Almost every property in Wellington would sell below its new rateable value if it sold in today’s down market, new research suggests.

Analysis of property values in the capital city by OneRoof’s data partner Valocity shows 99.8% of properties are worth less than their RV.

Wellington homeowners were issued their new valuations at the end of last year when house prices were nearing their peak.

Valuations were undertaken in September 2021, and many commentators thought runaway house prices would soon render them useless as a price guide but instead a market slump has dominated this year and has wiped out much of the city’s value gains.

Start your property search

The Valocity analysis identified 39 Wellington suburbs where 100% of homes were now worth less than their RV and a further 15 suburbs where more than 90% of homes were worth less than their RV.

Just one suburb bucked the trend: Horokiwi, on the city’s northern fringe. More than half of the homes in the suburb were worth more than their September 2021 rateable value.

The analysis also tracked the number of sales in the city that came in below RV since the valuations were issued at the end of November. Of 1503 settled sales tracked, 1062 (71%) sold for less than RV.

Wayne Shum, senior research analyst for Valocity, says the data shows Wellington’s market decline.

“The valuations were done in September last year so the market has changed a lot in the last year and we’re seeing that in a lot of sales – 70% of the sales now tracking below the rating value.”

RVs, also known as CVs, are carried out by councils every three years to give them a base by which to impose the rates and are quickly out of date in a moving market.

While owners can be attached to them, hoping their property will fetch the RV, Shum doesn’t think they affect what people will pay.

A real estate office in central Wellington. The capital’s housing market has been hit hard by the slump. Photo / Getty Images

“Oftentimes when they’re released you get some buyers or sellers using them as a benchmark for the first month or two but in such a moving market in Wellington they’ve probably abandoned that quite early on.”

Because the valuations were carried out at the peak of the market in Wellington, anything selling after the peak is more likely to be below the RV, he says.

RVs don’t tend to become more relevant during their three-year cycle either, Shum says, although that depends on what the market is doing.

“Sometimes it goes up then comes back down, sometimes it goes down then comes back up but sometimes it continues to go up so it doesn’t really become more accurate.”

Tawa, on Wellington’s northern boundary, recorded the most sub-RV sales (77), while Grenada North, Rongotai, Breaker Bay and Makara Beach had the highest share of below-RV sales, although there was a handful of sales in each.

Agents mostly advise sellers and buyers to take no notice of the RV, explaining to clients they are simply a tool for councils to determine how much people pay in rates.

The market determines the actual price but some vendors are still hopeful, says Nicki Cruickshank, principal of Tommy’s Real Estate in Wellington.

It’s a psychological wrench for some owners to realise their property will fetch less than the RV but they need to get realistic in a market which has seen prices plunge across the city.

The market moved up so much over the Covid years the rateable values from the previous round were extremely out of date but when the council adjusted them it overcompensated and now RVs are too high, Cruickshank says.

“I suppose they didn’t foresee the increase that we got last year. It’s almost like a knee jerk reaction to it, though.”

Before the market turned, it was the purchasers taking notice of RVs because they were low, she says.

“The purchaser was saying ‘well, the RV is only this much so why should I pay this much’. Now it’s swung around to vendors taking notice of them, not buyers.

“Now they go, ‘oh, good, I’m going to get $2.5 million’ and then we turn up and go ‘well, actually you won't, you’ll get $2 million’, so they're like ‘uh’.”

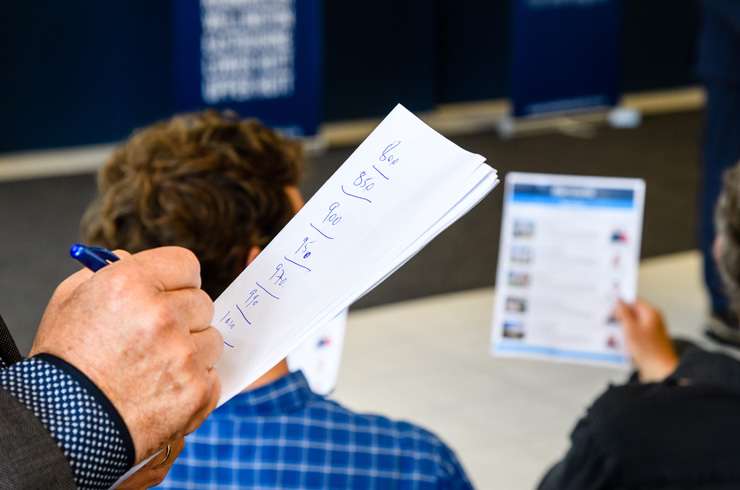

A buyer runs the numbers at an auction in the capital. Photo / Getty Images

But most vendors come around to the fact their property will fetch less and realise if they are buying in the same market they will also be paying below RV for their next purchase.

“Most people do get it but it’s got to be explained quite clearly to them. I’d say 80% of people get it.

“It’s a painful psychological thing for us to turn up and say ‘hey, your house is not worth $2.5 million, it’s worth $2 million’.”

Cruickshank says RVs are never accurate value-wise at any point in their three-year cycle because houses next to each other can have the same RV but one can be run-down and the other immaculate.

“RVs are there to collect the rates, they should never be used as an assessment on the value of your house.”

Harcourts auctioneer Darryl Harper says RVs are a revenue-gathering exercise for councils, adding that they should not be looked at as a way to determine property values.

“At the moment properties are travelling in excess of 20% below the RV on average and the gap’s only going to get wider with where the market’s heading – I wouldn’t want to give you a figure but we’re nowhere near the bottom yet.”

In auctions, sellers set a reserve figure they won’t sell below but they don’t generally set them around the RV, he says.

In Tawa, where the data shows has the most houses in Wellington selling under RV, there may be a few vendors holding on to a dream of getting as much as the RV but it is just a dream, says Marie Hook from the Professionals Tawa/Double Winkel Real Estate.

The suburb is settling into its new normal, “which is if you’re expecting prices like they were this time last year, mate, you missed that train.”

Most vendors are starting to see the market has changed and understand the RV is not the market price.

“At the end of the day it’s what our first-home buyers are prepared to pay and we don’t know that until it’s on the market.”

Phillip Reeve, sales manager for Ray White Johnsonville, which recorded 70 sub-RV sales, says some vendors are holding off selling and he thinks the RV may be a factor in their decision.

He says his agents are frank in telling vendors that properties in the area are selling for around 15% less than RV which should temper expectations.

“Last year agents were very good at bragging we sold 20, 30, 40% above our RV but we're not seeing much bragging they sold 15% below RV.”

Even if properties are selling for under RV, most property owners have still done very well out of their homes, he says.

“I've just appraised a house this week which I appraised in 2016 for $420,000 and this week’s appraisal was $950,000 to $1m so anything the vendors think they’re losing is a theoretical loss.

“If they’d come on the market six months ago, yes, they might have got more but now they’re still getting more than they would have done two years ago or three years ago.”