Just before Christmas, an Australian tech billionaire smashed the Australian house price record when he paid A$130 million ($141m) for a waterfront mansion.

The baronial Scottish-style house known as Uig Lodge, at the top of Sydney's prestige Point Piper suburb, was bought by Scott Farquhar, the billionaire co-founder of tech group Atlassian. It broke the previous record of A$100m, set in 2018 by Farquhar's co-founder Mike Cannon-Brookes for the former Fairfax mansion, Fairwater, also on the Sydney waterfront.

It's not the first time Farquhar has set records. His $71m purchase of another Piper Point mansion, also previously owned by the Fairfax family, set records in 2017.

But New Zealand doesn’t have sufficient billionaires to match those Sydney prices. For homes to soar to those prices, there needs to be a ready pool of billionaires to buy, said Bayleys head of insights, data and consulting Chris Farhi.

Start your property search

He said New Zealand’s residential property market may well get to $130m on a nominal basis eventually, but by then Sydney prices will have moved beyond that, and the lag will remain.

Waterfront suburb Point Piper, along with neighbouring Double Bay, is home to huge mansions that continue to break house price records. Photo / Getty Images

The big difference between the two countries, he said, is that Australia has many more ultra high-net wealthy individuals than New Zealand. “If you're thinking of a $130m house, it’s realistically, a billionaire, who can purchase,” he says. “In New Zealand, the number of people with that sort of wealth is very, very small.”

Sydney-based Ray White economist Nerida Conisbee concurred, saying there is a greater pool of high-net worth buyers on her side of the Tasman, who have made a lot of money in business.

“What we find in Australia is that a lot of people that make money from mining, tech, manufacturing or agriculture, tend to park it in very expensive properties.”

Bayleys partner Knight Frank’s Wealth Report 2022 estimated the number of ultra high-net individuals worth US$30m or more was 20,874 for Australia and 3,118 for New Zealand. Farhi said the company's estimate for billionaires in Australia was 46, and just two for New Zealand. Local estimates from NBR count up to eight families in that wealth bracket.

Unlike markets such as London, New York, and Hong Kong, most non-residents aren’t permitted to invest in residential property.

“If you look at New York or other cities such as London, there is a lot more foreign money coming in,” he said.

Both Australia and New Zealand have laws that restrict non-residents from buying homes, although high-net worth individuals who invest locally can apply for special visas.

The other reason New Zealand may continue to lag behind Australia on property prices at the top end is supply. Historic patterns of ownership mean that there are very few sites on the coast in cities to warrant the high prices paid in Sydney, said Farhi.

An apartment on One Sydney Harbour, Barangaroo, sold off-the-plan for A$140m, but the building won't be completed until 2024. Photo / Getty Images

And there are few properties that are worth that much.

OneRoof data show the top residential CV in New Zealand is for the mansion formerly owned by financier Mark Hotchin, just off Paritai Drive, which has a current CV of $46m. Its 2013 record sale price of $38.5m has still not been beaten. In second place is the Riddell Road property in Glendowie, with a CV of $40m, owned by Graeme Hart, New Zealand’s richest man, according to the NBR The List (formerly Rich List). Available figures don’t include the North Shore, Auckland, holdings of another of the country's wealthiest men, Berridge Spencer’s newly built home at Stanley Point which was estimated in 2016 to be worth at least $50m.

“There are examples where people have pulled together a site [from multiple sections]. It would take quite a bit of effort and it would need to be right on the waterfront. That limits your supply," Farhi said.

