1. OCR increases appear to be finished

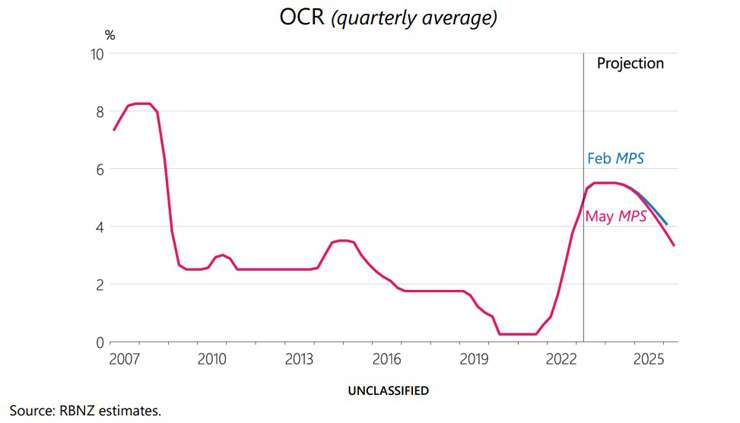

The Reserve Bank of New Zealand (RBNZ) increased the official cash rate by 0.25 percentage points last Wednesday, as expected, taking it to 5.5%. This was always the target, and indeed, based on the forecasts that accompanied the latest decision, it doesn’t plan to increase the OCR any further – instead ‘watching and waiting’ to judge the impact of the rises they’ve already pushed through.

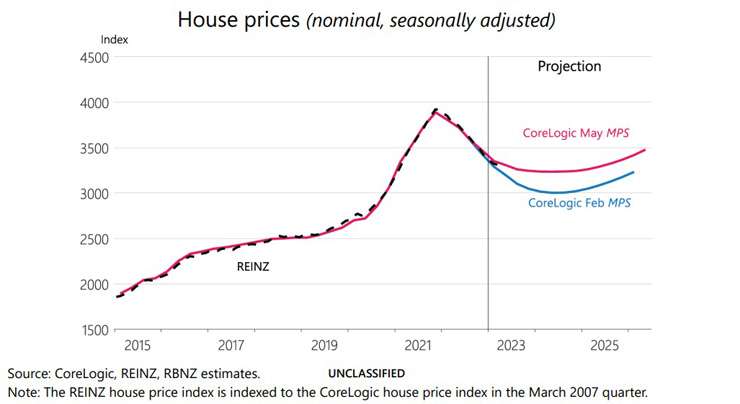

The RBNZ also thinks inflation will continue to ease lower, a recession will basically be avoided, employment will stay high (with unemployment not rising due to job losses, but a larger labour force alongside reduced new hiring activity), and that house prices only have a little bit further (3.5%) to fall.

On the whole, then, the RBNZ basically considers its work to be done, for now. Accordingly, the case for thinking that mortgage rates have already reached their generalised peak has got a lot stronger. But they’re unlikely to fall much anytime soon either, given that the RBNZ has also signalled a “higher for longer” OCR.

Start your property search

The Reserve Bank's May Monetary Policy State projection for the OCR, compared to the one it gave in February. Photo / RBNZ

The Reserve Bank believes house prices will fall less than it had previously assumed. Photo / RBNZ

2. Mortgage lending quiet again in April

Meanwhile, hot on the heels of the OCR decision, the RBNZ also released April’s mortgage lending stats last Wednesday too. Given that we already knew sales activity was low in April, it was no surprise to see that overall mortgage lending was subdued too. Within that overall picture, the detailed breakdown showed that lending flows on interest-only terms or with a low deposit remain controlled. But a bit more low-deposit finance might show up in May’s figures when they’re released in late June, given the RBNZ’s confirmation on Friday that the loan to value ration restrictions are easing on June 1, with the banks likely to have acted in advance of the increased allowance.

3. More pain and less gain for resellers

The CoreLogic Pain & Gain Report for Q1 2023 was released last week, and it showed that about 94% of property resellers got a sale price higher than what they originally paid, for a median profit of $305,000. Both figures are still high, but the downwards trend is clear. In Q4 2022, about 96% of resales saw a profit, and going back to the peak (Q4 2021), the median gain was $440,000. Generally speaking, however, when it comes to owner occupiers these aren’t cash windfalls – instead, that fresh equity will simply have to be recycled back into the next property they buy.

CoreLogic chief economist Kelvin Davidson: “The case for thinking that mortgage rates have already reached their generalised peak has got a lot stronger.” Photo / Peter Meecham

4. Economy easing and confidence remains low

The much timelier measure of our economy, the NZ Activity Index (NZAC), increased by 0.7% (year-on-year) in April, a reduction on previous months (1.4% and 1.3%), but providing further proof of our robust economy. While the RBNZ now forecasts a very shallow or no recession, ANZ’s consumer confidence survey showed consumers remain under pressure. More encouragingly for the RBNZ (and everyone) inflation expectations from the survey eased slightly from 5.3 to 4.8.

5. Filled jobs up again?

Late Monday morning, Stats NZ will publish April’s filled jobs data. These have been rising steadily in recent months and there’s every chance that we’ll see more of the same in April’s result. This would tend to insulate the housing market a bit, even if mortgage rates do actually rise a little further in the coming days/weeks (which in reality seems unlikely).

- Kelvin Davidson is chief economist at property insights firm CoreLogic