- Buyers are interested in a damaged “as is, where is” home in Merivale, Christchurch.

- The property is uninsured due to earthquake damage but offers a rebuild opportunity in a prime location.

- Experts warn potential buyers about hidden repair costs, suggesting it’s suited for builders or developers.

Buyers are lining up to take a gamble on an “as is, where is” trophy home in one of Christchurch’s most desirable suburbs, agents have told OneRoof.

Start your property search

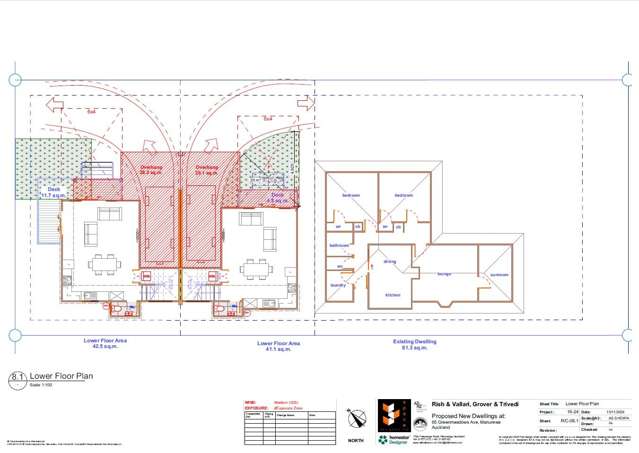

The four-bedroom architectural home at 17 Allister Avenue, in Merivale, looks as if it should sell for a top price: it’s spacious, presents well and has an outdoor pool.

However, the owner may have to settle for less. Earthquake damage caused almost 15 years ago has left the property in an uninsured state.

New Zealand Sotheby’s International Realty agents Sean Lines and Nicky Armitage have pitched the house as a rebuild opportunity for buyers who want a place in one of the city’s most coveted and private streets.

Lines told OneRoof that the vendor had been living at the address until recently but was now selling up, having downsized to another property. Records show the vendor paid $960,000 for the house in 1995 and that the RV sits at just over $2 million.

Allister Avenue presents well but is uninsured. Photo / Supplied

The four-bedroom property is on one of Christchurch’s most coveted streets. Photo / Supplied

Lines told OneRoof he was unable to “make any comments about whether it’s habitable or not”, but he said there were multiple reports available for potential buyers to review.

He also declined to give a price indication, telling OneRoof that “as is, where is” properties in the city usually sold at auction, and there was demand for this one in particular.

“Interest has been strong as you would expect for this location. It’s walking distance to Merivale Mall, close to the city, in zone for Christchurch Boys’ and Girls’ High, Elmwood Normal School, and Heaton Normal Intermediate School, and all the amenities buyers in that area look for.”

While the market for “as is, where” properties in Christchurch has remained relatively strong since the earthquakes in 2010 and 2011, the pipeline had slowed.

Discover more:

- Rich-lister sells his trophy home - but has he broken NZ’s $45.5m house price record?

- Christchurch uni student, 23, busy building a multi-million-dollar property empire

- Tux Wonder Dogs host Mark Leishman finds loving family for his country escape

Bayleys Fendalton agent Steve Ellis, who has sold many such homes in the last 14 years, said the peak period for “as is, where is” sales was between 2017 and 2019.

Some damaged properties were still out there and would eventually make their way to market, he said. “There are still a lot of people fighting insurance companies. Some owners get their cash payout from the insurance company, but rather than go through the stress of repairing their home, they just pocket the cash and put the property on the market ‘as is, where is’ and move on with their life.”

Ellis said the RVs on “as is, where is” homes were not always a good indicator of price, and in some cases, owners of uninsurable homes lobby council to reduce their RVs. “The land value might be worth $900,000. So, the RV should be $900,000, not $1.8 million, because the house no longer has any value,” he said.

“Quite often, however, the council won’t even be aware of it unless it’s been brought to their attention.”

The 2011 Canterbury quake destroyed many houses and left thousands more in an uninsured state. Photo / Getty Images

“As is, where is” homes weren’t for amateur renovators either, and those hoping to get a bargain would have to think carefully about the costs involved.

“[The deal] might sound good, but there are traps. You’re not just going to walk in and grab a bargain, and it will be OK. What happens is some people think it might be a $200,000 repair, and then all of a sudden, they’re facing a $400,000 repair, and all the upside they thought they had is gone.

“That’s why most buyers are builders or very savvy developers who know these products back to front. Sometimes they buy for land value and plan to demolish the house and develop townhouses or a new property on the site.”

Sometimes, they bought to fix up the home to an insurable state and then re-sell, he said, adding that just because a home isn’t insurable doesn’t mean it’s uninhabitable.

“There are people in the marketplace that have bought many, many, many of these and have held them as investment properties over the last 10 years. They have to pass all of the legislation for tenancy.”

The floors may not be level, but this doesn’t necessarily make them unliveable. “The majority of as is, where is properties have sunk on one or more sides. It might be completely structurally sound but out of level, so you can’t get insurance.”

Repairing the problem involves lifting and fixing the foundations and could cost anything from $30,000 to $300,000, he said. “There’s a huge range of cost depending on a lot of factors.”

“With large houses, the cost of re-levelling can be prohibitive. And you would end up with a product where the buyers would not necessarily have confidence in the property because of it.” In that case, it may be better to bowl the home, he said.

“A lot of the older homes with ring foundations were pulled down because the land’s so valuable for development, and you’ve ended up with modern townhouses on there. That’s happened a lot,” said Ellis.

“In some cases, vendors in Fendalton and Merivale have taken their insurance money, demolished the house, and built a new home.”

- Click here to find more properties for sale in Christchurch