An entire luxury apartment block in one of Auckland's most affluent neighbourhoods has sold, OneRoof can reveal.

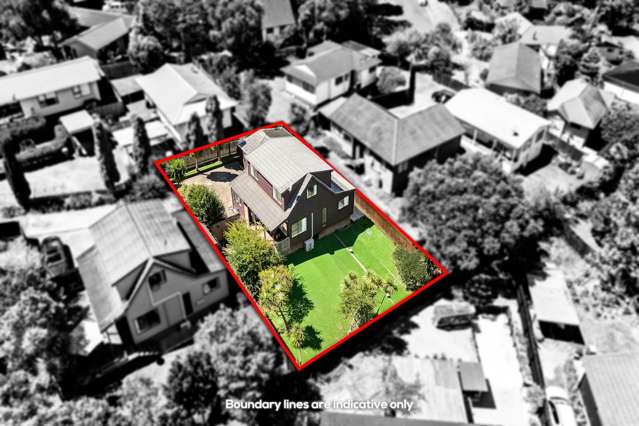

The owners of 719 Remuera Road, on the border of Remuera and Meadowbank, had put the entire site on the market for sale in March this year after failing to find buyers for the individual units.

The developers had been prepared to sell at a loss, amid turmoil in the wider residential development market in the city.

The listing agent, Bayleys’ Jock Kooger, confirmed to OneRoof that the property had sold, but was unable to give details of the sale price or the buyer.

Start your property search

The block comprises five high-end apartments, which had been priced between more than $2 million and $3.5m at the end of last year.

Kooger previously told OneRoof that the vendors’ price expectations for the entire block was below cost. “The estimated value on completion was in excess of $12m,” he said.

“The developers have said they are open to entertain all offers, possibly even sub-$10m range. This is the first time the completed block has been on the market for sale as a whole, they’re not for sale individually.”

Read more:

- Tony Alexander: Why Treasury’s predictions of further house price drops are wrong

- Block v Block: TV show apartment finally sells after stiff competition

- What a cracker: Auckland apartment with egg-stra incentive sells for $1.013m

The vendors bought the site in October 2021, at the height of the market, for $7.291m when the unfinished property had been put up as a mortgagee sale by Bayleys.

Kooger, who brokered that sale with colleague Robert Ashton, told OneRoof in March that an earlier deal for well over $8m had fallen over. At that time, the half-finished apartment block had been beset by lengthy construction delays and expensive cost over-runs.

Kooger estimated that the new owners would have then spent some $2m-$3m to complete the build. “It was a good buy at the time, apartment values were right up there, the developers would have figured out the on-sell values,” he said in March.

“It took them a year, they ripped out and changed everything except the bathrooms, put in really nice kitchens, flooring, all sorts.”

Building company Bufton Construction, which has also completed developments for Kāinga Ora and built the Quest hotel in Wellington, finished the concrete and steel structure with what they describe on their website as “high-level architectural finishes inside and out”.

Kooger said in March that the new-build apartment block would appeal to investors as it met the reduced tax bright-line length and interest deductibility requirements. “You can buy this below replacement cost and de-risked as it has all been completed,” he said.

He said the handful of developers who were trading right now were cashed-up and ready to pick up opportunities. “There are a lot of opportunities – any developer would sell at a loss just to get rid of the debt. Some of them are paying up to 15% interest, with no income. I know of some who have bought for $3.6m and would sell for $1m less,” he said in March.

“Smart developers would rather take the loss and keep rolling [on to other builds] rather than sit on a project.”

The market has witnessed several high-profile development casualties of the downturn in New Zealand, and the sharp tightening of credit.

The biggest development to have come unstuck in recent years was Beachcroft Residences, a block of 85 apartments in Onehunga. The development was beset by lengthy construction delays and huge cost over-runs that have nearly derailed the entire project. A new buyer for the semi-completed development is currently doing due diligence on the site, according to reports.