Resale profits in Auckland slumped in the three months to the end of September, with the revival in the city’s housing market not enough to prevent crippling real estate pain for some.

While the vast majority of residential resales in Auckland in the third quarter achieved a gross profit, the size of the gain shrank back to levels last seen in 2019.

However, analysis by OneRoof and its data partner Valocity found the share of resales making a profit dropped to a 10-year low of 86% – six percentage points lower than the same period last year and well below the 98% peak seen in 2021.

Start your property search

The median profit for Auckland resales in Q3 2023 tumbled 27% year-on-year to $325,000 while the median loss jumped 45% over the same period to $51,000, although this was smaller than the quarter before.

The nationwide median resale profit in Q3 2023 was $271,000, down 18% ($62,000) on the same quarter last year, while the median loss grew from $28,5000 to just over $42,000 over the same period.

The research found that Christchurch sellers did best in Q3, with their median profit in the three months to the end of September down only 4.4% ($11,875) year-on-year to $253,125. Tauranga sellers scored the highest median resale profit in Q3, which, while down 8.3% year-on-year, was still a healthy $431,000.

Dunedin resale profits dropped 17.5% ($53,000) year-on-year to $250,000, the lowest out of the major metros.

Read more:

- The Waiheke mega-mansions that no one's allowed to talk about

- Best home, best street: Christchurch stunner could make house price history

- $10m-plus compound on Hawke's Bay's wealthiest street for sale

In Auckland, resale profits in Manukau shrank the least and were among the highest in the city, dropping just 8.3% ($39,500) year-on-year to $401,000. The sale of long-held family homes in South Auckland, still attractive to developers, investors and first-home buyers, will have kept resale profits in the district high, as would the sale of high-end family homes in East Auckland.

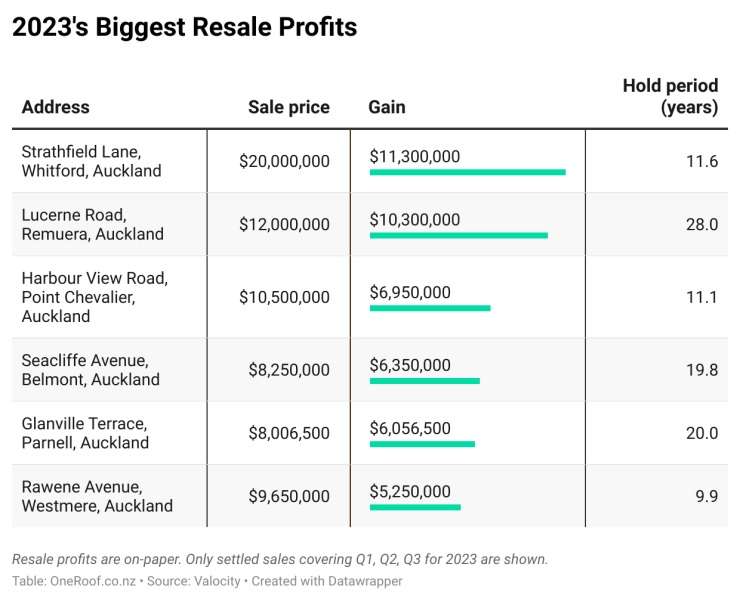

Some sellers in 2023 managed to score huge profits even against the backdrop of a downturn, although the biggest sums were all in Auckland and typically the result of long hold periods.

The research found the biggest gross profit so far this year was $11.3m for a Whitford mansion that sold for $20 million at the start of the year.

The vendor, a wealthy American entrepreneur who made his money in the motor industry, had paid $8.7m in 2011 for the Strathfield Lane property. He had used the five-bedroom mansion as a holiday home, bringing in his own designers to upgrade the 900sqm house and grounds.

The renovation, not surprisingly, included a 10-car garage as well as a pavilion for entertaining, a swimming pool, tennis court and man-made water features.

The property was listed with Ollie and Graham Wall, of Wall Real Estate, with the buyer brought to the deal by Bayleys agents Angela Rudling and Michael Chi, who had sold the house to the owner in 2011.

A Mediterranean-style mansion, known as Bramasole, on Lucerne Road, in Remuera, made the second-highest resale profit when it fetched $12m in April, yielding a $10.3m gain over nearly 30 years. OneRoof-Valocity records show the owners paid $1.7m in 1995 for the 1869sqm site.

