There could be “light at the end of the tunnel” for the housing market, property experts told OneRoof, but Kiwis shouldn’t expect interest rates to plunge or house prices to soar anytime soon.

OneRoof canvassed the opinions of various economists following the Reserve Bank’s announcement that yesterday’s lift in the Official Cash Rate (OCR) to 5.5% will be the last this cycle.

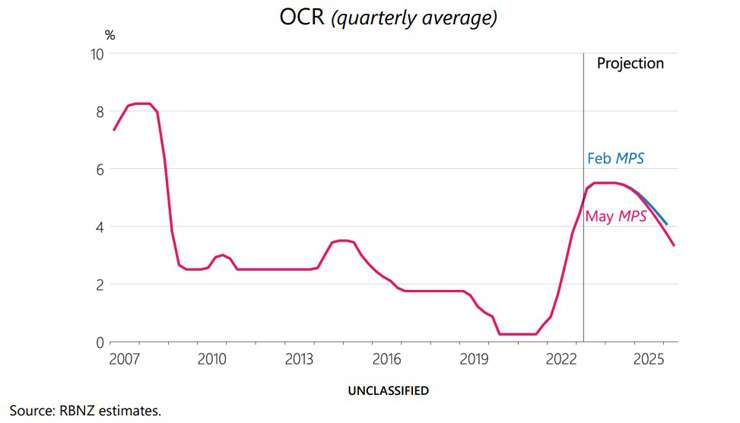

The Reserve Bank's Monetary Policy Statement noted that higher interest rates were required to return annual inflation to its target rate, and signalled that cuts to the OCR were unlikely to take place until the tail end of 2024.

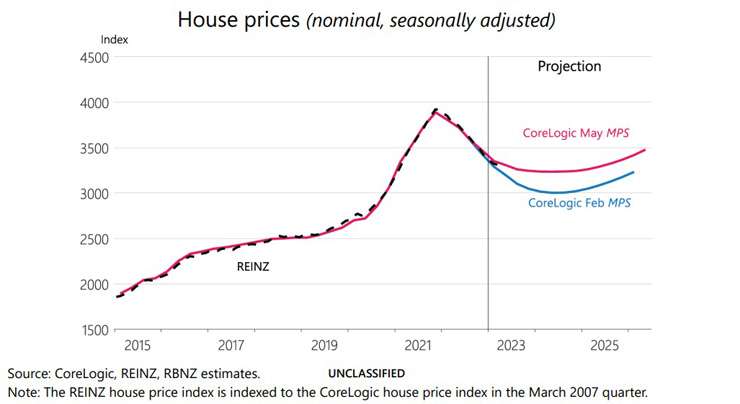

However, it also noted that house prices are unlikely to fall as steeply as it had previously assumed.

Start your property search

Bayleys head of insights, data and consulting Chris Farhi said there had been some concern last year that interest rates might “rage totally out of control” and the current tweaks by the RBNZ gave people more confidence around where interest rates were heading.

He felt the housing market would start to stabilise in the second half of the year, but different regions could reach the bottom at different times.

“Auckland and Wellington markets have corrected faster and harder than most other places around New Zealand, so we would expect to see those two markets stabilise earlier than others with maybe a lag effect in some of the other regions.”

The Reserve Bank's May Monetary Policy State projection for the OCR, compared to the one it gave in February. Photo / RBNZ

The Reserve Bank believes house prices will fall less than it had previously assumed. Photo / RBNZ

Ray White chief economist Nerida Conisbee said the Reserve Bank's strong signal that the OCR had peaked could provide people with some certainty after a stressful period of ongoing interest rate rises.

“It does provide a bit more certainty around the outlook that if you buy a home now, whatever interest rate you are at is going to probably be the peak of your repayments, and if anything, those repayments will start to reduce over time as those interest rates are cut.”

Conisbee said the biggest house price drops in both New Zealand and Australia occurred last year and it was a good time to buy at the lower prices if people could get financing.

“We are not going to see a rush of buyers coming in – that will absolutely start to happen when rates get cut, but you will start to see those more sophisticated investors coming back in and really taking advantages in conditions.”

Read more:

- Tony Alexander: There is a very good chance now of an early cut in interest rates

- Auckland boatshed used in hit TV show David Lomas Investigates for sale

- When will house prices return to their post-Covid peaks?

CoreLogic chief property economist Kelvin Davidson did not think the “inevitable” OCR increase to 5.5% would make much of a difference to interest rates or even house prices.

“They might not rise any further – I think we are probably at the peak, but I think we will stay at that peak for a while because the Reserve Bank isn’t planning on bringing down the OCR anytime soon.”

And while the latest announcement, along with the country’s higher net migration, strong labour market, mortgage, and the loosening of the CCCFA and LVR all point towards the end of the downturn, he added, that it also didn’t mean it was “boom time” again either.

“I don’t think house prices are going to run away on people so they have time to save that deposit, they can sort of start to have a bit more confidence about the market in terms of making those decisions again.”

CoreLogic’s own research is in line with the Reserve Bank’s projections which expect sales activity to pick up in spring when house prices will also flatten.

“She’s a steady as she goes market in 2024.”

CoreLogic chief economist Kelvin Davidson: "I don’t think house prices are going to run away on people so they have time to save that deposit." Photo / Peter Meecham

Opes Partners resident economist Ed McKnight said the latest announcement shows there is “light at the end of the tunnel” and is positive for mortgage borrowers, potential buyers and people who purchased at the peak of the market and are hoping that price increases will recover to those levels.

“They are now forecasting that they are going to bring it (the OCR) down earlier and faster than what they previously signalled.”

While the projections for when that will start to happen is still more than 12 months away, he said, having interest rates drop sooner is good news for borrowers.

When the interest rates finally do drop, he expects they will end up at a “more normal level of around 4 to 4.5%” in the next couple of years rather than going back to the super low 2% interest rates.

The Reserve Bank’s forecast that property prices will not fall as much as they previously projected is also a step in the right direction, he added, and could start to change people’s buying sentiments.

“They are saying, ‘hey look house prices still have a little bit further to fall’, but nowhere near what they have previously said.”

He said people are holding off purchasing properties, but once they start to think interest rates are at the peak then they will start to buy again.

“It’s not going to be a total bounce back, but it might see the capacity for maybe 5% increases in 2024 in terms of house prices.”

- Click here to find properties for sale