House hunters are starting to fulfil their new year’s resolutions early as agents reveal there are a lot of new properties for sale and people, especially first-home buyers, have been flocking to some of their first open homes for 2023.

Harcourts agent David Ding held his first open home at 29 Spinella Drive in Bayview, Auckland, on Sunday and was shocked to see 11 groups turn up to view the three-bedroom entry-level home.

He is aware of other agents who also saw good turnouts to their open homes at the weekend. “The fishes are there, first-home buyers are there,” he said. “No one would predict 8 January is busier than November.”

Ding said the early interest could be down to people wanting to get a jumpstart on new listings first while trying to beat the predicted interest rate increase in February and use their existing pre-approvals before they expire.

Start your property search

However, he also noticed that buyers are price sensitive, adding that a property priced in the $800,000s is attracting a lot more buyers than one in the $900,000s.

Harcourts Holmwood agent Zani Polson said the Christchurch market is already kicking off with a number of new listings already live and many more due to go up in the next week.

A three-bedroom cottage at 38 Dacre Street in Linwood was listed by another agent in her office earlier this week and has already attracted plenty of interest, especially from first-home buyers.

Polson has held seven open homes so far this year for those having staycations and expects to see more people show up at the viewings from this weekend.

“I would say this weekend will be the one where we will see a good increase of numbers where people will have been away on holiday and had chats – that sort of thing.”

She also expected to be referring people to mortgage brokers so they could discuss their options in order to fulfil their new year plans. “I think it’s more around people are going ‘ok new year let’s get my ducks in a row and work out whether I can actually buy or not’.”

This three-bedroom cottage at 38 Dacre Street in Linwood, Christchurch, was listed earlier this week and has already attracted plenty of interest, especially from first-home buyers. Photo / Supplied

In Wellington, Tommy’s Real Estate salesperson Jason Lange has tried to beat the usual rush by putting up some new listings.

“This year we’ve already listed 20 properties and often try and get ahead of the market in some cases where there’s less stock on.”

Lange said the week following Wellington’s Anniversary Weekend – on January 23 – is when the market is bombarded with listings.

“Generally, there’s anywhere from 200 to 300 properties that have hit the market in that week, but to be honest this year I think it will be a little bit more subdued.”

Lange said a lot of people seem to waiting for the next OCR announcement in February and its impact on interest rates before making the next move.

“As soon as those interest rates or fixed term rates stabilise, I really do think that things will settle down pretty quickly.”

Ray White agent Ross Hawkins says interest in 43 Taumata Road in Omaha, has been high and he expects the four-bedroom, four-bathroom waterfront property to crack the $10m price ceiling. Photo / Supplied

In Queenstown, the early kick-off in the local market surprised Premium real estate agent Hamish Walker.

“In the local, entry-level market – homes around the high $1 million mark – we had our first open homes January 7. One property had 30 people, another had 40,” he said, adding that three big off-market deals worth $15m closed just before the holidays, but these were for lifestyle properties with potential to develop high-end homes.

“While we have expats, about 70-75% of our buyers last year were locals, then there were Aucklanders and some from Christchurch, Wellington and Hawke’s Bay.

“Business is certainly coming in thick and fast, it’s busier this summer than it was last year. It’s very encouraging.”

And while the high-end market in Auckland’s blue-chip suburb usually takes a breather until February, when buyers return from travelling or their holiday homes, Ray White agent Ross Hawkins said he squeaked in a deal on Christmas Eve.

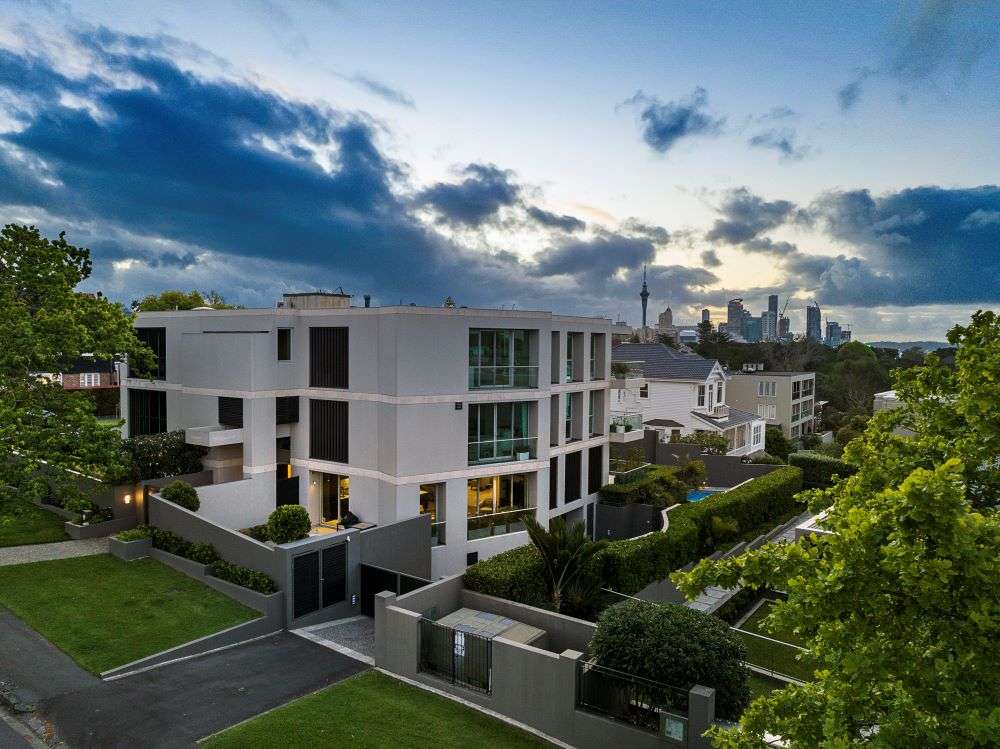

He sold an apartment in Parnell’s St Stephens Avenue for more than $6m the day before Christmas, just five days after the marketing sign went up.

“We’re getting a lot of city viewings too. I think because the weather is so bad there’s not so much coastal activity,” he said, although interest in a waterfront property he is marketing on Omaha’s Taumata Road has been high and which he expects may even break records in the beach town, possibly crack the $10m price ceiling.

An apartment in Parnell’s St Stephens Avenue in Auckland was sold for more than $6m on Christmas Eve after just five days on the market. Photo / Supplied

“While there’s a real unknown of what we’re going into, it’s not going to get any cheaper, these properties will hang onto their value,” he said.

Hawkins, whose patch also includes high-end properties in both the Bay of Islands and Queenstown, said there is still a shortage of good properties in the $2m-$3m range in those second-home markets and that is keeping agents busy this summer.

Carolyn Vernon, who manages Barfoot & Thompson’s Remuera office, said that agents have already made some quiet off-market sales these holidays.

“There are buyers for them, we can’t get enough properties over $5m. We did sales on December 23 and 27; this week we did a deal for $6.6m.

“We’re very fortunate that we work across all the price points, we’re doing more appraisals in January to start marketing though we’d expected more before Christmas. People are fed up with waiting and saying ‘we have to make plans, let’s just do it’,” she said.

Vernon said that the first flush of listings in January are for investor-type properties, generally below $1m, as owners grappling with high interest rates, meeting the healthy homes regulations and facing an uncertain outlook for 2023 quit their investments.

- Additional reporting by Catherine Smith