The Auckland suburbs hit hardest by the housing market slump have rebounded, but new research by OneRoof and its data partner Valocity points to a slow return to previous price peaks.

However, the research also found that one of the city’s cheapest and poorest suburbs may be the fastest to recover.

The downturn saw Auckland’s average property value drop 19%, from a peak of $1.578 million in January 2022 to a trough of $1.278m in June 2023.

Since then, the city’s average property value has bounced back 3.5% to $1.324m – 19% off value peak.

Start your property search

The research identified 99 Auckland suburbs where property values plunged more than 20%. The worst hit was Point England, where the average property value dropped 33% ($482,000) from a peak of $1.46m in December 2021 to $978,000 in August last year.

Read more:

- Property hotspots: 13 suburbs first-home buyers should watch in 2024

- Rich-lister selling off beach homes after ditching mega-mansion plans

- Sir Rob Fenwick’s Waiheke paradise up for grabs

Values in the suburb, which is dominated by former state housing on high-value land, have since rebounded 3.98% to $1.017m – still more than $400,000 off value peak.

Other suburbs laid low include Ramarama, in Franklin, where property values plunged 28%; Wesley, in Auckland City (down 27%); and Kelston, in Waitakere (down 25.4%).

Only suburbs with 20-plus settled sales in the 12 months to their trough date were analysed.

The list of “slump” suburbs includes some of the city’s wealthiest neighbourhoods, including Glendowie (down 20.7% from a value peak of $2.73m); Mellons Bay (down 22.7% from a peak of $2.59m); and Oneroa (down 20.8% from a peak of $2.54m).

However, most the worst-affected suburbs were in lower-priced parts of the city that were caught up in the post-Covid scramble for properties on development land.

They were hit hard when rising interest rates and rising inflation resulted in a sharp market retreat by builders and developers.

One such suburb, Otara, in South Auckland, has enjoyed the city’s strongest recovery post-slump. Its average property value has grown 10.7% since hitting a trough in June last year and is now just $160,400 (16%) shy of recouping its losses.

The suburb closest to value peak is Highland Park, in east Auckland. It is now 13.4% below value peak, following an 8.3% house price surge post-slump.

The suburb with the biggest hill to climb on the way back to value peak is Point England (30.7% below peak), followed by Ramarama (25.6% below) and Te Atatu Peninsula (23.2% below).

The research also covered suburbs outside of Auckland. Nationwide, the average property value fell 14% from peak to trough, although some regions and cities, like Auckland, suffered harder falls, while others got off lightly.

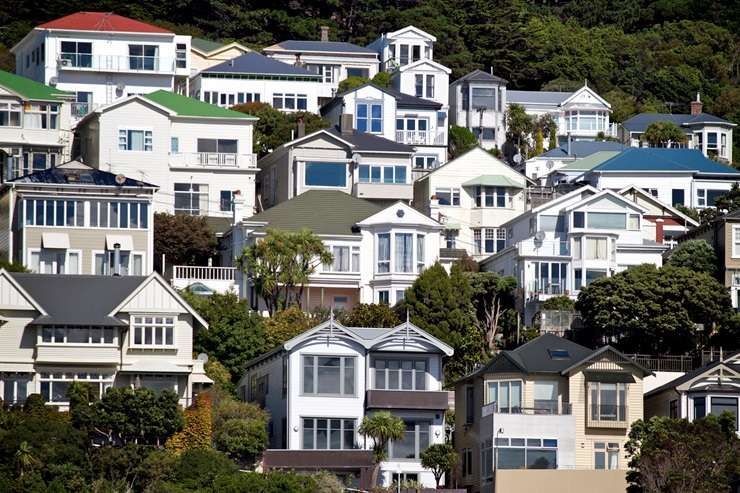

Wellington City’s average property value dropped 27.4% during the slump, whereas values in Christchurch slid only 7.75% and are now just 2.4% below their post-Covid peak.

The research identified 116 suburbs and small towns outside Auckland where property values dropped more than 20% during the slump. All but one, Newton, in Wellington City, had recorded value growth in the three months to the end of December.

Most of the worst-hit locations were in Wellington Region although the area that recorded the biggest drop during the slump was Woodville, in Tararua, Manawatu-Whanganui. The average property value in the small town tumbled 34.7% from a peak of $509,400 but has since recovered strongly and is now just 14% below value peak.

Three other hard-hit towns in Tararua have also come back strongly, including Dannevirke (up 18.6% from value trough); Eketahuna (up 25.5% from trough); and Pahiatua (up 26.2% from trough).

Valocity’s senior research analyst Wayne Shum said the bounce back was pretty small and the market was behaving more like it used to pre-Covid.

He expects the recovery to take time and said not every suburb will fire on all cylinders.

In Auckland, for example, the data shows the big drops were in areas where a lot of properties were sold as development sites during the Covid boom.

People went crazy thinking they could subdivide, and sellers got great prices for any property that had a good-sized section. That drove values up but when market conditions changed, demand dropped away and values went down.

Shum thinks lower value suburbs like Point England, Kelston and Manurewa will take longer to recover because they are essentially still development sites – it’s just the developers are not yet back.

Some developers have tried to re-sell sites, but others are holding on, waiting for a financial recovery.

