A Lotto win of $50 million may not cover the bill for New Zealand’s most expensive home, but agents have told OneRoof they still have plenty of homes that bulging bank accounts could afford.

The residential listing with the highest search price on OneRoof.co.nz is 27 Marine Parade, in Auckland's Herne Bay.

The five-bedroom waterfront mansion hit the market last week with expectations it would break New Zealand sale price records.

Listing agent Graham Wall, of Wall Real Estate, told OneRoof during an exclusive tour he was “confident this will be the highest value residential home ever sold in New Zealand”.

Start your property search

Wall declined to put a figure on the property, but the highest-valued property in New Zealand is the former Hotchin mansion on the corner of Paritai Drive and Huriaro Place, in Auckland, which has a CV of $58m.

That would leave a $50m Lotto winner with a bit of a mortgage to pay off.

Discover more:

- Barfoot & Thompson patriarch selling his own home for the first time ever

- Budget 2024: What the tax cuts mean for the housing market

- Will Auckland's $13m manor find a saviour? Buyers urged not to demolish everything they see

Before Wednesday's Lotto draw, when the jackpot was at $43m, Barfoot & Thompson’s Paul Neshausen told OneRoof he was the agent to contact in the event of a win. He said he had once helped a Lotto winner spend a good portion of their $32m prize.

“One of the last big lottery winners was my client. He was living overseas and had come to New Zealand for a couple of weeks and bought a lottery ticket on the way from the airport to Auckland," he said.

“He walked into my office on Monday morning and said, ‘I want to speak to an agent’. I just happened to be in the office He goes, ‘I want to buy that apartment that is for sale on Tamaki Drive’.

“I was thinking I was going to be the laughing stock of the office. His hair was a mess. He was dishevelled, and he had forgotten his hearing aids. But that day he made an offer on the apartment and the chattels and the owner’s car.”

Neshausen asked the client if he’d sold a business or had inherited a large sum. “He goes, ‘Mate, don’t you say a word, but I’ve just won $32m.”

Neshausen accompanied the client to a luxury car yard to buy an Aston Martin and a Ferrari. The sales staff in the car yard didn’t take the buyer seriously at first.

27 Marine Parade, in Auckland's Herne Bay, is up for grabs but would $50m buy the house outright? Photo / Supplied

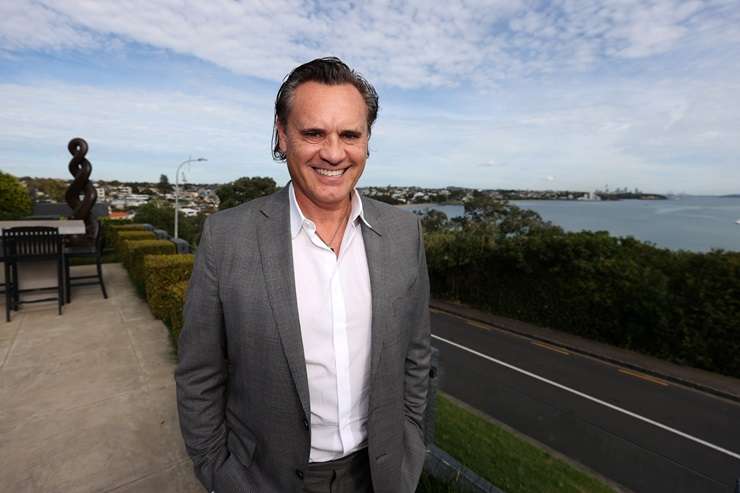

Barfoot & Thompson agent Paul Neshausen helped the last big lottery jackpot winner spend his money. Photo / Fiona Goodall

“That year he went on to buy 10 houses off me. I flew down to Queenstown with him, and he bought a house down there. He bought a couple of apartments, houses for his family, and a couple of investment properties. It was the kickstart of my real estate career. I had a jumpstart because of that.”

Neshausen has a ticket for the Lotto draw, bought thanks to an automatic subscription. He said if a sold sign appeared on his listing at 489 Riddell Road, in Glendowie, then he’s won the $43m.

The home has a CV of $11.4m, and is the epitome of Neshausen’s perfect property to live in. “It’s low-maintenance, has world-class sea views, is made of solid concrete and is private, because if there’s one thing that wealthy people want, it’s privacy and confidentiality,” he said.

The home fitted with the “quiet luxury” lifestyle concept that has been growing in popularity among the uber-wealthy, said Neshausen. The lifestyle is an antidote to both the public interest in the lives of the wealthy, and narratives on social media for public consumption of lavish lifestyle.

