As New Zealanders debate once again whether to head across the Tasman for higher wages, perceived cheaper living and an easier path to citizenship, OneRoof asked the experts if it really is cheaper in Australia.

The answer is a resounding maybe. Wages are higher but Australian housing, like New Zealand’s, is the biggest expense and affordability comes down to where people are prepared to live.

Sydney, where New Zealanders often flock, is super expensive but Adelaide, the capital city of South Australia, is still affordable, as is Perth, the capital of Western Australia. In New Zealand, Auckland is very expensive but Christchurch is more affordable.

There are different viewpoints about moving countries but the experts agree New Zealanders need to take off any rose-tinted glasses before they make the move and crunch the numbers.

Start your property search

They also warned there is a big rental problem in Australia, saying Kiwis thinking of renting should beware and sort out accommodation, if they can, before they leave.

Rental prices are expensive across much of Australia, and headlines regularly decry the shortages in rental stock, and with Australia facing similar surges in migration as New Zealand, the crush is only going to get worse.

For example, Adelaide is one of Australia’s cheapest cities for property, with its median house value sitting at A$709,829 - NZ$199,143 below New Zealand's average property value and NZ$549,143 below Auckland's.

But Adelaide also has the lowest vacancy rate of any capital city at just 0.3% which means there is hardly anything to rent.

If in a position to buy a house, however, mortgage rates are lower in Australia and that can save thousands of dollars.

At the time of writing, Westpac in Australia was offering a one-year fixed rate of 5.54% compared to Westpac in New Zealand’s one-year rate of 6.79%.

But Australia has Stamp Duty which New Zealand does not have. Stamp Duty is a tax that is paid at the time of purchase which can add thousands of dollars to the cost - around $44,000 on a $1m property.

There’s also debate around cost-of-living expenses. While there is a perception that inflation is lower in Australia, the Australian Bureau of Statistics recently released data which shows inflation to the end of March was 7%, compared to 6.7% in New Zealand for the same period.

And things can change fast. In a surprise move, Australia’s Reserve Bank hiked its Official Cash Rate to 3.85% on Tuesday.

The rate rise was the 11th made by the bank since it started tightening monetary policy in May last year, reports the Sydney Morning Herald.

“On a $600,000 mortgage, the rate rises have increased monthly repayments by almost $1400,” the newspaper article said, with the head of Deloitte Access Economics, Pradeep Philip, warning the Reserve Bank was pushing the country to the brink of recession.

Wayne Shum, senior research analyst for Valocity, OneRoof’s data partner, says Australia and New Zealand have experienced a similar trend since 2020 when Covid arrived.

The initial housing market boom was followed by a slump caused by high inflation driven by the low interest rates of 2020-2021.

Inflation is high in both countries and Shum says it has been fuelled by supply chain constraints in both, along with government spending and the low interest rates of 2020 and 2021.

The central banks of each country lifted their official cash rate to tame inflation, he says, but Australia less so.

Read more:

- Auckland’s median sale price drops below $1m but ‘hibernation’ may not last

- Interest rate pain: Banks urge some property owners to sell up to shed the debt

- Is a mansion tax on the cards? NZ’s super-wealthy put on notice

The RBNZ lifted the OCR from 0.25% to 5.25% over 18 months from late 2021 while Australia lifted theirs from 0.1% to 3.6% within 12 months from May last year.

Says Shum: “The interest rate rise in Australia was less severe and over a shorter period than in New Zealand; it had less impact on debt serviceability compared to New Zealand’s.”

Shum says the CCCFA credit restrictions continue to hamper some potential borrowers in New Zealand and that overall New Zealanders pay higher mortgage rates than in Australia, despite Australia’s latest hike.

While both countries have low unemployment the average wage is definitely higher across the Tasman.

The average pay in Australia is over NZ$100,000 compared to an annual wage of nearly NZ$78,000 in New Zealand, but while While New Zealanders may indeed reap the benefits of higher wages, Nerida Conisbee, chief economist for Ray White, points out house prices in Australia have started rising again whereas in New Zealand they are still falling.

She says that means New Zealand may currently be the better place to snag a bargain.

She says Sydney’s median house value, according to Neoval figures, hit A$1.557m last month, which means buying in Sydney is significantly more expensive than Auckland.

Auckland house prices compare more to those in Southeast Queensland, Conisbee says, which includes the Gold Coast and the Sunshine Coast (about A$1.1m median) and Brisbane, where the median is around A$800,000.

There’s also a big employment shortage in Brisbane so movers would likely find work there, but if people are set on Sydney, Conisbee says to get like for like they would have to move further out.

But even in the suburb of Blacktown, about 34km west of the CBD and which Conisbee says has a high crime rate, properties can cost over A$1m and there’s also transport costs to factor in.

If people want to live near the beach in Sydney, however, prices can jump to A$3m-A$5m.