Valocity senior research analyst Wayne Shum says affordability is still a big issue for first-home buyers. Photo / Fiona Goodall

Buyers also had more choice when prices fell so places like Point England, which is further out to the east of the city and without such good transport links, lost buyers to more central suburbs like Mt Wellington and Ellerslie because they were suddenly more affordable.

Shum said even though a recovery has started in house prices, high interest rates mean affordability is still a big issue and not just for first-home buyers but for people wanting to get into higher value suburbs.

Wealthy suburbs which slumped, such as Glendowie, Mellons Bay and Oneroa, tend to be inhabited by second and third-home buyers, he said. The usual pattern is for people to sell a first or second home and move up the ladder but the high interest rates have made that move harder.

“Once you own a home and you’re looking to borrow an extra $400,000 or $500,000 at 7% and move to your next home in Mellons Bay or in Glendowie, that’s a pretty tough ask at the moment.”

With interest rate cuts likely this year more suburbs are likely pick up over time, he said.

Steven Liang, from Ray White Manukau, who sells in Point England, said when the market was booming, property became more unaffordable in nearby Glendowie, a more sought-after suburb, so the next suburbs out, Glen Innes and Point England, became areas of “untapped potential” for a lot of developers and investors.

Otara, in South Auckland, was seen as a canary in the coal mine suburb. Photo / Getty Images

In Point England, most of the buyers were developers from the previous market and Liang said the area soon overflowed with new builds.

But, like Shum, he said when the market adjusted people found themselves able to afford more centrally located properties in better school zones.

Liang said residential sales were taking place again in Point England but that back in 2022 there were times when there was only one transaction a month.

“It’s definitely slightly picked up a little bit but it’s nowhere close to what it was before.”

And that’s only residential sales – Liang agrees not much is happening with development properties.

Tom Rawson, director/branch manager of Ray White Manukau, said suburbs like Otara and Highland Park were canary in the coalmine suburbs and the fact they were recovering strongly bodes well for the rest of the market.

When Otara fell it had been at the high end of the growth cycle so had further to fall than other suburbs, but Otara is always the first in the area to go up or down, he said.

That’s because it’s a volatile area. Of around 5000 homes, about 3500 are Kainga Ora homes, so there is not a lot of stock available to transact.

Ray White Manukau owner Tom Rawson says there's a "good vibe" in the market right now. Photo / Supplied

Otara is a popular family-oriented suburb, though, and of the stock available there has been a big demand from first-home buyers, especially for rejuvenated properties as opposed to new builds.

Highland Park is similar in that it is a more affordable postcode than its neighbours of Howick, Buckland’s Beach and Farm Cove making it a stepping-stone suburb for people who want to break into the other suburbs.

When Highland Park moves, others are likely to follow suit, he said.

Rawson said there was a “good vibe” in the market at the moment, and the delay in the government being formed after the election helped because while wanting to get moving, people were waiting to see what happened with the coalition.

Now that is sorted, they are acting: “They’ve still been excited but it’s been bottled for a little bit so now it’s like take the top off it and it’s whoosh.”

Down country, Property Brokers Pahiatua sales manager Patrick Baker said the Tararua area was yet to turn a corner, but the town of Woodville was recovering well and that multiple offers were being made on properties as confidence grows.

Houses in the capital. “Wellington got the biggest punch in the face and it's because of the RVs.” Photo / Getty Images

A new four-lane highway underway, which will connect Woodville and Palmerston North, is helping confidence as people are aware the road will help drive value growth.

Like everywhere, the previous government’s restriction on the bright-line test made a difference to the market, and banks’ stress-testing people at high interest rates also made home buying very difficult, he said.

Other Tararua towns, like Eketahuna, were taking longer to come back: “I’ve got a lot of listings down there at the moment and they are selling but they are just slowly selling.

“It’s just getting people’s confidence. People are being quite standoffish whereas I know my colleagues in the Manawatu and the Wairarapa, like Masterton and stuff, it’s been a totally different story.”

In the capital, the suburb of Wellington City was among the first to take off during the boom but also the first to come back and it is yet to recover, said Paul Dickason, Professionals RedCoats co-owner.

Wellington City ran into the perfect storm, he said, pinning the 2019 RVs coming out during the peak of the market as a big contributor.

“We all got brand-new RVs so people who thought their house was worth $900,000 opened their letterbox and their house was worth $1.5m apparently.”

That meant vendors thought they could get more and a “massive” gap opened up between sellers and buyers.

Even now houses are selling for “many, many hundreds of thousands of dollars” below the RV, he said.

“Wellington got the biggest punch in the face and it’s because of the RVs.”

Other factors in the perfect storm was the recession, and also the fact that six months before every election the Wellington market comes to a halt.

“It’s because a decent amount of the population is connected in some way to government services and it really just doesn’t matter either way whether it’s red or blue, in my humble opinion. Everyone pauses for six months in the lead-up to an election.”

But there are signs of change with first-home buyers emerging back in the market.

“We had 170 people asking for information on an affordable home in Karori at a discount – it’s an almost unbelievable number.”

- Click here to find properties for sale

* A previous version of this article stated that Otago had as of December 31, 2023 returned to peak article. This was incorrect. Otago at that point was close to returning to peak value, with 5.5% lift from its trough not the equivalent of a return to the peak. OneRoof is happy to correct the graph commentary.