Anyone who bought a residential property in the last 12 months would be up to $61,000 better off than those who invested their savings in a term deposit or the share market, new research suggests.

Data analysis by Canstar NZ and OneRoof highlights the huge gains made by the housing market since October last year.

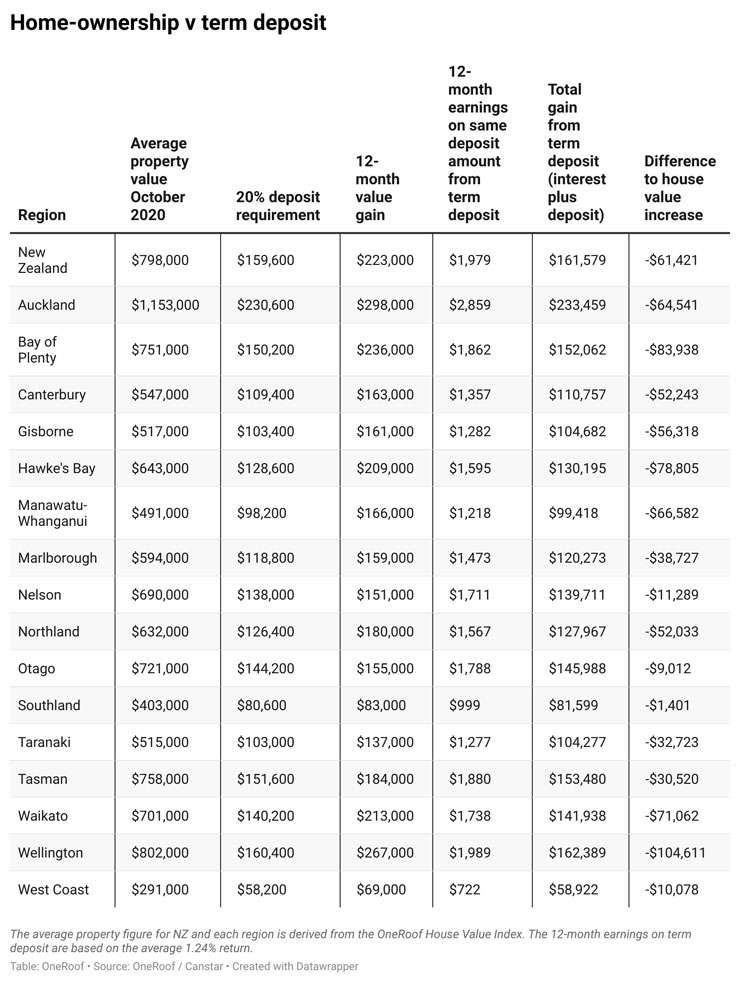

If a Kiwi bought a house in October 2020 for $798,000 - the then nationwide average property value - with a 20% deposit of $159,600 they would have seen the value of their property rise by 27.9%, or $223,000, by October this year.

The same 20% deposit invested in an average term deposit of 1.24% would have earned just $1979 over the same period - a difference of $61,420.

