New Zealand’s housing crisis is decades in the making but this decade more than ever has parents worried their children may not be able to afford a home – a dream that was once a given for previous generations.

Those same parents might find the children don’t move out at all and are still living with them in their 40s because of the high cost of renting or buying.

“I think the independence of your adult children is going to be delayed,” says Massey University sociologist and professor emeritus Paul Spoonley.

OneRoof spoke to Spoonley and other experts about housing in New Zealand. They reported back that younger and older Kiwis were worried about the future.

Start your property search

Some highlighted the growing frustrations among the young, who believe there has been a breach in New Zealand’s “social contract” and argue that the chances of being able to study, get a job and raise a family in a house you own are decreasing.

Other experts told OneRoof that New Zealand can expect to see more multi-generational households, where people are living together under one roof to save money.

Discover more:

- Mortgage or baby? Agonising choice Kiwi first-home buyers are making

- Kieran McAnulty: It will take more than a decade to fix NZ's housing crisis

- Ex-minister reveals ‘incredibly damaging moment’ for housing in NZ

Children will live with their parents for longer, they say, and when, or if, they do get a mortgage they may be much older and have longer repayment terms.

The experts also expressed fears that there may be further rises in inequality as wealth concentrates among those with housing.

Politicians from the main parties agree there is a housing shortage, but they can’t seem to agree on how to address it.

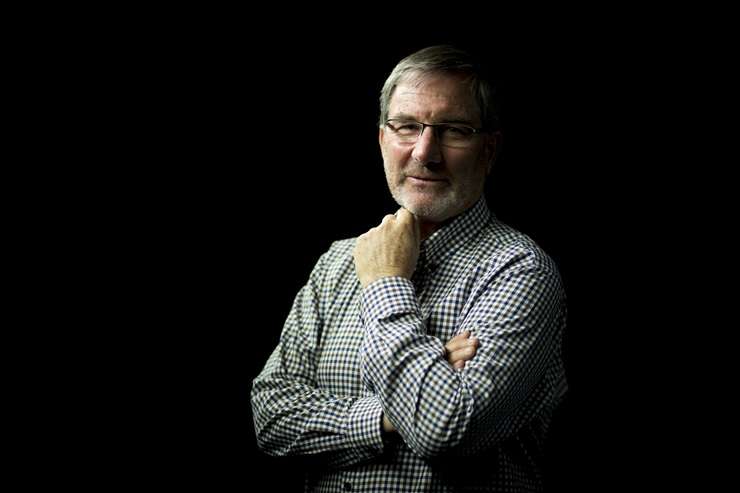

Paul Spoonley, the sociologist

Strap in because we are in the midst of a big change, says Spoonley, with young adults already facing more debt and delays than any previous generation.

Changing work patterns mean they are getting into their career jobs later in life, and women delaying giving birth because the high cost of living has become more apparent over the past five years.

“I think there are decisions being made. ‘Do we have children, or do we buy a house? I can’t afford both – which am I going to have?’.”

Back in 1935, it was different. The then Labour Government operated on a principle of home ownership based on the family make-up of the time; a male breadwinner, a female carer and three children.

The welfare system was built around the financial sustainability of that model, says Spoonley, and the state provided cheap housing, or cheap capital for housing, plus paid for other costs such as education.

Professor Paul Spoonley: "Getting politicians to take notice or act on our evidence is a struggle." Photo / Dean Purcell

The old social contract – study/job/house/family – has changed, however. Young New Zealanders pay a high price for their tertiary education or training and the debt burden they are facing, including the high cost of living, has become “extraordinary”.

Spoonley says when he bought a house in the 1970s it cost double his annual income – today the median cost of a house is around nine times the median household income.

Because of concerns about housing affordability and the build-up of unmanageable debt, the Reserve Bank will, from July 1, enforce debt-to-income ratios.

Under the new rules, home buyers will, in most cases, be unable to borrow more than six times their pre-tax income, while investors will be restricted to seven times their pre-tax income.

Spoonley says more planning is needed as we look ahead to the next 20 years. Along with a rise in “beanpole” households, where different generations live under one roof because of affordability issues, is the rise of “boomerang” kids, where adult children leave home to travel or study but then come back.

Multi-generational households are not necessarily a bad thing, but Spoonley’s issue is that New Zealand does not have enough options for this kind of living, or enough suitable homes to cater for the predicted rise of single-person households.

Houses in the Bay of Plenty. Changing demographics are forecast to put pressure on housing supply. Photo / Paul Taylor

These issues are important to keep on top of, Spoonley says, because while this decade is full of change, by the 2030s things will be quite different.

The country will be “old dominant”, with a large population of over-65s outnumbering the under-15s.

These over-65s will own a lot of the assets, including a lot of the housing. Spoonley says it is unknown as yet how much of that wealth will become part of an intergenerational transfer, but already the “bank of mum and dad” features large in the housing market.

He says when baby boomers (those born 1946-1964) get together the conversation goes along the lines of, “Have your kids bought a house and are you helping?”.

