buyers and investors taking advantage of low interest rates and the city’s relatively low prices.

The boom has been resulted in some sky-high prices: a house in the high-end suburb of Fendalton recently sold for $3.1 million and a bach in Akaroa fetched $2.4 million.

Start your property search

James Wilson, director of valuations at OneRoof’s data partner, Valocity, said: “After a few years of slow value growth, the wider Canterbury region is now experiencing strong value growth, fuelled predominantly by significant interest among first home buyers.

“Investors also continue to increase their share of new mortgage registrations in the area, particular notable within Christchurch City as they hunt for comparatively more affordable stock.”

Ray White told OneRoof that its auctions in Christchurch had been so crowded, offices were bringing in Mr Whippy ice cream trucks to keep the buyers entertained.

Ray White’s South Island regional manager Jane Meyer said the agency sold 24 properties under the hammer last week for a combined total of more than $16.5 million.

This bach at 113 Beach Road in Akaroa recently sold for $2.4 million. Photo / Supplied

“It was a crazy week of auctions, with six properties called forward with pre-auction offers,” she said.

“The crowd that turned up to 20 Carrington Street in St Albans saw five buyers battling it out. Bidding started at $997,500 and the competition drove the price all the way up to $1.107 million.”

She added: “The seller’s market shows no sign of slowing down anytime soon so people thinking of coming to market still have time to take advantage of strong selling conditions.”

Harcourts Papanui owner Chris Kennedy said the market had been strong for the last three to four months, driven by low interest rates and both offshore and inshore interest.

“Offshore being expats or those coming back to the country but I think we’ve seen a lot of people from within the boundaries of New Zealand, and the boundaries of Christchurch.”

There have also been people who would have gone overseas changing and upgrading within the housing stock as well.

“When you look at Christchurch’s housing stock, it’s produced very good value for a long, long time given the number of houses that were developed in subdivisions, housing that was built over a period of time post the earthquakes.

“I think we’ve seen a very balanced market and a very fair market. It hasn’t seen the lofty rises that your Wellington’s, Auckland’s, Tauranga’s and your Queenstown’s have seen. We haven’t had the declines and we haven’t had the big rises. I think we work with a really strong market.”

And people have moved to Christchurch from other parts of New Zealand, including Kennedy five years ago.

“I moved back to its better pace of life. It’s a more affordable city and a city that’s in the throes of rebuilding and becoming incredibly vibrant. I was away five years and the changes are just phenomenal. It’s a beautiful city and it offers a lot.”

His office has had some incredible results, including a $3.1 million sale of a four-bedroom house in Wood Lane Fendalton – the highest sale price for the city this year.

“There were multiple bidders on it. To me that’s an indicator of the market and auction is a very relevant barometer of the market because it measures straight away, it gives you an indicator of what’s happening in the market.”

The Fendalton property was a beautiful, luxury property with a pool and there have been “wonderful” sales in Bryndwr and Ilam with over 100 people through the doors.

“There’s just good numbers of people coming through these homes. Next year we’ll be in a good market. I think momentum will continue. The only thing that will possibly play into it is if the vaccine for Covid works and delivers on expectation then you might see borders open up sooner and therefore you might see some of that discretionary money that’s spent in real estate, cars and jewellery, heading overseas for holidays again because people are yearning to get overseas.”