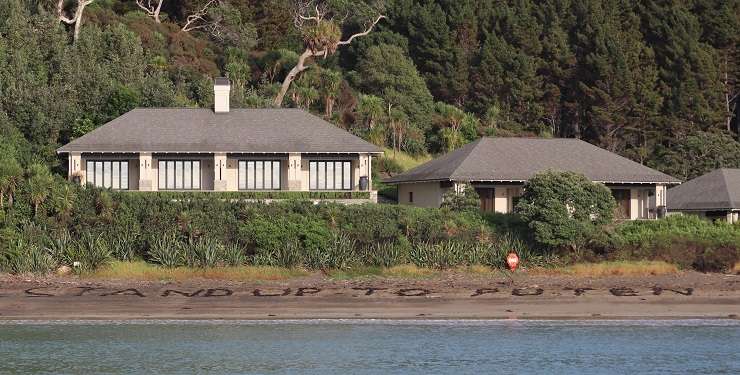

The highest residential price of the seven-bedroom mansion on Orakei's exclusive Paritai Drive has not been broken in nine years. Sanctioned Russian oligarch Alexander Abramov owns a $41m lodge at Helena Bay, Northland, which is a different market to residential.

There are properties that are likely to be worth significantly more than those record sales - in theory over $100m - but they don’t come up on the market. Ray White's Conisbee said Australia also has equivalent properties that remain tightly held and don’t come onto the market.

The Helena Bay, Northland, estate of disgraced Russian billionaire Alexander Abramov is valued at $41m. Photo / Peter de Graaf

Hart’s property in Glendowie was built up over the years, with the businessman buying neighbouring sites to create a larger landholding. The Spencer home in Stanley Point, near Devonport, is made up of 17 titles but has been in the same family for three generations.

A potential site could have been the 300ha farm with 5km of private coastline on Waiheke Island that Mainfreight chairman Bruce Plested bought last year for $72m. If a luxury home was built on the site, the value could be boosted significantly, but the businessman has said he intended to protect the land and leave it in its natural state.

New Zealand Sotheby’s International Realty managing director Auckland projects and developments Gavin Lloyd has worked in top-end real estate in both Sydney, for 27 years and, for the last eight years, in Auckland. He doesn’t rule out a sale in New Zealand competing with the Point Piper home.

“If Graeme Hart’s [property] ever came on the market, that would be something that can potentially compete with that type of pricing.”

But in general the big difference between the two markets is the land size of Sydney waterfront estates, and its larger population, Lloyd said.

“A lot of them are sitting on substantial landholdings of two, three, four or 5000 square metre-sections. They're big plots of land, [and] lovely old estates that have been preserved over the years and haven't been subdivided up. Double Bay, Point Piper, [and] Vaucluse are really world-class trophy suburbs.”

It’s that phrase “world class” that really differentiates Sydney's top-end properties from New Zealand’s, said Barfoot & Thompson agent Paul Neshausen, who is based in Auckland’s St Heliers. Regulation in Auckland in particular stops the city attaining that status, he said.

“It's not just the house and how much land it has got. There's a whole world class city synopsis at play that New Zealand needs to think about and catch up with.

“Sydney represents a true world-class city in terms of its infrastructure,” said Neshausen. “I'm talking about transport and talking about a council that is forward thinking and less bureaucratic than New Zealand, and all those things that you need to make a world-class city that culminates in $100 million-dollar housing opportunities.

“London, Paris, Sydney, New York are the ones that are attracting all the money. Not only just from high net worth individuals, but businesses that are finding it easier from a tax relief perspective to set up in Australia. Australia’s made it easy to set up business.”

Neshausen cites controversies here over rich listers’ helicopters as examples. The Spencer family failed to get permission to build a private helipad on Stanley Point in 2013, and Briscoes boss Rod Duke failed in an attempt to get permission to convert a boatshed into a helipad in Herne Bay in 2018.

“These decisions are made by people in council earning $100,000 a year who don’t get it,” said Neshausen, adding that Sydney understands that its high net worth individuals need jetties, helipads, security, and other infrastructure.

“You need a macro view on what needs to happen for New Zealand to have a $100m house.”

Neshausen said that almost all of New Zealand’s trophy properties can be found in four locations - the Bay of Islands, Auckland coastal, Waiheke Island, and Queenstown Lakes.

It’s that last location in particular, that could see the stars align for much higher property prices than currently, said Farhi.

He cites the Queenstown Lakes area as one to watch for mega sales. Buyers are quietly grouping together sections into larger estates.

“But they are more likely to be around the $20m mark, not the $100m mark, currently.”