That is generally followed by questions around whether the contribution is a gift or a loan, and if it is a loan, the question is, “Do you charge interest?”.

Spoonley expects these tricky debates among families to increase as the cost of buying a home rises, especially in Auckland where the median sale price is already above $1 million.

The research is out there, he says, but he, like others OneRoof spoke to, does not have a lot of faith in governments being able to address the long-term issues facing the housing market.

“One of the things that frustrates me is while we look at the long term and know pretty much what our demography will look like in 20 years, getting politicians to take notice or act on our evidence is a struggle.”

Young adults with good jobs

The generational splits are making their presence felt now. Even young adults with well-paid jobs report homeownership dreams seem to belong to an earlier era.

Brad Olsen, the chief economist for Infometrics and a regular go-to for analysis on the economy and the housing market, says buying a house is not currently on his radar.

He’s 27, works hard and is well paid, but he says if he wanted to buy a house in Wellington with a 20% deposit he would need $150,000-$200,000 in cash, which he doesn’t have.

Brad Olsen, chief executive and principal economist at Infometrics. "The current group of people who'd like to get into houses are left to the scrap heap.” Photo / Mark Mitchell

He feels the social contract is weaker than it used to be and says affordability has become incredibly tough after the rocketing of house prices after Covid, and then the rocketing of interest rates.

A couple of years ago, when older Kiwis kept inferring young people did not have it as tough as they’d had it, by saying a 7% mortgage rate did not sound like a lot compared to the 20% rate in 1987, Infometrics set out to investigate.

Analysis found affordability in 2022 was the worst for first-home buyers since 1957. Olsen says while it was true 1987 homeowners paid a much higher interest rate, the difference was they were servicing a much smaller house price.

Today’s homeowners pay substantially more of their average household income over the lifetime of a loan than previous groups because house prices relative to income are “so, so much higher”.

Olsen is not saying younger New Zealanders can’t get into the housing market, but he is saying getting in is much harder than it used to be, and there are consequences.

People his age have to rely on outside help now more than they ever have, and people who don’t have parents in a position to help are “up the creek without a paddle”.

That’s bad for society because the potential for wealth inequality increases, with a class of “haves”, who can pass on housing to children, versus the “have nots”, who can’t.

As a result, more people will leave the country, and that’s not good for New Zealand either because the people who leave today are the innovators of tomorrow. “It’s pretty hard to innovate for New Zealand when you’re in Australia or the UK,” he says.

Asked if he thinks politicians think about all this, Olsen replies, “absolutely not”, although politicians spoken to by OneRoof says they grapple with and lose sleep over housing issues.

Olsen says it’s not enough to call for house prices to remain stable because house prices need to come down and that means there will be losers, but in this situation not everyone can win.

“It is a situation where a current group of people are winning – people that have houses – and the current group of people who’d like to get into houses are left to the scrap heap.”

Catching a plane

Dr Matthew Birchall, who is in his early 30s, is crossing the ditch a little bit angry. Not being able to buy a house in New Zealand is not the whole reason he is heading to Australia but it is part of it.

Birchall is a senior fellow at the New Zealand Initiative, a pro-business think tank, and he acknowledges he is in a privileged position. He had a strong education and a good job in New Zealand but he says buying a house here is not feasible.

“You know, unless you’re getting help from mum and dad, it’s just really hard to even entertain the idea of getting on the housing ladder,” he says.

“I think a lot of Kiwis my age cohort struggle with is that you can try and do everything that you should do to get ahead but you’re still fighting up against that brick wall.”

The brick wall, he says, is a supply problem. New Zealand has a lot of land but artificial constraints have been created around being able to build on it which has inflated prices.

“It’s a crisis of our own making, and that’s where my generation feels real frustration, a kind of burning frustration, is that the policy settings have made it almost impossible to build enough houses and so we just feel squeezed and don’t have options.”

Brisbane, in Australia, has become target for Kiwis looking for higher wages and cheaper housing. Photo / Supplied

There are “massive” social repercussions to New Zealand’s housing crisis, from parents who may find their retirement affected by having to help out adult children, to the many people living in emergency motels with children stuck in “awful” living conditions, some of whom skip school to earn money to help with the rent.

Birchall defines the implicit social contract as every Kiwi feeling like they have the opportunity to get ahead but says this has been breached.

“We’ve seen successive governments not tackle the supply side dimension of building it and we have to wear the consequences of that,” he says.

“It forecloses talent. It’s a driver of poverty. You name it, that’s what it’s helped give birth to, so when I put my policy hat on I’m immensely frustrated and pretty angry.

“I think a lot of young Kiwis look at the housing crisis and there’s a kind of incredulity at what we’ve done.”

Got babies? Get them into KiwiSaver

Auckland-based Loan Market adviser Sanjeev Jangra has already opened KiwiSaver accounts for his children. He has a newborn and a toddler and says parents today have to be savvy if they want their children to get on the housing ladder in the future.

He wants his babies to be able to buy a house and is aware that without his help they will likely struggle, saying a house doubles in value roughly every 10 years so today’s $1m house will be $2m in 10 years and $4m in 20 years.

