Two of the country’s leading economists predict the Reserve Bank of New Zealand will lift the Official Cash Rate one more time this year – just not next week.

The RBNZ is due to release its next Monetary Policy Statement on August 16, and expectations are that it will hold the OCR at 5.5%.

But the remaining announcements on October 4 and November 29 could be a different story.

The chief economists at both Westpac and ANZ believe the RBNZ will raise the OCR further in November in order to tame inflation, despite strong indications from the Reserve Bank that the OCR has hit its peak.

Start your property search

The forecasts are a warning to borrowers who are already facing interest rates of 9%-plus in some cases.

Westpac chief economist Kelly Eckhold told OneRoof that mortgage interest rates would need to play catch-up if the OCR goes to 5.75% in November. “The market doesn't fully have that 25 basis point increase priced into the yield curve. So when that happens, then you would expect some further increase in mortgage rates, particularly the floating rate [and one-year rates],” Eckhold said.

Rising interest rates offshore could also have an effect on New Zealand mortgage rates, Eckhold said. “Global funding costs have been going up, which you need to keep in mind.”

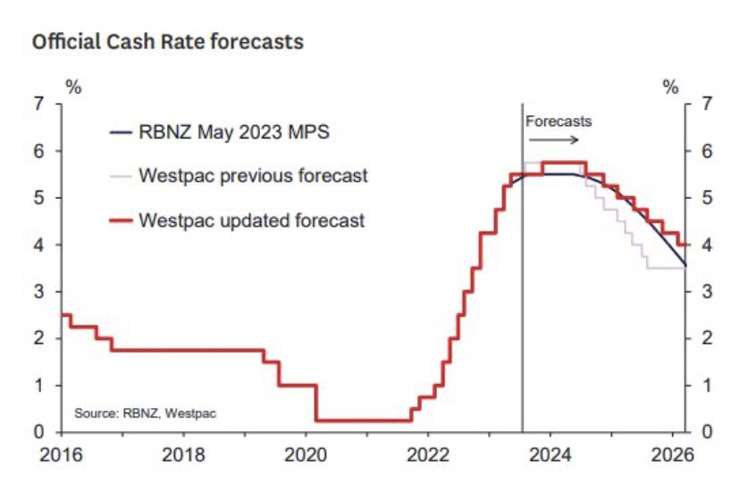

Westpac's revised OCR forecast. Photo / Supplied

Westpac economists don’t anticipate cuts to the OCR until August next year, which may be a long time for homeowners to wait. “Markets might perhaps start to anticipate some of that in the middle of next year, as the data is starting to suggest that that’s actually something that’s really going to happen. In the interim, it’s probably an environment where mortgage rates remain at these relatively high levels, for the foreseeable future,” he said.

ANZ chief economist Sharon Zollner also expects the RBNZ will lift the OCR to 5.75% in November, and that the increase will have an impact on interest rates.

ANZ’s latest mortgage rate predictions see one-year fixed rates rising from 6.9% in the second quarter of this year to 7.3% in three months to the end of September, before dropping in the first quarter of 2024. However, the bank expects two-year, three-year, and five-year rates will begin falling in the final quarter of this year.

BNZ’s chief economist Mike Jones disagrees that the Reserve Bank will need to raise the OCR this year. Even if inflation, currently at 6%, doesn’t retreat, he predicts that the RBNZ will simply hold the OCR at 5.5% for longer until it does. It’ll be a nervous wait for the Reserve Bank, Jones said, “but we continue to believe waiting is the right approach”.

He added: “We’ve pushed back against calls or expectations that mortgage rates might fall noticeably this year. Before mortgage rates can start to fall, we would need to see the Reserve Bank declare victory on inflation and start to talk a little bit more forcefully. There are still underlying niggles here on the inflation front and speculation that the OCR might have to rise further.”

Read more:

- Tony Alexander: Where buyers are in a panic about house prices

- More pain in store? Why mortgage interest rates are still climbing in NZ

- First-home buyer celebrates house purchase with surprise marriage proposal

If BNZ’s predictions are correct for the OCR being cut from mid next year, mortgage rates might start to fall ahead of then. “But there’s a lot of water to go under the bridge between now and then.”

Also in the “no rises” camp is Kiwibank chief economist Jarrod Kerr. He also believes that mortgage rates might start falling sooner than some fellow economists have forecast. “I think by the end of the year, mortgage rates will probably start falling. And if we're right and the next move from the RBNZ is a rate cut, which I am growing in conviction should be February or May next year. The markets will see it coming, and we should see mortgage rates declining by the end of this year and falling further next year.”

Infometrics chief forecaster Gareth Kiernan also expects mortgage rates to fall sooner rather than later, telling OneRoof that they are probably very close to the top, despite having drifted up in the past couple of months. “There has been a little bit of volatility in international markets, driving it. But we don’t see any massive upside from here,” he said.

However, he expects rates to come down slowly. “Banks’ margins have been squeezed on the way up. They may have been chasing market share, trying to meet lending targets.” The banks may try to make up for that as interest rates fall, he said.

ANZ chief economist Sharon Zollner does expect huge growth in house prices, despite recent lifts in market activity. Photo / Supplied

All five economists also gave their view on house prices.

Westpac’s economists are predicting that house prices will rise 1.8% for the final two quarters of this year, and 7.7% year-on-year by the end of 2024.

ANZ’s Zollner points out that house price growth is unlikely to beat inflation, which means they’ll likely fall in real terms.

“Our house price forecast is 3% for the second half of this year and another 2.3% year-on-year at the end of next year. That is lower than our forecast for inflation at December 2024, which is 2.8%. So we have house price inflation not keeping up with CPI [consumer price index] inflation next year,” she said.

Homeowners shouldn’t read too much into the widely reported uptick in the housing market in June of this year, she added. In an earlier report, ANZ's economists wrote that it would be a stretch to call the housing market “hot” right now, although the trajectory is certainly pointing towards warming.

One particular driver stood out, said Zollner, and that was the easing of loan-to-value ratio (LVR) restrictions from June 1. “We’re comfortable with our view that the upside surprise we saw in the June housing data is unlikely to be the harbinger of a string of upward surprises from here,” she noted in the bank’s July Property Focus, released in August.

BNZ is sticking with a prediction of a 2-3% rise in house prices in the second half of this year, although Jones admits that that might be “undercooking the outcome”. The bank's prediction for calendar year 2024 is a 7% rise in house prices.

Kiwibank is expecting to see a 5% rise in house prices between now and the end of next year. Infometrics is similarly conservative. “We did expect them to continue drifting down, but given the latest monthly result in June and migration [data], I wouldn’t be surprised if they are at bottom. Over the next 6 to 12 months, I would see potential for prices to lift by maybe 5%,” Kiernan said.

Use the search field to find out the best mortgage deals available today.