- The number of mortgage-free homes in New Zealand has fallen from 36% in 2014 to 32% in 2024.

- Factors include rising house prices and a buying frenzy after Covid, despite low interest rates.

- Selwyn, Southland and Queenstown-Lakes saw the steepest declines, with Selwyn down 20%.

The number of homeowners who have cleared their mortgage has fallen sharply in the last 10 years, raising concerns that Kiwis will still be paying them off during retirement.

Start your property search

Figures from OneRoof’s data partner, Valocity, show that less than a third of New Zealand homes are mortgage-free – despite a prolonged period of low interest rates.

Factors include higher house prices and a buying frenzy in the two years after Covid, when interest rates were at their lowest point.

OneRoof and Valocity found the percentage of homes without a mortgage slipped from 36% in 2014 to 32% in 2024.

The proportion of mortgage-free homes dropped in 48 local council districts. The areas with the steepest declines in mortgage-free homes were: Selwyn (-20%); Southland (-12%); Queenstown-Lakes (-8%); Waipa (-8%); and Tauranga (-8%).

However, the nationwide decline in the number of mortgage-free homes slowed in the last five years, dropping only percentage point. In fact, the share of mortgage-free homes in Auckland grew one percentage point, from 28% in 2019 to 29% in 2024, although the 2014 share was a lot higher at 35.9%.

A similar situation can be seen in Tauranga where the share of mortgage-free homes has grown in the last five years (from 29% to 32%), although is still down 8% over the decade.

Of the major metros, Queenstown-Lakes has the highest share of mortgagee-free homes (39.7%) while Hamilton has the least (26.4%).

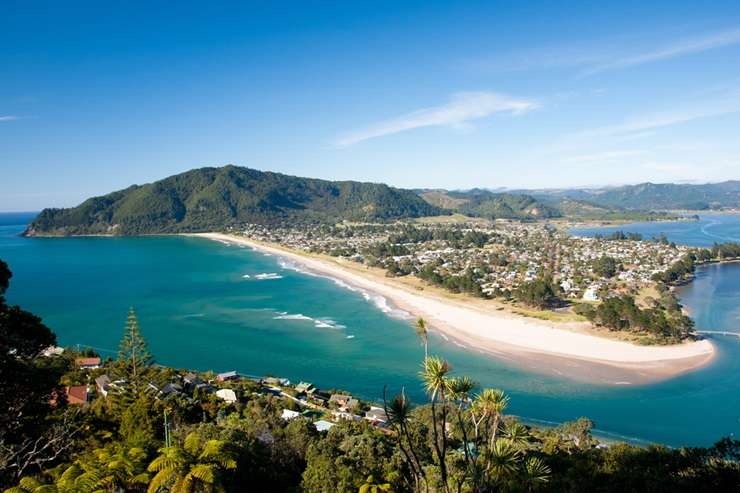

Pauanui, in Thames-Coromandel. Buyers in the town are often high net worth individuals who don’t need a mortgage to purchase a second home. Photo / Shutterstock

Thames-Coromandel has the biggest share of mortgagee-free properties overall, at 55% (up from 54% in 2019 and 53% in 2014). Upper Hutt had the largest share of mortgaged properties, at 79% (up from 75% in 2019 and 72% in 2014).

The total number of mortgaged properties has grown from 1,067,460 in 2019 to 1,169,893 in 2024 (+9%), while the total value of mortgaged properties jumped from $784,510,892,250 to $1,115,288,907,400 (+42%).

The total number of non-mortgaged properties has grown from 515,654 in 2019 to 548,655 in 2024 (+6%), while the total value of non-mortgaged properties jumped from $370,532,975,461 to $539,542,864,170 (+$5%).

Thames-Coromandel homeowners are likely to have the most disposable income, according to the research, but how much disposable income depends on where they live. Homes in the more permanent hub of Thames have an average value of around $680,000 while homes in holiday spots like Pauanui, the district’s most expensive suburb, have an average value of around $1.5 million.

Harcourts Pauanui director Alyce Rowe said homes in Pauanui were often handed down through generations. Also, buyers in the area were often high net worth individuals who didn’t need mortgages to purchase a second home.

“Pauanui is very unique and different to the likes of Thames which is still very much a permanent population with first homes,” Rowe said.

“About 50 percent of our buyers in Pauanui don’t have finance as a condition of sale and purchase.”

Sharp rises in house prices have seen more first-home buyers take on bigger debts. Photo / Fiona Goodall

Valocity senior research analyst Wayne Shum said similar dynamics were at play in Queenstown-Lakes, where 40% of properties were held without a mortgage.

“It’s maybe a little surprising that some of our most expensive places in New Zealand, like Queenstown, also have a high share of mortgage-free homes but many are likely to be owned by retirees who have downsized or cashed-up buyers who have done well and don’t need finance,” Shum said.

Places like Queenstown and Thames-Coromandel contrasted with the likes of Hamilton where only 26.4% of homes are free from mortgage debt – the lowest proportion of all New Zealand’s major urban centres.

Discover more:

- House prices rise for the first time in seven months, up 0.7%

- Filthy Wellington do-up up for grabs - kitchen covered in mould and grime

- Queenstown adventurers selling their 'retirement' home for $7.95m

Shum said this was a reflection of Hamilton’s economic and housing structure, which had a lot of younger families and first-time buyers who carried debt longer as they pay off their mortgages.

“Most people buying their first home in places like Hamilton will have a mortgage. It’s not until later, sometimes after purchasing a second or third property, that they might achieve mortgage-free status,” he said.

Shum added: “It’s interesting that we haven’t seen a rapid change in mortgage-free numbers despite big economic changes.” He also cautioned that properties owned by councils, charities, or government housing providers were also often mortgage-free which could slightly skew the data.

Selwyn District, in Canterbury, was one of the areas with the steepest decline in mortgage-free homes, the number falling by 20% since 2014 most likely driven by the district’s huge expansion following the Christchurch earthquakes.

Valocity senior research analyst Wayne Shum: “It’s interesting that we haven’t seen a rapid change in mortgage-free numbers despite big economic changes." Photo / Fiona Goodall

Selwyn is New Zealand’s fastest-growing territorial authority area with Rolleston home to about 30,000 residents and projected to grow by a further 17,000 people.

Ray White agent Caine Hopcroft said Rolleston did take off after the earthquakes, but buyers were now also moving to the district from more expensive areas like Auckland and Tauranga. Areas in the district like Lincoln had earmarked developments for 1700 new homes and a huge industrial development, iZone in Rolleston, was expected to add up to 1500 new jobs. It was also set to get the South Island’s largest PAK‘nSAVE.

“For most people buying here it is their first home and they are relying on finance or the bank of mum and dad, particularly in the last couple of years,” Caine said.

In Southland, known for its affordable property prices, the number of mortgage-free homes has also fallen by 12% over the past 10 years.

“In Southland, while property prices are more affordable, the local employment market doesn’t always support rapid mortgage repayments,” Shum said.

For many locals, income constraints meant mortgages stayed on the books longer, even with lower property values. Figures could also be impacted by homeowners who had paid off their mortgages but did not discharge them with the bank, using it as a line of credit if they might need it in the future, Shum added.

- Click here to find properties for sale