Words like “hotelification” have popped up overseas in connection with office blocks as organisations try to provide environments that lure staff back into CBDs.

A report from The Guardian in the UK says global commercial real estate and investment company CBRE’s new London HQ could be mistaken for a hotel with its comfy seating, coffee, tech bars and library.

But the report also raises concerns around the future of office blocks, given the post-pandemic hybrid-work changes, the US banking crisis, and also inflation and interest rates all putting pressure on commercial investors.

Given the collapse of Silicon Valley Bank in the US and the UBS rescue of Credit Suisse, the story says some London investors are worried pressure could pile on the commercial property market, which The Guardian reports is worth 20 trillion US dollars globally (around $NZ32tn), if banks rein in lending.

Start your property search

The report also says with rising interest rates some owners of commercial property could be forced to sell assets when existing loans mature.

The situation is a bit different in New Zealand on several fronts with commercial real estate experts not expecting the demise of the office block any time soon, although CBRE NZ says there could be sales to come.

Read more:

- The 16 suburbs where house prices jumped more than $100K

- 100 years of selling Auckland: The story behind city’s biggest real estate agency

- Billionaires' new hangout: Coatesville overtakes Herne Bay as NZ’s most expensive suburb

“Investors with two and three-year debt rolling off in 2023 are faced with an increased cost of debt,” says Zoltan Moricz, executive director/head of research.

“Buildings with a higher than normal vacancy will be difficult to refinance without additional equity injection and some owners will inevitably make the decision to sell.”

But banks here are subject to stricter macro-prudential controls and have different operating models than the overseas banks.

And while The Guardian reports UK commercial property values sliding, Moricz says there is still plenty of buyer depth on sale campaigns in New Zealand, with more private investors at the table this year compared to prior years when syndicators and listed groups dominated transactions.

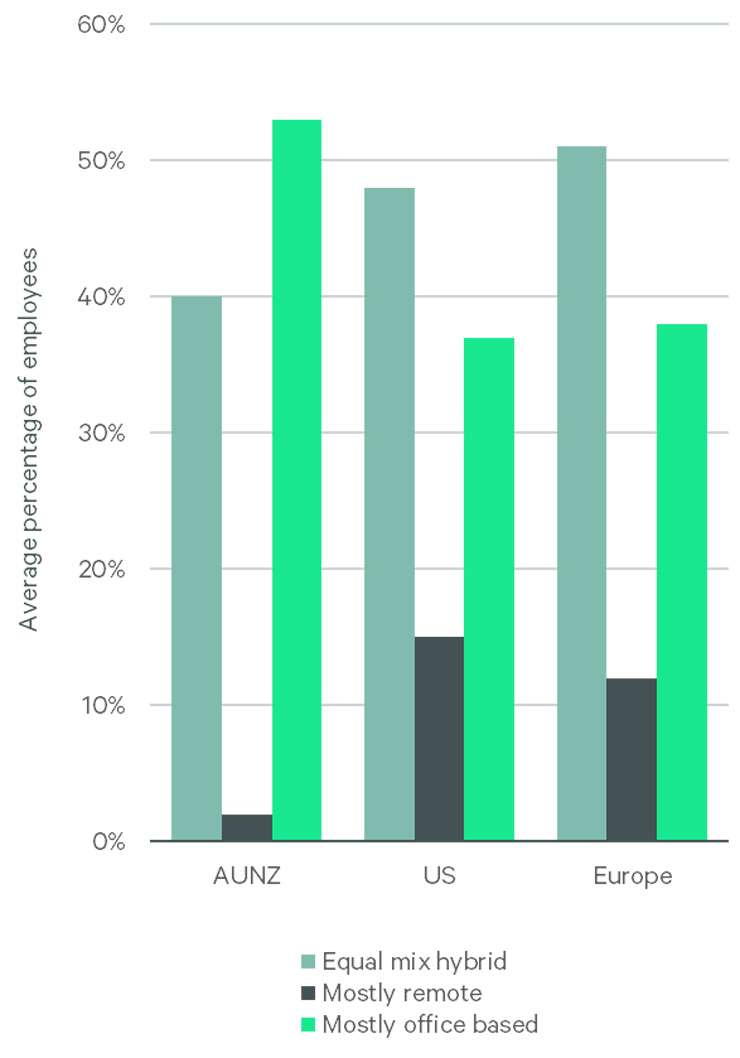

New Zealand is showing different patterns in office-based working, too. CBRE’s regional and global surveys of office occupiers from last year showed New Zealand is more predisposed to office-based working than remote working compared to the US and Europe.

“Our view is that hybrid working has become ingrained for office-based occupations in New Zealand but it has been more balanced towards being office-based than in the US and Europe,” says Moricz.

