Auckland's real estate market is holding its breath. With new listings all but dried up and the city's auctions now the preserve of developers, agents are pinning their hopes on a surge of activity once the city moves down alert levels.

While the hard lockdown in Auckland started off well for the industry - with plenty of properties on the virtual auction block and plenty of bidders driving up prices - stock levels and clearance rates have come under pressure.

That's understandable given that a month of alert level 4 in Auckland has kept would-be vendors on the sidelines and agents unable to physically appraise properties or arrange photography and staging.

The city’s biggest real estate agency, Barfoot & Thompson, told OneRoof that the company’s total sales during the closing weeks of August had fallen sharply while the number of properties being brought to auction this week was a fraction of what it would normally see.

Start your property search

Barfoot and Thompson operations manager Vaughan Borcovsky said: “There were quite a number of scheduled auctions that were postponed so there’ll be a big wave of that stock, plus we’ll see new listings when levels change.

“There’s too much uncertainty, and until we’re more certain, then people [will] say ‘I can’t plan’.”

A 1960s house with plans for three townhouses on Terry Street, Blockhouse Bay, Auckland had 29 online bidders and sold for $2.23m. Photo / Supplied

Borcovsky said that some vendors have decided to wait until level 2 before going on the market in order to attract more buyers to their property.

Given the lead times to get properties prepared and photographed for listing, and a three- or four-week campaign, it will be the early weeks of October before the spring listings show up in auction numbers.

Twenty bidders competed for a development site on Allenby Road, Papatoetoe, South Auckland, that sold for $1.92m. Photo / Supplied

“It’ll be about the logistics, rather than people being willing to buy or sell,” he said.

Martin Cooper, managing director of Harcourts Cooper & Co, on Auckland's North Shore, said that while online enquiry was huge, new stock was not.

“The tipping point was a week ago, we’d only got a handful going to market," he said.

“But immediately after the announcement [that Auckland levels may change next week] our consultants and auction managers’ phones were ringing to fill up for level 3.

A four-bedroom house at Buckley Avenue, Hobsonville Point, on Auckland’s North Shore had 17 offers and sold sight unseen. Photo / Supplied

“I predict that as long as there’s no stop/start in level changes, vaccines are up and businesses are open we’ll have a huge October to December. It’ll take the slack up, and it’ll take right through to Christmas to clear the blockage.”

Harcourts Milford branch manager Kristina Marmont said her office had 10 new listings at price points of between $1.1 million and $3m this week, with some vendors confident enough to book auctions for two weeks out from Wednesday.

“I’m super confident we’ll see a surge, the usual spring plus the five weeks’ worth. The numbers already are healthy.”

A 3-bedroom home on Porchester Road, Papakura, South Auckland sold to developers, who had not stepped inside, for $1.475m. Photo / Supplied

Bayleys national auction manager Conor Patton expects that while campaigns will kick off as soon as agents can bring buyers through houses in level 3, that spring flush won’t appear in auction rooms until at least mid-October, allowing time for preparation and a three-week sales campaign.

“It will be interesting to see if there’s a flood of pre-auction offers. People who have held off since pre-lockdown might want to fire off early shots. If they’ve already sold, they’d be very motivated to buy.

“People want to act before Christmas. They’ll be chomping at the bit.”

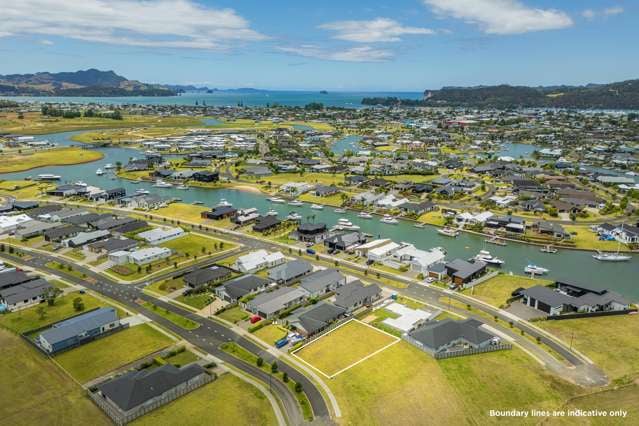

And while there have been lockdown headlines of properties selling sight unseen, these have been largely for development sites or for homes in new suburbs like Hobsonville Point, Stonefields or Millwater where buyers are familiar with homes that are replicated across the master-planned streets.

A developer paid $2.616m for a pair of 1960s houses on McDivitt Street, Manurewa, South Auckland. Photo / Supplied

Mid-lockdown, a four-bedroom house in Hobsonville Point’s sought-after Buckley Road, sold unconditionally for $1.65m without any buyers setting foot inside the property. A six-year-old, five-bedroom house on Fennell Crescent, Millwater, one of North Shore’s newest suburbs, sold for a record $2.002m after just a week on the market, again with no buyers seeing it in person.

Developers have turned out in record bidder numbers at Barfoot & Thompson and Ray White auctions. Last week a record 29 bidders competed at a Barfoot & Thompson auction for an inner-west 1960s house on Terry Street, Blockhouse Bay on a 715sqm site. The three-bedroom house with resource and building consent for three standalone townhouses sold for $2.23m, nearly twice what the vendors had paid for four years ago.

In South Auckland, ReMax’s Don Ha sold a block of three investment studio units in a rental apartment building on Chapel Road, Flat Bush for just under $5m. The investor paid $1.65m for each of the Chapel Studios units, sight unseen during lockdown, a total outlay of $4.95m.

Another South Auckland development property on Allenby Road in Papatoetoe had 20 bidders and sold for $1.92m.

Co-owner of Ray White Manukau Tom Rawson told OneRoof that more than 80% of the 50-plus sales across the company’s four offices in the first two weeks of September were to developers.

“Our auction this week of 26 homes, 23 sold on the day and none had been seen by the 226 registered bidders.”

A pair of 1960s homes on McDivitt Street, Manurewa on over 1400sqm zoned for density sold to a developer for $2.616m, more than twice their combined council valuation of $1.21m; while fierce bidding pushed the price of a four-bedroom house on a 782sqm site on Porchester Road in Papakura, to $1.475m, more than double its $630,000 ratings valuation.

That is changing, pending Auckland’s move to level 3. “Listings are slowing up now because people are waiting,” Rawson said.

“We’ve got big auctions next week and the week after, but for October auctions, supply has dried up. Then there’ll be a massive surge as the usual three-month pre-Christmas is condensed into two."

Rawson expects part of that surge to come from Aucklanders selling up to bail out to the regions.

“This is a shock to everyone after a year of near-normality. People who tossed up leaving Auckland last time are saying if this is going to keep happening, let’s just do it.”