Thousands of homeowners in Auckland and Wellington could be in for a shock when they get their new rating valuations, with new OneRoof research indicating RVs will likely fall in multiple suburbs in both cities.

The last time Auckland and Wellington RVs were assessed was at the height of the property boom, in 2021, but the subsequent housing market slump has taken its toll, with house values dropping sharply in both.

The impact of the “boom and bust” cycle on the next round of valuations will be uncomfortable for homeowners who have become accustomed to rising RVs.

OneRoof and its data partner Valocity identified 21 local authorities that are due to update homeowner RVs this year. The two standouts are Auckland and Wellington, which suffered the biggest value drops during the downturn.

Start your property search

OneRoof and its data partner Valocity assessed which suburbs were at risk of lower RVs. The research compared average property values when the last RV was taken and the average property value at the end of 2023.

Those that suffered drops of 10% or more were deemed to be at risk, with the analysis assuming that the odds of 10% rise in property values between now and the next RV date to be quite high.

Only suburbs with 20-plus settled sales in the last 12 months were examined.

In Auckland, 25 suburbs were deemed to be at risk of suffering a drop in RV – just over one in 10 suburbs in the city – while in Wellington, all 30 suburbs examined were flagged as at-risk.

Point England, Avondale and Manurewa East saw the biggest property value drops between June 2021, when Auckland’s RVs were taken, and the end of 2023. Point England’s value drop was a steep 19%, and is unlikely to be recouped this year. In Wellington, nine suburbs recorded value drops of more than 20% between the date of last RV – September 2021 – and now, with the steepest drop in Aro Valley.

For Auckland residents in the at-risk suburbs, a lower RV will come at the same time as the city council is putting up rates.

Council officials in Auckland and Wellington told OneRoof that a lower RV did not necessarily mean a lower rates bill.

Andrew Duncan, Auckland Council’s manager for financial policy, said the next revaluation process would begin in May 2024, with the new values used to assess rates from July 2025.

“Any increase, or decrease, in the city’s property value does not change the total amount of rates the council collects,” he said.

“Property values are used to share the total rates requirement between property owners. So, all other things being equal, it is only if a property’s value rises or falls more than average that its share of rates would change.”

Read more:

- Tony Alexander: With so much interest in the market, what is holding buyers back?

- Couple's all-night celebrations wake up the neighbours after house sells for $300K above CV

- House prices rising in nine out of 10 suburbs: Where have they grown the fastest?

The council’s average was worked out at city level, not at a suburb level, and Duncan said the council was unable to speculate on future rates changes as there were many other factors that influenced the final outcome.

Property commentators told OneRoof the new rating valuations could still be confronting for some homeowners, although many properties will see value increases, and real estate agents pointed out that RVs – also known as CVs in Auckland – were not the same as market value.

Valocity senior research analyst Wayne Shum said property values varied from suburb to suburb and the fact that some had dropped more than others during the downturn could be the result of multiple factors, such as new developments coming on stream.

“Some people came off the boil earlier, some people came off the boil later, some people came off the boil more, some people came off the boil less. It’s just a function of that.”

For example, the demand for big sites with development potential drove up prices in Manurewa and Mangere Bridge during the market peak but that demand evaporated in 2022 and 2023 as developers retreated in the face of rising interest rates and cost blowouts.

The 14% value plunge in Grafton, an apartment-heavy suburb in central Auckland, reflected the overall slump in the apartment market, Shum said.

Valocity senior research analyst Wayne Shum: "Some people came off the boil earlier, some people came off the boil later." Photo / Fiona Goodall

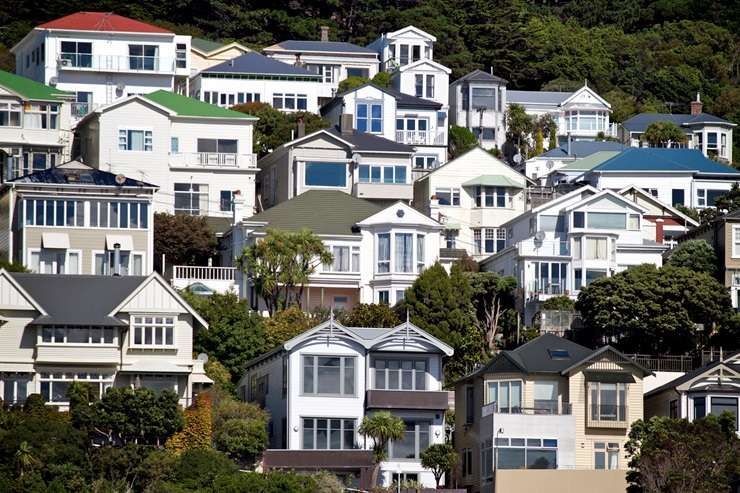

Houses in Mangere Bridge. Auckland's new RVs are due for assessment this year. Photo / Fiona Goodall