More flexible work arrangements are having an impact but less than what was previously expected, he says.

Moricz says the prime office market here saw a net occupancy gain in 2022 and among relocating occupiers the lost footprint was about 12% at an aggregate level.

“While there has been a fair amount of in situ contractions in the market last year, expanding businesses and new market entrants – signs of a well-functioning market – have largely compensated for this.”

Office Attendance – 2022 CBRE Office Occupier Survey

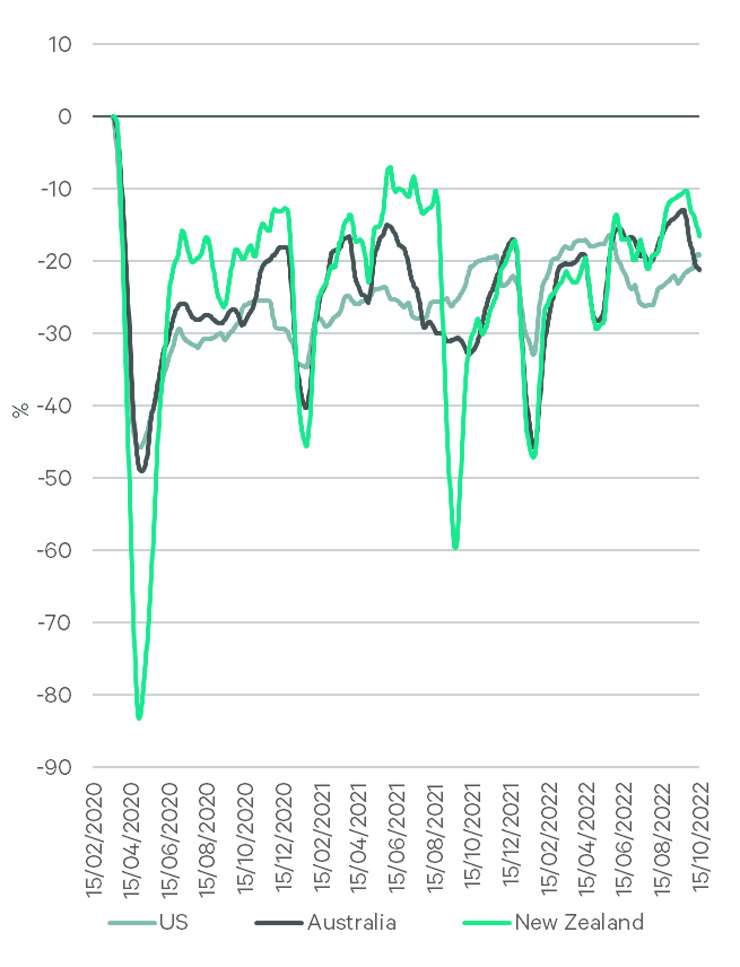

Workplace Mobility - % of mid Jan to mid Feb 2020 daily average

CBRE’s global chief economist and global head of research, Richard Barkham, said in a statement for OneRoof a global banking crisis is not imminent, even if more negative surprises appear.

“Amid recent concerns about the banking sector, swift action taken in recent days by the Federal Reserve and other global central banks will stabilise the system.”

Jarrod Kerr, Kiwibank’s chief economist, says New Zealand is “a mile away” from what’s going on in the United States.

He points out what happened with Silicon Valley Bank and other banks is specific to them and the way they are funded but New Zealand has a much higher level of regulatory scrutiny.

The US Federal Reserve, however, along with every central bank in the world, has been fighting inflation to the point “we have seen something break”.

“We’re seeing the Fed lifting interest rates very quickly to very high levels and things are creaking, and things are creaking here in New Zealand as well.”

One of the impacts is the slowing down of commercial activity. Kerr says a lot of deals which would have gone ahead last year are not getting done this year.

“They no longer stack up with the higher interest rates and higher hurdles businesses have to jump through to get things done.

Kiwibank chief economist Jarrod Kerr: “We’ve heard a lot from customers as they roll on to higher rates but we haven’t heard of distress yet.” Photo / Fiona Goodall

“There are a lot of things we may have approved already that are not being drawn down by customers because they are changing their opinion on the outlook.”

There may be forced sales still to come of commercial property, he says, but he is not aware of any yet.

“We’ve heard a lot from customers as they roll on to higher rates but we haven’t heard of distress yet.”

Kerr addressed a cross section of business customers this week and says most have their heads down and are “putting out fires”.

“They’re doing what they can to adapt to the changing environment and they are not looking ahead.

“Appetite for expansion has evaporated and we’re even hearing appetite for employing is going the other way now.”

That’s a big shift in a short period of time - but Kerr hopes the Reserve Bank will be cutting interest rates next year so there is light at the end of the tunnel.

