When OneRoof spoke to leading Auckland auctioneer Ross Foreman in May last year, the housing market advice he gave turned out to be spot on.

Covid-19 was new to the world, and to global housing markets, but Foreman was blunt - don’t sit on your hands waiting to see what might happen to the housing market but get on with the business of buying and selling.

Drawing on his experience from the stockmarket crash of 1987 and the GFC of 2008, Foreman said that people who waited around for the market to crash and prices to drop were likely to miss out.

We all now know the housing market defied pretty dire predictions and instead of crashing, prices rose by some 30%.

Start your property search

Those who heeded Foreman’s advice and bought quickly managed to dodge a frantic highly competitive market.

They are no doubt thanking their lucky stars they did so, given the national average property value has since reached $1m.

As Auckland struggles with another lockdown and the country faces a listings shortage, OneRoof decided to get Foreman’s take on the current market.

Auctioneer Ross Foreman has been in the property business more than 40 years. Photo / Supplied

Foreman, who has called auctions for most of the big real estate companies, says this lockdown has gone on longer so it’s harder to call but he’s sure that while momentum could be stalled, the market will soon get going again.

“It’s a little bit like an America's Cup yacht which has fallen off its foils. It might take a few gusts of wind to get going,” he says.

And much the same as last time, buyers and sellers shouldn’t put their lives on hold. “There's still a market ticking over regardless of how bad we think it is,” he says.

“Virtual auctions have been surprising to me. I've done a few and they've worked really well and we’ve got good prices, well above what was expected. That gives you confidence that buyers have still got confidence in certain property areas.”

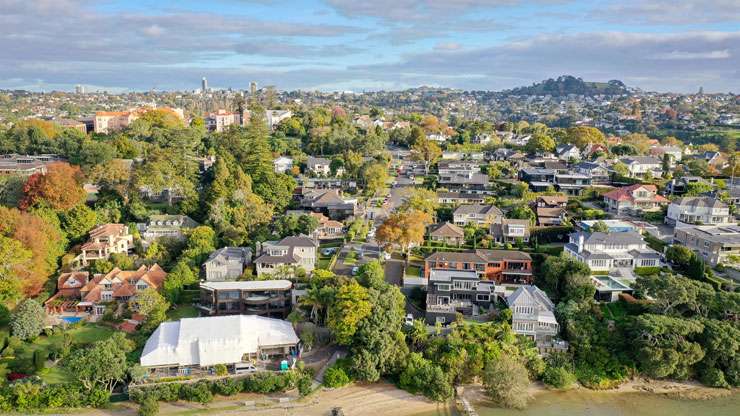

Blue chip areas of Auckland and family-based suburbs with good schools will pick up again quickly, he thinks, because the demand for the liftestyle they offer is high. Some of these suburbs, whilst being among Auckland’s most expensive, are actually under-priced, he says.

Waterfront Remuera, one of Auckland’s most in-demand suburbs. Photo / Chris Tarpey

“People are surprised by the high prices, but are they high? You know, you guys report on $12m, $13m, $15m properties but at the same time in Australia, houses [are selling for] $50m, $60m, $70m. I think there’s still plenty of growth here.”

There will always be eager buyers, he says. “I reiterate my comment of earlier, get on with the job because those people will be out there and the early bird will probably get the worm again - don’t wait and see what will happen, get on and make it happen.”

The fact the market and property types are changing rapidly also gives Foreman confidence.

High-end apartments are springing up in suburbs like Remuera and offering real alternative accommodation choices.

“That’s an emerging thing that is happening, so the oldies don’t have to move out of their area. They sell their big old house which is costing them a fortune and move into an apartment,” he says.

“You can’t build the jolly things quick enough at the moment and that will keep things moving.”

Foreman also thinks while the listings shortage is real it’s exaggerated and to those who are afraid to sell in case they can’t find anything to buy, he says to be open-minded about their next property.

“I hear it all the time, so I’m not being frivolous about it but they’ve just got to get on and get the job done.

“I've been in the business 40-odd years and there has always been too few listings, so I think it’s an over-hyped thing in many ways.

Sold signs cover a real estate window in central Auckland. Photo / Fiona Goodall

“As I say, the choice for people moving is getting a bit wider. There's a lot of redevelopment going on and good quality redevelopment, and properties are selling off the plans.

“There’s plenty of willingness to get on with things even when they can't see the end product.”

There are good agents out there who have learnt a lot since the first lockdown and who offer a high-quality, sophisticated service, Foreman says.

“Deep conversations are going to be what people need to hear to move them forward, because there will be a bit of inertia, I imagine.

“A good agent understands the plight of people saying ‘well, if I sell what the hell am I going to go and buy’ but that’s always the way. It hasn’t changed much. You’ve just got to make your choice and go.”

The trend is also for agents to offer more of a one stop shop which can help take the stress out for sellers.

“I I know of agents that have a band of fixer uppers, so they have a team of people that can come in and say ‘look, we think this, this and this needs to be done, I'll get this bloke who's independent of me but I trust him, he does the job right, he'll come in and give you a quote on that work and get it done’.

“That's probably been around a while but there's some really good ones around now and that service is quite a lynchpin for a good quality agent who can enable that stuff and give people comfort in what needs to be done - when you are 60 or 70 or 80 you don't want to be doing all that stuff.”

Foreman doesn’t see the market crashing any time soon and says all the innovative approaches to new dwellings, from retirement-style apartments to homes on smaller sections, will all help keep the market going.

“There are some pretty smart operators out there who are tuned to the market who are seeing opportunities.”

And there is still room in the market for a further lift of activity and prices, he thinks. “Interest rates will go up a bit but they’re going up from a very low level. There is money there.”