A grand Med-style mansion on Lucerne Road, in Remuera, Auckland, had a gross resale profit of $10.3m after selling for $12m in April. Photo / Supplied

Selling for just over $10m in July this luxury waterfront Harbour View Road home in Point Chevalier, Auckland, netted a gross profit of $6.95m. Photo / Supplied

This modern home on Seacliffe Avenue, in Belmont, Auckland, enjoyed a gross resale gain of $6.35m after selling for $8.25m in July. Photo / Supplied

However, three years later consents were issued for the luxury 634sqm house, which was finished around 2000. It sports five bedrooms, landscaped terraces overlooking the water, a swimming pool, gym, spa and sauna. It had been updated over subsequent years, and one of the agents involved in the April 2023 resale, Bayleys’ David Rainbow, said the new owners planned to give it a full-scale makeover.

A classic home on Glanville Terrace, in Parnell, Auckland, recorded a gross profit of $6m after selling for just over $8m in May. Photo / Supplied

A luxury waterfront villa on Rawene Avenue, in Westmere, Auckland enjoyed a gross resale gain of $5.25m after selling for $9.65m in July. Photo / Supplied

Also riding high were two luxury clifftop homes: one on Harbour View Road, in Point Chevalier, which netted a $6.95m gross profit after selling for $10.5m in July; the other a five-bedroom near-new pad on Seacliffe Avenue, in Belmont, which netted a $6.35m gross profit after selling for $8.25m in July.

Auckland properties dominated the list of loss-making properties as well, but the hold periods for these homes were a lot shorter, around the one to two-year mark.

The year’s biggest resale loss was $1.5m for a penthouse on Kepa Road, in Mission Bay. The owner had, at the start of the year, declared to OneRoof his willingness to sell well below the original purchase price of $5m.

“We bought on the high and we are selling on the low and that’s life,” he said.

He wasn’t the only one to show their hand. Listings for other loss-making properties were similarly upfront about their vendors’ circumstances.

A penthouse on Kepa Road, in Mission Bay, Auckland, is this year's biggest resale loser, selling earlier this year for $1.5m below its initial purchase price of $5m. Photo / Supplied

The resale loss for this villa on Shelly Beach Road, in St Marys Bay, Auckland, was $1.352m. Photo / Supplied

A house on Patey Street, in Epsom, Auckland, recorded an on-paper loss of just over $1m after selling this year for $2.95m. Photo / Supplied

A luxurious 400sqm house on a 1.86ha lifestyle estate on Goldflats Lane, Coatesville, changed hands in May this year for $4.1m, $950,000 less than the $5.05m paid for it in October 2021.

The listing for the property boldly stated: “Our vendors’ change of circumstances now dictate a sale, Overseas Move Demands Sale.”

And the listing for a three-bedroom house on Grand View Road, in Leigh, which made a paper loss of $800,000 after selling in May this year for $2.2m, said: “Act now, this property must be sold! Priced $500,000 below its January 2022 purchase price.”

The listing agent, Caleb Paterson, of Telos Group Real Estate, did not want to comment on the circumstances of the sale except to say that his extremely private vendors were “extremely comfortable and happy” with the resale and that it was a fair price.

A lifestyle property on Goldflats Lane, in Coatesville, Auckland, sold for $4.1m in May, almost $1m below what it sold for in 2021. Photo / Supplied

A luxury home with water views on Grand View Road, in Leigh, Auckland, recorded an on-paper loss of $800,000. Photo / Supplied

A villa on Buchanan Street, in Devonport, Auckland, resold within less than a year for $800,000 less than what the owners paid for it. Photo / Supplied

He did note that an auction, planned for March, had to be cancelled after the weather events caused road closures to the north and buyers could not get up to see the property, adding that there were five bidders at that point.

Two homes with development potential that had been picked in the post-Covid peak also suffered big losses. A villa on a 1034sqm site on Shelly Beach Road, in St Marys Bay, sold for more than $1.3m below what it had been bought for in August 2021, while a 691sqm corner site on Patey Street, in double grammar zone Epsom, incurred a paper loss of just over $1m.

That property on Patey Street was surprisingly re-advertised as a mortgagee sale less than three months after its purchase in April. The listing agents, Ray White’s George Erdos and Howard Sidnam, told OneRoof that the planned auction in July did not go ahead as the mortgagor had settled with the mortgagee.

- Click here to find more properties for sale