Did you know that properties can actually talk? At AMI Insurance, our friendly team wants to help property owners understand them.

Our knowledge, based on the claims that Kiwi property owners make most frequently, helps us to help you in protecting your precious investment.

For an idea of the areas that your due diligence should always cover when looking to buy, we asked experienced tradie John McKenzie of Rag Reno’s in Auckland to run through some common areas of potential concern, starting with water damage.

“When you’re checking out a possible property to purchase, look absolutely anywhere that water could possibly be causing damage now - or even in the future,” he says.

Start your property search

He advises looking and feeling around the kitchen sink, dishwasher, washing machine, bath, basin, and shower, as well as hot water cylinders, and points out that if something is soft, or damp, then further investigation may well be needed.

Flooding and water damage caused by faulty braided pipes make up some of AMI’s most common water-related claims. If they’re present in the house you’re thinking of buying, check they don’t have signs of damage. You can find them under sinks in kitchens, bathrooms and laundries. Warning signs include bulging and rust spots.

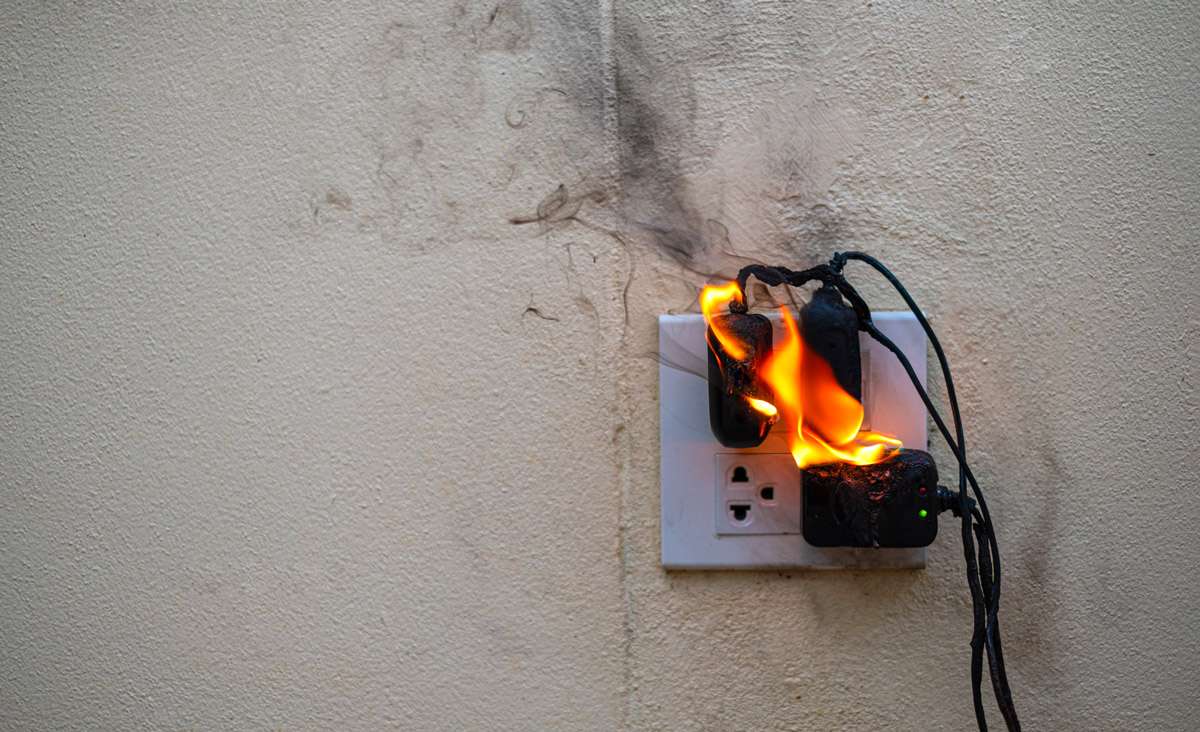

Mr McKenzie says he often has to remediate the results of fire and smoke damage– another unfortunate claim landlords make with AMI.

“It’s a good idea to bring an electrician in to check the wiring in your property, because it’s a common cause of house fires - especially if that wiring is old and hasn’t been updated,” he adds.

Photo / Getty Images.

“Never underestimate the importance of smoke alarms. Whether you’re buying to live or to rent, always make sure they’ve been installed in all the places they should be.”

Wayne Tippet, Executive General Manager, Claims at AMI, adds: “Remember to install smoke alarms in rooms that you normally wouldn’t think about, like the garage, which often houses flammable materials.”

Meth contamination is another potential headache area for property owners because the cost of fixing it can be high and losing tenants – even temporarily - means losing income.

At AMI we understand how worrying this can be and if your property is a rental, we suggest carrying out a meth contamination test before settlement and advise having your property manager carry out a thorough inspection with every change-over of tenants.

Mr Tippet adds, “Meth contamination is an unfortunate reality for many property owners. It’s crucial to regularly use indicator test kits during and between tenancies.”

Just in case your worst meth fears are realised in future, AMI insurance policies come with bonus cover of up to $30,000 for meth contamination for extra peace of mind.

To find out more about how AMI can help protect your property investment in general, get in touch with us on 0800 100 200 or visit ami.co.nz.