Chris Farhi, Bayleys’ head of insights, says the commercial property market has been impacted in a similar way to the housing market by inflation and higher interest rates.

Asset values have reduced as have the number of sales, he says - around $12b of commercial property sold across New Zealand in 2021 with that figure down to $4b last year.

“Last year was quite a quiet year for sales activity and that was basically just a difference between vendor expectations on prices and buyer expectations, so a very similar mechanism to the housing market.”

Office space for lease in London. Office occupancy in the UK capital has dropped sharply since Covid. Photo / Getty Images

Scott Pritchard, CEO of Precinct, one of NZ's biggest office developers and commercial landlords. In the background is Precinct's Commercial Bay tower. Photo / Michael Craig

The commercial market covers everything from office property to warehousing and retail and Farhi says the lending that has gone into the sector here is more conservative than some of that seen overseas.

Investors and property owners do not appear jittery about the overseas banking issues, he says: “We don’t get a sense there’s any acute problem coming through off the back of those regional failures in the US.”

He also says because commercial properties are more actively monitored by banks here, banks will step in earlier to help those in trouble through mechanisms such as restructuring finances.

“I guess they have a bit more warning and so we haven’t seen too many examples of forced sales in the commercial property space and I think that’s because where risks are identified the banks are quite proactive in working with their customers.”

Larger commercial owners also have sophisticated interest rate hedging programmes, he says, where they swap out a short-term interest rate for a longer-term rate.

AS for office blocks, Farhi does not foresee their demise. He says in 2020 The Economist ran an article called Death of the Office which scared people a bit but Farhi says the office has remained a core part of how business operates.

Some corporates are using less space or fewer desks but for the most part tenants are still recommitting to offices for long periods of time.

But what has been happening in New Zealand is companies wanting nicer spaces for staff.

“It’s what they call a flight to quality and that reflects them wanting to make sure the office environment is a good place that staff want to come to rather than just working from home.”

In Wellington, seismic risk has also pushed organisations to take better quality offices, he says.

The ability work from home has emptied offices around the world, but the occupancy trendline in New Zealand is higher than in the US and UK. Photo / Getty Images

But while businesses might be adopting more of a “café lifestyle” within office fit-outs, that trend was around before the pandemic, Farhi says.

In Auckland’s CBD, for example, mid to large organisations are preferring the waterfront locations and higher grade buildings, such as in the Wynyard Quarter.

Poorer quality office spaces are in less desirable parts of the city and investors for those properties will have to either accept more vacancies or do some refurbishing and repositioning of their buildings perhaps to a complete change of use, Farhi says.

Vacancy rates vary across the CBD but Farhi says vacancy rates for high amenity areas like Britomart and Wynyard Quarter are sitting below 3% while for areas like Midtown and Symonds Street the vacancy rate is over 12%.

But, again, that was already a trend prior to the pandemic, and the university quarter and the upper part of the CBD has seen more conversions into residential.

Farhi points out Bayleys’ global partner Knight Frank’s Q4 report on the office market in London showed the situation there was not all gloomy.

The report says while there has been lower investment transactions amid volatility in interest rates, there has also been a 31% rise in take-up of for best-in-class buildings.

Ian Little, Colliers’ associate director/research, says Auckland’s office occupancy is much higher than the UK’s on an average day, with Precinct, an owner of inner-city real estate, reporting some time ago occupancy was back over 80%.

Little says Auckland is a different type of city to London – over there it’s not uncommon for commuters to travel 90 or 100 minutes to work in each direction, and that can be an expensive commute, too.

CBRE’s UK headquarters has been said to look more like a hotel than an office. Photo / CBRE

“It’s quite an impediment to going back to work if you don’t really need to whereas although Auckland City can be a bit tricky to get through from time to time obviously we don’t have those huge commutes so it’s not as daunting to come back to the office.”

He agrees businesses are looking at their fitouts to make office space more attractive but says they are probably stopping short of turning their offices into hotels with concierge service and spas.

There are examples, however, of partnerships with providers that can encourage staff attendance.

“Even here at Colliers there are examples of partnerships with some providers, you know, like gyms.

“I don't know about spas but I know we had one for dentists recently and that sort of thing where local providers give you a discount count for the staff within the office, so that might be something that's being done.”

Colliers has not seen forced sales coming through, either, Little says, and says building owners would have built up some additional equity over the last few years, plus banks stress test them when lending just as they do residential buyers so there is some slack built into the system.

Little also points to Colliers research which shows Wellington CBD to be the strongest performing of all Australasia’s major office markets with a vacancy rate of 5.4% in December last year, one of only three centres in Australasia with a vacancy rate below 10%.

Auckland CBD’s vacancy rate was 12.5%, just behind vacancy rates in Melbourne and Brisbane but ahead of Adelaide and Perth.