Start your property search

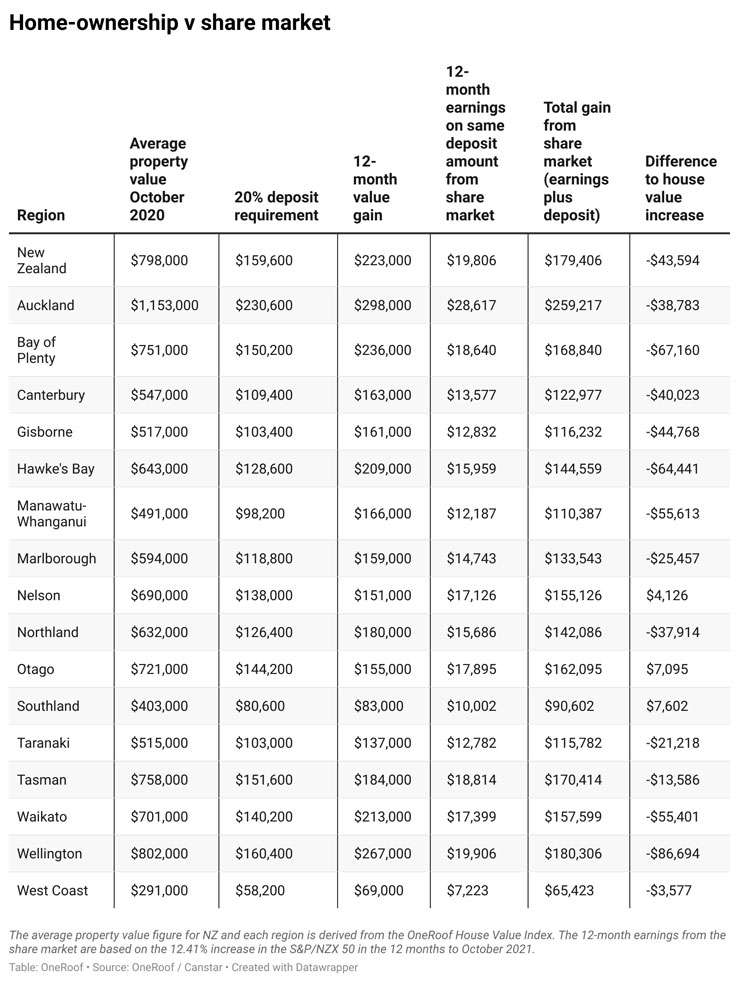

And if the same amount was invested on the S&P/NZX 50 share index, the 12.41% growth over the last 12 months would have resulted in a return of $19,806 - a difference of $43,593.64

The research showed that buying a house was better investment strategy than a term deposit for all regions, although home-owners in some regions enjoyed higher returns than others.

The gap between earnings on a term deposit and increase in the average property value over 12 months was widest in Wellington.

A buyer who invested in a house in the region in October 2020, at the average property value of $802,000 with a 20% deposit of $160,400, would have enjoyed a 33.3% rise in value of their property, or $267,000.

That would have left them $104,611 better off than someone who invested the same $160,400 in a term deposit.

Buyers in Bay of Plenty would have been $83,937 better off over the last 12 months while those in Hawke's Bay would have come out $78,805 ahead.

The advantage for Auckland buyers was $64,540 and for Canterbury buyers it was $52,243.

The advantage over term deposits shrank considerable in regions where the average property value is low or where house price growth was relatively small over the last 12 months. In Southland, where the average property value in October 2020 was $403,000 and value growth was just 20.6%, home-owners came out just $1,400 ahead.

The research showed that the value gains for homeowners was actually lower than share market earnings in three regions: Nelson (-$4125); Otago (-$7095); and Southland (-$7602).

The advantages homeownership had over an investment in the share market was again widest in Wellington, where buyers in the region were $86,694 better off.

Jose George, general manager NZ at Canstar, said the research underscored the huge lifts in the housing market.

The past 12 months had been very profitable for home buyers and property investors with skin in the market, he said. “On the face of it, if you compare investment in a property against the share market or against a term deposit, property is a run-away winner."

That did not mean property would always beat those other investments, as the research showed. “Historically, share markets have always outperformed property prices. Over the last 50 years you see that the NZX gets you an average return of 15% per annum. Property has been in the 7% to 8% [range] of returns per annum over that same time.”

Canstar NZ general manager Jose George: "Property is a runaway winner.” Photo / Supplied

The reality of real estate versus shares, and term deposits, however, was more complex than the data suggest, George said. “One thing is it’s a unique period of time when you’ve seen extraordinary price increases in property.”

The reasons for that range from historically low interest rates to the housing shortage driving up prices. “So, the comparison between property [deposits and share markets] becomes very simplistic,” he said.

“The other thing to bear in mind is the power of leveraging.” That’s making a profit on borrowed money such as a mortgage. “So, you put in 20% and you're taking a full benefit of the 100% property value. That’s why there is a significant difference.

“Clearly with that leveraging [property] would be a winner, compared to putting it in the share market only because the leveraging is where it makes property even more attractive."

George said that investors could leverage share investing by borrowing money. This is called margin trading but can be risky because share prices tend to rise and fall more dramatically than property prices, amplifying losses as well as gains.

Property buyers also sometimes failed to factor in the costs of buying and selling property such as agent fees, the high cost of renovation, and also on-going maintenance, which does add up to a lot.

Likewise, property wouldn't always go up at more than 20% per annum. At some point the rise will slow. With new regulations, interest rate rises, and other pressure on the property market, it’s unlikely the residential property market would replicate the gains of the past 12 months over the next year, said George.

“Even if there isn’t a downward decline in property prices we might not see the kind of meteoric rise as we’ve seen over the last two years. That’s yet to be seen. I don't think it's a situation of expecting a downturn as much as a slowing in the growth rate.”

Although the share market returns still showed a comfortable gain over the past year, term deposit interest rates were so low that investors were in effect making a loss, said George.

First home buyers who can’t yet afford to get into the market because of the housing crisis could invest in shares in the meantime. “With the share market one of the pros is you’ve got a low entry point. It’s a far more liquid investment because you can get out quicker,” he said.

“The other big thing when [to bear in mind] you're comparing property to shares is that with property you're putting a massive investment into one unit. In the case of a share market, you have the ability to create a portfolio and to manage your risk better by diversifying [across] sectors, industries and companies. You can make sure that you've got a far more diversified and therefore, a better risk adjusted portfolio.”