ANALYSIS: The Reserve Bank has just invited submissions by March 12 on its plans for introducing Debt to Income (DTI) rules for bank lending on residential property. We don’t know when the rules might start, only that the Reserve Bank will make an announcement around the middle of the year.

It proposes limiting banks to lending at a maximum of six times the before-tax income of a household looking for a new mortgage. For investors they propose a limit of seven times, but in both cases banks can still have a maximum of 20% of their new lending above these six and seven times limits.

When the rules come in, will they make much difference in the housing market? Not until the next boom arrives.

Read more:

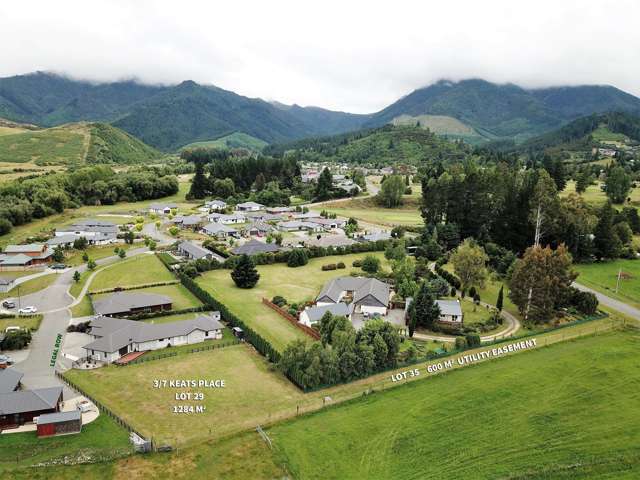

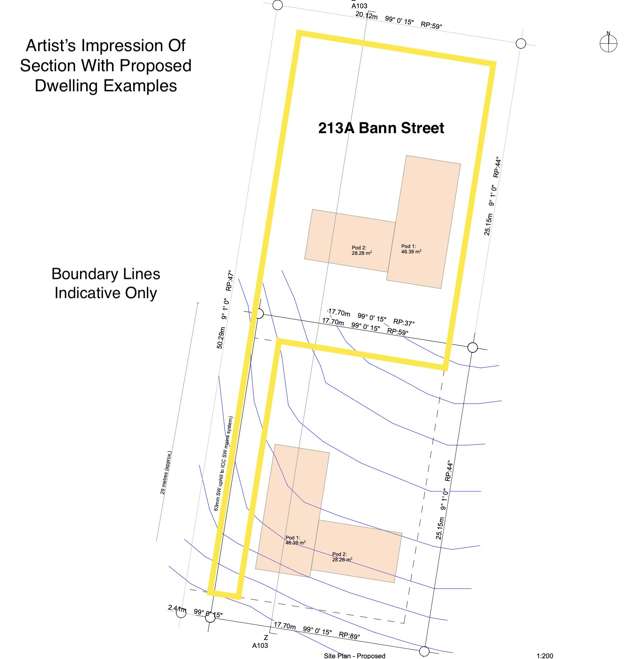

Start your property search

- Tony Alexander: At some point the Reserve Bank will capitulate on interest rates

- Revealed: The NZ suburbs where house prices hit an all-time high in 2023

- Rich-lister selling off Takapuna beach homes after ditching mansion plans

According to data provided by the Reserve Bank, on average over the past six months only 7% of new lending to first-home buyers has exceeded the six times limit. For all other owner-occupiers the proportion is 10% and for investors 8% exceeded seven times income. Looking at those low percentages, which are well away from 20%, you might think there is no point having the rules. Not so fast.

When the New Zealand housing market was booming over 2020-21, the peak monthly proportion of new lending to first-home buyers which exceeded six times income was 28%. For other owner-occupiers the peak was 36% and for investors 37%.

It is when things boom that the new DTI rules will become binding and the impact will be to restrict the pace of house price growth. This will help reduce the risk of households taking on excessive debt and potentially being caught out badly when conditions change. In this way DTIs will limit both the booms and the busts.

But they will probably also lengthen the period during which prices rise at a firm pace (let’s say 10-15% per annum rather than 20%) as frustrated buyers have to wait for their deposit to grow before making a purchase.

Speaking of deposits, here is where things get interesting for first-home buyers. At the same time as the DTIs get introduced, the Reserve Bank intends letting banks have up to 20% of new lending where the deposit is less than 20% property value for owner-occupiers. The current limit is 15%.

Independent economist Tony Alexander: "DTIs will limit both the booms and the busts." Photo / Fiona Goodall

It also proposes cutting the minimum deposit for investors from 35% to 30%. But the main point to note is this. Put aside the fact that for the moment high interest rates mean a lot of people cannot make a purchase because debt servicing is too high a proportion of their income. For many young people the biggest constraint is lack of a sufficiently large deposit.

Saving a deposit can take a long time. Having more bank lending able to be undertaken with less than a 20% deposit is going to be of strong benefit to first-home buyers.

Therefore, when the DTIs come in, the situation for first-home buyers overall will actually get better. The DTI rule for most won’t matter but better low deposit access to funds will be positive.

When might this easing of LVRs happen? Probably before the end of this year and potentially mid-year. Banks have now had plenty of time to get systems in place to handle a DTI regime.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz