Mortgage rates: Double shot?

Brace yourself for more mortgage stress. The Reserve Bank is expected to raise the Official Cash Rate when it releases its next Monetary Policy Statement, on May 25, six days after the Government delivers the Budget.

There are four more Monetary Policy Statements scheduled for this year - July 13, August 17, October 5 and November 23 - which could mean four additional hikes this year on top of this month’s expected rise.

Start your property search

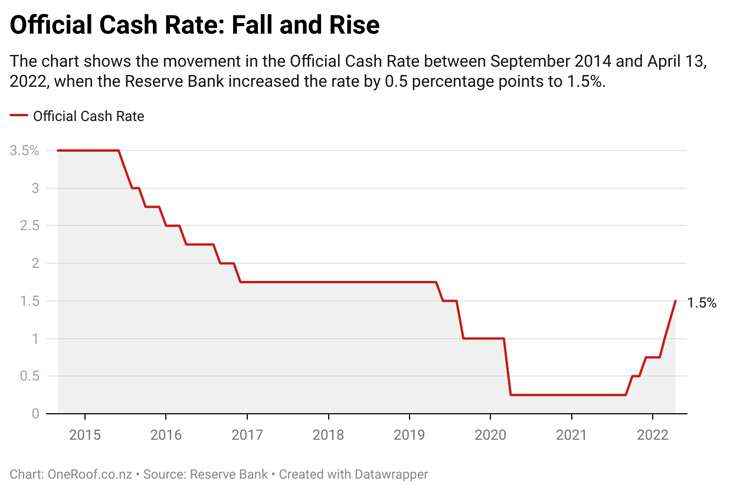

Last month, the Reserve raised OCR 50 basis points to 1.5%, and Governor Adrian Orr has made taming the “inflation beast”, as one bank describes it, his priority. Most of the major banks expect the Reserve to push the OCR to 2% on May 25. The last time Kiwis saw a rate that high was six years ago, but back then rates were falling not rising.

ANZ’s economists said in their latest report that inflation will ease, but it’s just a question of how high the OCR needs to go to have the desired effect on rising prices.

ASB’s economists are warning mortgage-holders to brace for impact. Around 60% of all mortgages will come off their existing fixed rates over the next 12 months and when they do, home-owners will be paying higher interest rates.

Westpac, however, says mortgage rates are unlikely to rise on the back of the expected OCR hike, describing mortgage rates as “overcooked”. “That suggests to us that there is no advantage to fixing for longer terms,” the bank’s economists said in their latest report.

Homeowners with one-year mortgage rates might, however, benefit from fixing because that rate is likely to see further increases in the year ahead. “Fixing and rolling for this term is likely to produce a lower borrowing cost on average over the next few years.”

House prices: The downturn worsens

The housing market is paying for last year’s excesses, Kiwibank economists noted in their latest economic report, citing the $50,000 fall in the country’s median sale price in the last six months. Putting downwards pressure on prices are “tighter credit conditions”, increased costs for investors and the surge in new-build activity. The current market “correction” is likely to be short and sharp, they say.

ANZ economists expect prices fall 10% over 2022. “That’s great news for those who have been locked out of the market, but particularly bad news for recent first home buyers who are more likely to have high debt, are facing rising mortgage rates and are watching their equity go up in smoke. No one wants to buy at the peak, and buyer interest is unlikely to pick up again until it’s looking like prices are finding a floor.” Another figure of note is the 30% year on year fall in property sales in April.

House sales in April fell across the country. Photo / Fiona Goodall

Westpac’s economists have revised their house prices predictions. Currently they’re forecasting a 10% drop this year and 5% next year before house prices start rising again.

And ASB economists are predicting a 12% fall in total, although that only takes house prices back to where they were in early 2021 - still 27% higher than they were at start of the pandemic.

New builds: Are houses still in short supply?

Westpac’s economists say New Zealand needs to build 26,000 new homes a year to meet demand. Councils have issued consents for more than 50,000 homes nationwide in the past year, but materials and labour shortages could get in the way of building. And finally, even though house prices are heading south, housing affordability is going to remain an issue.

ANZ says the outlook for the construction sector is shaky. A net -36.8% of businesses expect residential construction activity to decline over the next 12 months. “Residential construction intentions (are) slipping well into contractionary mode,” the bank says, warning that projects could end up on the scrap heap as “cost blow-outs meet falling prices”.

Jobs keeping homes safe

Employment is important for the housing market. Buyers’ ability to repay mortgages is based on their employment status and income. Home-owners need an income to pay the mortgage and tenants need income to pay rent to their landlords. Westpac, like other banks, headlined its latest economic newsletter on the fact that the New Zealand job market is running hot. The unemployment rate for the three months to the end of March was an ultra-low 3.2%. Wages are clearly heading up, the Westpac economists noted, but not keeping pace with the cost of living. It may be a good time to switch jobs.