He said RVs were a snapshot of property values on a certain date – it’s just that the last snapshot was taken at a time when the market was rising rapidly, and that the next snapshot will taken following a big decline and slow revival. “That’s why in the lower suburbs you see the value is still down,” he said.

Some suburbs would need a 10% value increase just to get back to where they were in 2021, he said.

But not all suburbs will fall – Coatesville, for example, has gone up 11% in average property value, while other suburbs broke even.

A fall in RV will be a first for many homeowners. Shum could not find similar rateable value drops in the past decade, and was unable to find data showing any prior to that. Even the property value slump after the Global Financial Crisis in 2007-2008 was not as big as the most recent slump.

Wellington City Council checked its last 16 revaluation reports since 1993 and found all had increases in the average residential dwelling values except for 1998 when there was a 4% reduction, and 2009 when there was a 3.5% reduction.

The largest increase since 1993 was the 58% increase in 2021 for residential buildings – with residential land values increasing by 102%.

Quotable Value NZ, which works with councils to set the valuations, said some declines were likely.

Wellington homeowners endured big value drops as a result of the market slump. Photo / Getty Images

QV operations manager James Wilson said: “Generally speaking, if a homeowner’s rating value changes significantly more than the average value change of their local authority, then their rates may be higher or lower than the average rates increase.”

A spokesman for Wellington City Council said there was a common misconception that rises or falls in property valuations mean rates bills will correspondingly rise or fall.

“This is not the case,” media manager Richard MacLean told OneRoof. “Property valuations are used to fairly distribute the council's budgeted rates burden across the city’s property owners.

“This ensures that properties of higher value contribute more.”

A decrease in valuations citywide does not influence the total amount of rates collected, “it only affects the distribution of the rates burden among properties”.

Duncan, too, said a rates percentage did not go down in line with any reduction in property values, just as rates didn’t increase in line with increased property values in previous valuations.

The cost of providing council services was not driven by property values, he said, with the total rates revenue council requires determined after community consultation and based on the cost of providing the services they fund.

“Once we know what the total rates revenue council requires in 2025/2026 and what the changes in property values will be as a result of the revaluation then we will be able to advise how rates might move from July 2025.”

Bayleys head of insights Chris Farhi: “It would be a bit of a reality check for some people." Photo / Fiona Goodall

Chris Farhi, head of insights for Bayleys, said buyers and sellers no longer used RVs as a price indicator as much as they used to.

Sometimes values might be out of step with the market because councils often used bulk analysis to set them so there can be some “pretty wild” fluctuations, which don’t take things like substantial renovations into account.

Farhi thinks falls are likely given there has been such a big correction in the market, and some people might see substantial falls, especially people who paid over the odds at the height of the market.

“It would be a bit of a reality check for some people as to what’s happened with market value,” he said.

That might be good for the market as people would have to re-set their expectations around prices in today’s market as opposed to the very different market of a few years ago.

The market itself was unlikely to be much affected by any mild shock caused by lower rateable values, he said. “I’d call it a ripple, not a huge splash, but I think there will definitely be people that are surprised when their CV maybe not dramatically move but when it goes down they’ll be like ‘what’s happening?’.”

While a drop could be confronting, his message was not to worry because time in the market was key and in the long run everything pointed towards capital gains for property. “Just hang in there," he said.

Tom Rawson, director and branch manager of Ray White Manukau, said falls would be a good thing because the 2021 rateable values were set very high.

“I think people have been seeing the rateable value at the moment as the top end of what the property could be worth rather than what it is worth.”

RVs that were too high can be a problem, he said, because they put potential buyers off from even looking at properties that might otherwise be within their reach.

- Click here to find properties for sale