Recent moves by lenders to cut mortgage interest rates will bring relief to homeowners, who have been struggling with soaring inflation and the highest borrowing costs since the GFC.

Business confidence is also rising, as the country looks to better times ahead, but for many Kiwis, the post-Covid economic slump is still a worry. The unemployment rate for the first quarter of this year rose to 4.3% – its highest level in more than two years – and is expected to rise above 5% by the end of the year.

That means many more Kiwis can expect to lose their job. For those with mortgage commitments, unemployment brings extra headaches. Mortgagee sales, while some way off post-GFC levels, are rising.

Homeowners who bought at market peak, when the nationwide average property value was over $1 million and interest rates were below 4%, are particularly vulnerable, and would likely sell at a loss if forced to sell in the current market.

Start your property search

OneRoof talked to various experts to find out what homeowners should do if they lose their job or find themselves in financial hardship. The message from mortgage brokers and real estate agents is “don’t panic”. They also urge homeowners to start building up an emergency fund.

Discover more:

- Tony Alexander: How fast will interest rates tumble?

- Fire-damaged Auckland house sells for $430,000

- $300,000 discounts in Waikato's most expensive suburb

“If you lose your job, it’s going to take at least a couple of months to secure another one, due to the whole hiring process,” Canstar editor Bruce Pitchers told OneRoof. “So to have three months’ mortgage repayments set aside is great – if you can manage it. But, ultimately, any savings a person can set aside is a good thing.”

Pitchers calculated that homeowners would need around $11,000 in the bank to survive three months without any income, based on the average first-home buyer mortgage of $552,164 and monthly repayments over 30 years at 6.99%.

Separate analysis by OneRoof, based on median purchase prices by first-home buyers during market peak and broken down for each region, echoes Pitchers numbers. Homeowners in Auckland and Wellington face the biggest savings climb for an emergency fund – $15,963 and $13,308 respectively.

LJ Hooker Manurewa franchise owner Dylan Turner said he had been approached by homeowners who live in fear of mortgagee sales. For many of those, the worst-case scenario doesn’t need to happen. “The first thing I always say to a homeowner who has lost a job is to speak to the bank and explain the situation.

“Compared to 30 or 40 years ago, banks are quite understanding and compassionate, if you explain your situation. Generally, banks are more than happy to make some changes to the structure of the loan to ease repayments.

“If you are considering putting your home on the market, you’ve got to tell the bank. You have to have their blessing, to make sure that there’s enough equity to cover that mortgage.”

Turner also advised homeowners to be upfront with their real estate agents as to why they were selling and what their financial position was. “They [the agents] are going to try and get you as much as possible without making you look desperate.”

Homeowners who were able to put their house on the market before their lender forced a mortgagee sale would be in a better situation, he said. However, he warned that some homeowners might find themselves in a negative equity situation, meaning they owe more in the mortgage than their property is worth. He said those who bought in 2021 were most at risk. “Not to a large extent, unless you overpaid.”

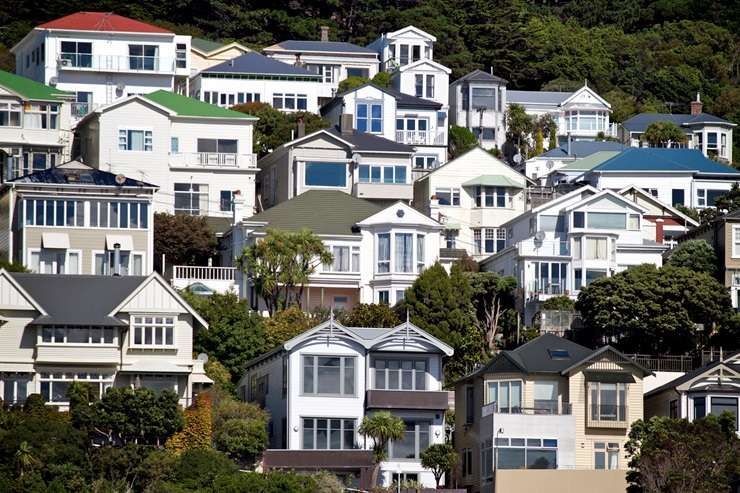

Unemployment in New Zealand is set to rise above 5% by the end of the year. Photo / Ted Baghurst

Those who do get into financial strife may have lost a job, or still have a job, but be struggling financially for other reasons, said Turner. “Sometimes they struggle financially and have almost given up. Once they get into a bit of a hole, they put their head in the sand. That’s the mortgagee sales that I’ve seen over the years. Definitely not as many this time around. The banks don’t want to go down the mortgagee track.”

In an ideal world Kiwi homeowners should have an emergency fund to tide them over redundancy, he said. Asked if this is common, Turner replied: “Very rarely. Kiwis are terrible savers. Myself included. We don’t have a lot of cash reserves, do we?”

Stuart Wills, of Mortgage Managers, said his brokers recommended clients build up an emergency fund, but another option for homeowners was to take mortgage or income protection insurance covering redundancy.

He had noticed the toll rising unemployment was having on his clients. Wellington, with its public service cuts, had been the hardest hit, he said. “Wellington seems to have gone back quite a bit. Some of those who bought at market peak are in those roles that have been disestablished.”

Homeowners in Wellington may be feeling the pinch the most. Photo / Getty Images

Those in more specialist roles were finding it harder to get new jobs, said Wills. “We’ve had a couple who have lost fairly specialist project management-type roles in New Zealand. They have rented their house out and gone to Australia.” Some Wellington clients were also looking at moving away from the capital for work.

Some clients had also taken a hit due to falling property prices. “We’ve had a few, mainly in South Auckland, that have seen the property values go down. But a lot of them aren’t necessarily in negative equity. They’ve just lost the equity they’ve put in.”

Homeowners who don’t have the suggested three-month emergency fund may be in a position to use their holiday pay when they lose their jobs. “A lot of people have the ability to cash out some holiday pay,” Wills said.

Wills said even when clients had an emergency fund, some dipped into it for expenses such as holidays. “It might be a holiday and they’re a bit short of money. They’ve got $5000 sitting there, so they’ll just go and whip it out.

“Or they might have just replaced the stove, when the hot water cylinder blows. Stuff happens.”

- Click here to find properties for sale