He advises teaching children how to invest as early as possible and says by the time his own children are 18 they should have a decent amount saved towards their first house – he does not want to see the despair in their eyes that he sees in the eyes of some of his clients who can’t make their money work to buy a house.

A woman passes a sold sign in the Wellington suburb of Churton. Mortgage experts advise parents to open KiwiSaver accounts for the children. Photo / Getty Images

Challenges around saving up deposits are one thing, but Jangra says the high interest rates have put paid to some dreams. A couple paying $800 a week in rent might be able to save the extra $200 a week they need to service a mortgage for a modest house, but often what stymies them from buying is the extra 2% margin added to mortgage test rates by banks.

Likewise, people who have saved hard but have not reached a 20% deposit but want to buy with a lower deposit are charged a margin on top the normal interest rates with some facing a level of repayment that leaves them no option but to keep renting.

Jangra, who has clients nationwide but whose largest patch is South Auckland, does not see affordability getting better 20 years from now and says the gap will only get harder for first-home buyers with the introduction of debt-to-income ratios.

He thinks in the next 10 years New Zealand will have to adopt longer-term mortgages of 40 or 50 years instead of the current maximum of 30, saying this is already happening in the United Kingdom.

The politicians

There is widespread agreement the country is short of houses but not widespread agreement about the fix.

Former Labour Housing Minister Megan Woods says “the biggest thing we can do in terms of ensuring affordability is to increase supply”, and current Housing Minister Chris Bishop says “it’s my view that one of the most important things we can do to rebuild New Zealand’s economy is to fix our housing crisis”.

But Woods says she is watching with concern as the National-led Coalition has set about throwing out Labour policy, saying progress was being made.

There is no doubt the portfolio is complex: Nick Smith, a former National Minister for Housing under the Key Government told OneRoof a couple of years ago it was the most stressful portfolio of the 14 he’d held.

Bishop provided a short comment to OneRoof saying he was proud to be the Housing Minister. “It’s a really challenging job but it’s an enormous privilege to work on a portfolio that touches the lives of every New Zealander.”

Megan Woods in 2022 when she was Housing Minister. She is dismayed by the National-led Government's approach to housing. Photo / Mark Mitchell

A media spokesperson then referred OneRoof to a speech Bishop made to the Wellington Chamber of Commerce in February.

In it, he criticised the Labour Government for its “spending spree” but also spoke of a “collective failure” to build enough houses which he said had trapped people in poverty, increased inequality, made the country poorer and “shattered the Kiwi dream of a property-owning democracy”.

“The simple truth is that young people today just don’t have the same opportunity to get into the housing market as their parents did, or their grandparents.”

This Government’s fix is five “interlocking actions” including smashing urban limits, fixing infrastructure funding and financing and introducing incentives to encourage cities and regions to grow – councils have to zone enough land for 30 years of housing growth.

Last week he agreed that house prices in New Zealand needed to fall.

“Average house prices to the average household income are too high by any objective measure. They are severely unaffordable by international standards,” Bishop said.

“The flipside of house prices falling for people who own homes is that they become more affordable for people who don’t own homes. There is a whole generation of young New Zealanders who have been locked out of the housing market because average house prices are too high.

Housing Minister Chris Bishop addresses the media on June 17, 2024. He told reporters that house prices needed to come down. Photo / Mark Mitchell

“If we’re going to be a property-owning democracy, which [we] used to be, we need to make housing more affordable.”

Matthew Birchall says Bishop’s speech in February made him optimistic, but Woods says so far all she has heard are “words” and no detail or dollars.

She hopes Bishop will “actually start to think about how where he is undoing bits where the consequences are going to be felt”, describing the housing market as like “chaos theory”.

“You know, a butterfly flaps and the social housing sector and you’re going to feel that in commercial residential construction as well.”

The regions

Anxiety about future affordability isn’t universal. Those OneRoof spoke in the South Island weren’t as concerned as those in North Island. Gareth Veale, a financial adviser with EasyStreet in Canterbury, believes Christchurch will remain relatively affordable because there is plenty of land to expand into.

There are suburbs in the east of the city that allow a house with land to be bought for $500,000 today, and as long as people are willing to sacrifice – be that now or in 20 years – he believes there will be opportunities, saying the bottom rungs of the market are always open.

Houses increase in value over time as does equity and incomes, and the ability to move from the first rug to the second, third and fourth becomes a reality, but if people don’t take the first step there’s no chance of the eventual dream home.

That goes for Aucklanders, too, where a 60sqm apartment on a transport route might replace the old quarter-acre dream for new buyers.

“That will have to be the Kiwi dream, your shoebox apartment and having a roof over your head that’s yours. It’s taking that first step,” he says.

“I would say that Kiwi kids and potentially Kiwi parents have lost sight of that first and second rung, expecting to sort of be three or four rungs up the ladder.”

Cameron Bailey, of Harcourts Gold, says even in expensive cities like Sydney and London, affordable housing exists if people are willing to work their way up – it’s just the first rung might be a different one to the one they had hoped for.

- Click here to find properties for sale