“It’s all around privacy and no bombastic advertising. I liken it to the fashion world, where the share price in Gucci is way down because people want quality goods, quality manufacturing and quality materials, not necessarily completely branded and stand out.”

Quiet luxury: 489 Riddell Road, in Glendowie, Auckland, is agent Paul Neshausen's dream purchase. Photo / Supplied

Neshausen said he might also buy property in France and New York. “That would be my dream.”

Neshausen doesn’t necessarily recommend that tonight’s winner buy in New Zealand’s traditional millionaire miles. Depending on where they grew up and live now, they might not fit in to Paritai Drive, in Ōrākei, or Arney Road, in Remuera.

The winner may not get on with the neighbours in posh neighbourhoods. “If you’re used to parking your car on the front lawn and playing loud music, then you’re probably not going to feel as comfortable as you want to be and be your own person in that environment. The cultural shift might be a bit uncomfortable. When you have got a bit of coin, you want to actually just be comfortable [in the] lifestyle you want to lead.”

Sometimes big lottery winners end up broke a few years after having millions of dollars fall in their laps.

“You’d want to see a financial [adviser] to make it last for the rest of your life,” said Neshausen. “Going from no money to a lot of money, [people can] go off the rails. I liken it to rugby league players who turn professional. They go from being destitute to earning $300,000, $500,000 a year, and they go off the rails because they’ve not been given the right guidance or guardianship. They waste all their money, [and] they get themselves in trouble.”

Paritai Drive, in Ōrākei, is home to a lot of wealth but it may not be to everyone's taste. Photo / Chris Tarpey

Spending all the winnings on luxury property would be unwise as would opening a term deposit, because it won’t keep pace with inflation.

Tim Fairbrother, financial adviser at RIVAL Wealth, expects the eventual winner will spend money on “toys” in the initial aftermath of the win. After that, they should then seek advice.

“Your goals will substantially change in terms of the lifestyle you’re going to live, the house you’re going to buy, and things like that,” he said.

“You’ve essentially had a one-off change – for you, your family and future generations. You’d want to set up a large piece of [the win] in a portfolio of assets, which would produce enough income for you to live off and continue to grow in terms of capital growth.

“The property component of the portfolio might include residential properties, commercial properties, or exposure to property through Real Estate Investment Trusts [REITs].”

He said winners needed to understand their money personality and diversify accordingly. People who worry about money shouldn’t, for example, be buying shares in volatile tech companies. “You’re just going to be sitting and getting nervous about what’s happening.”

Fairbrother was once approached by a lottery winner who was worried that the windfall was dwindling. “They just kept changing their car every two or three months, and ended up with not a lot left because they managed it very poorly. They thought the cars were a good investment, and they weren’t.”

Opes Partners economist Ed McKnight: "I would start by allowing myself a budget to go and buy a bigger house. But I wouldn’t buy a $20m house." Photo / Fiona Goodall

Opes Partners economist Ed McKnight said his first piece of advice for a winner would be to do nothing - don’t tell people, don’t pay off the family mortgages - until the big financial picture is sorted.

“I would start by allowing myself a budget to go and buy a bigger house. But I wouldn’t buy a $20m house, because of the expenses that come with owning it. Your rates will be absolutely outrageous. Same with insurance and maintenance. You may not have the income to cover that. I’d buy something more humble, like a $4m or $5m house. A really nice house. But I wouldn’t go spending it on a massive house.”

McKnight would then look at investing the majority of the leftover money into a portfolio that would last the rest of the winner’s life and pass down to children and grandchildren. “I would talk to a financial adviser and split it between shares and property. I’d be buying high-yielding apartments or student rentals. I wouldn’t be targeting really expensive properties. Then I’d just live off the rent.

“In my book Wealth Plan, we call that the Golden Goose Strategy.” The idea is to generate a stable passive income with consistency of cash flow, said McKnight.

“Once I had sorted myself out [with a financial plan and investments], I can then pay off my family’s mortgages and afford to be generous. But I would be setting up my life first.”

Finally, McKnight said that Opes Partners had been researching Lotto returns and found that for every $1 spent on lottery tickets, 52c was paid out. “It’s not a winning long-term strategy. People often say, ‘Oh, I’ll do that when I win Lotto.’ I’ve always encouraged people not to even think about Lotto. Make it happen through your investments. If you win Lotto, that’s a bonus.”

- Click here to find properties for sale