Given the roller coaster housing market over the last few years OneRoof asked industry experts where they think buying will be good in 2023.

James Wilson, head of valuations for Valocity, OneRoof’s data partner, says when prices in Auckland become too expensive people pan out to the next urban location.

That’s a trend he expects will reverse, saying nearer the central city could be more affordable.

In the last couple of years there has been a “sort of concentric rings theory”, with people spreading out from Auckland to Hamilton and Tauranga then on to the regions, such as Hawke’s Bay and Gisborne.

Start your property search

When the market is softer, as it is now, Wilson says people should be thinking about looking back towards centres.

“Make that next purchase as close to a big economic centre as you can do because that’s where New Zealand traditionally performs the best so markets don’t tend to go down as far or for as long, as opposed to the regions which can be far more exposed to housing market shocks.”

Hamilton central is one area Wilson highlights, saying rental rates are strong for investors.

“I think Hamilton has a lot to offer. It stacks up quite nicely as an investment and with decreased competition I think there are some people making some pretty good buys around there.”

The central Auckland suburbs could also be good buying, especially the “golden ring” suburbs on the fringe of the CBD, so areas like Ellerslie, Onehunga, Three Kings on the southern and southwestern fringe and suburbs like Mt Roskill on the western side of the city.

These areas have good public transport to take people back to the CBD for work, and heading back to the CBD is a global trend, Wilson says.

There are good amenities in established central areas as well, and because there is less competition the suburbs attractive to investors and first home buyers alike.

“The thumb should always be buy as closely as you can to the heart of urban areas, which is typically where you will get the best long-term returns.

Valocity head of valuations James Wilson: “Make that next purchase as close to a big economic centre as you can.” Photo / Fiona Goodall

“First home buyers have been happy to rule out those central locations for the last few years but now it’s time to have a look because they might be surprised what less competition does for them in those areas.”

Kelvin Davidson, chief economist at CoreLogic, says of New Zealand’s major metros, Wellington has been hardest hit but there will still be “damn good” buying opportunities.

People don’t buy the average property, he says, they buy an individual property and there will be some absolute bargains to be had.

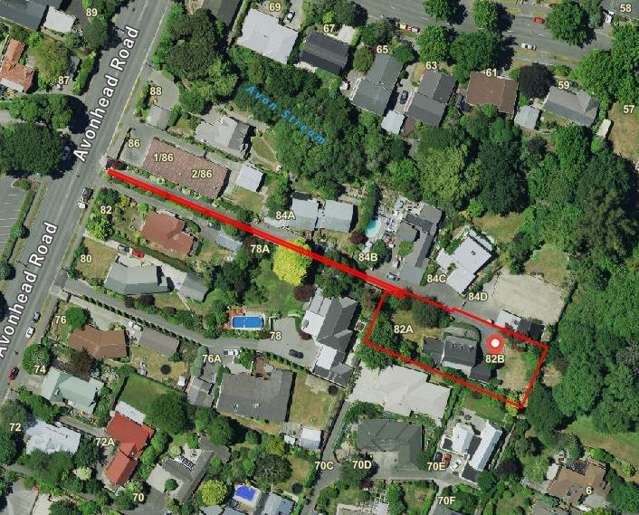

Canterbury is also still an attractive part of the country for buyers. Davidson says while most parts of the country will see price falls in 2023 some areas will see less.

Among the less vulnerable is the Canterbury region, including the likes of Ashburton, Timaru and Waimakariri.

They have held up well and that’s because prices didn’t rise as high in the first place, and also because affordability is better, Davidson says.

They have solid agriculturally-based economies and people want to live there.

Other isolated parts of the country have also held up well, such as New Plymouth, which Davidson says also has better affordability.

“That’s not to say it will continue to do well but it’s been pretty resilient so far so it could stay that way.”

Buyers looking further ahead timewise should keep an eye on Auckland and Wellington. Because the larger cities have fallen a lot quickly they could reach the bottom faster and begin to present opportunities again.

“Let’s face it, Auckland is our biggest market and most diverse, it’s where our commercial centre is. If net migration picks up probably Auckland will benefit the most from that.”

There could be some deals in the outer fringes given all the townhouse developments, especially if developers have properties sitting there ready to go and are wanting to free up cash to get on with the next project.

Onehunga is one of several “affordable” suburbs in central Auckland that are tipped for growth. Photo / Fiona Goodall

In Wellington, Lower Hutt is one of the markets that has fallen the most nationwide and with the number of new builds in the suburb it may be possible to pick up a bargain, Davidson says.

He also points out that while prices are coming down there will be another upswing in property values, although he’s not saying when.

Sam Steele, Ray White’s lead auctioneer, thinks anywhere in South Auckland is worth keeping an eye on.

That market saw “extraordinary” growth over the last two or three years but with the market correcting itself there’s the opportunity to get great value for money.

“What I mean by that is you can still get a sizeable house with a sizeable section in a reasonable area for well under $1m now.”

First home buyers who don’t want an apartment or an attached townhouse should look in the south of the city, Steele says.

“That was a market that was predominantly seven figures last year but it's well below that now.

“We're selling three-bedroom homes on about 500 or 600sqm sections in the $600,000 and $700,000s – places like Manurewa, Papatoetoe, Mangere.”

Lifestyle areas in the likes of Gisborne, Hawkes Bay or Whangarei are all still popular, and people seeking a quieter life are also looking to those areas where their money goes a bit further.

“If you're someone who's selling up in Auckland or Christchurch and going to a market like that, your money is certainly going to go a lot further than what you can possibly secure anywhere else.

“Obviously after that craziness of the last couple of years prices in those centres have come back and it's opening up that affordability, whether it's to the first home buyers or to established families.”

Steele says an $800,000 budget might buy a terraced house in Auckland but in Whangarei it might get four bedrooms and a backyard.

He also looks to Christchurch for affordability, saying it offers the benefits of a large city but is much cheaper than Auckland or Wellington.