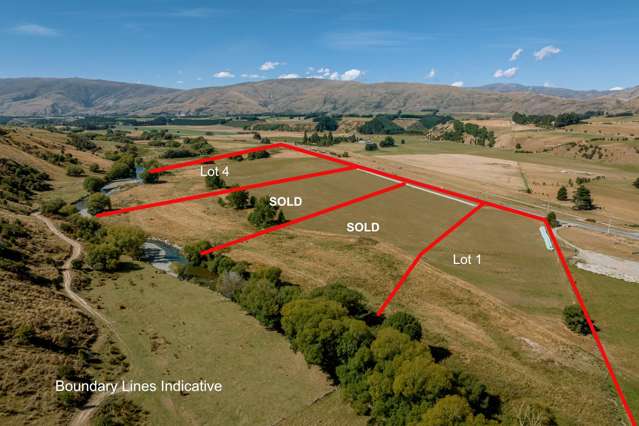

Adelaide is one of Australia’s cheapest major metros for property but it has an acute shortage of rental homes. Photo / Getty Images

Auckland’s average property value has dropped, but it is still sitting at just above $1.3m. Photo / Chris Tarpey

Conisbee also warns people might not get a nice house in Sydney for their money, even if they are on good pay.

“Even moving within Australia to Sydney is an epic challenge for a lot of people because the cost of housing is so expensive.

“I moved from Melbourne to Sydney eight years ago and the house we got in Sydney versus the house we got in Melbourne was a lot worse, plus we had a lot bigger mortgage.”

While there are cheaper apartments available, she says, “they’re not in Bondi, they’re in Paramatta (out west).”

Conisbee says while Sydney is a great place to start for younger people who don’t mind where they live, it may not be a great option for people with children.

She notes that while the city has the biggest number of international migrants it also has the biggest outflow of interstate migration.

“What seems to happen is that people land here in Sydney and they get jobs and they get settled and then they realise that elsewhere in Australia you can get a similar job for a similar pay level, for many people, but much lower cost of living.”

The smaller capital cities, however, have more affordable housing, she says.

“If you were in Auckland and you had a $1m house and you moved to Adelaide you could live in a really beautiful suburb and you worked as a teacher or in the police that would be great.

“But if you wanted to sell a $1m house in Auckland and move to Sydney with that same sort of job it’s going to be a lot tougher and you’re not going to be able to live in such a premium part of Sydney as you would in Adelaide.”

But don’t expect the grocery bill to be halved by moving to Australia. Just as New Zealand’s fresh food prices were hiked after the recent floods, Australia has floods, too.

“We saw it here when we had flooding in Queensland and NSW; a lot of those goods did rocket up in price.”

On the other hand, Tim Lawless, CoreLogic’s research director for Asia Pacific, thinks Australia does work out cheaper, but he also warns cheaper does not mean inexpensive.

“Affordability in Australia, both from a buying and renting perspective, is still a major challenge for Aussies so even though it might be a little bit better than New Zealand I wouldn’t expect it to be a massive change – it’s definitely worth crunching the numbers pretty conscientiously before jumping on a plane.”

Lawless says Kiwi buyers should take note that Australia’s stamp duty can add thousands of dollars to a purchase.

Ray White chief economist Nerida Conisbee: “Even moving within Australia to Sydney is an epic challenge for a lot of people because the cost of housing is so expensive.” Photo / Supplied

Renting in Australia has become a lot tougher, with rents up 19% year-on-year and rental stock in short supply. Photo / Getty Images

Rents have also soared, about 19% year-on-year, with the typical rent for a house in Sydney sitting at about A$756 a week and rising. According to Tenancy.govt.nz, a three-bedroom apartment in Auckland central has a median rent of NZ$750 while a three-bedroom house has a median rent of NZ$805.

Lawless says anyone coming from New Zealand should not only budget for high rents but will also likely struggle to find somewhere to live, saying there have been stories lately of people spending a whole weekend waiting in queues just to view a property.

Conisbee talked of friends who moved from Melbourne to Perth who had to live in “horrifically expensive” serviced apartments before they found a place to rent.

“They had kids so they couldn’t just live in some scrunchy apartment, they had to get them settled as well. It was quite stressful”.

Lawless also recommends anyone thinking of moving to look at cities like Brisbane or Perth.

The median house price in Perth is half of what it is in Sydney, and the economy is strong but the downside is Perth is on the other side of Australia “so the tyranny of distance from New Zealand in particular is quite extreme”.

Another consideration New Zealanders should factor in to costs is how often they plan to visit home. At the time of writing OneRoof found return airfares from Perth, which can vary a lot, were around the NZ$1500 mark.

Sydney-sider James Blair now lives in Auckland working as the wealth director for Lighthouse Financial Services.

The company went through the exercise of which country is cheaper back in October and found Sydney came out cheaper across a range of factors - but Blair still prefers Auckland.

He says New Zealanders should not forget the scale of Australia, saying he now lives 10 minutes away from Auckland’s CBD and drives to work along the waterfront.

To get that in Sydney, which is “a very big place”, it’s way more expensive, he says.

Blair is from out west in Sydney and says from Paramatta, a large inland suburb in the western suburbs, going to the beach is a day trip.

“Like, they’re building their own airport out in West Sydney it’s that big of a place so if you’re out that way it’s more of an hour drive to go and do those things.”

Blair also advises a serious examination of the costs of moving, also saying there is a combination of pros and cons.

Groceries were more expensive in Sydney when his company did its comparison, but a McDonalds combo costs a little bit less.

“It sounds really good, the grass always feels greener but the reality might not be quite what you expect,” he says.

- Click here to find properties for sale in New Zealand