If you bought or owned a house through the 2014 to 2019 housing boom it’s likely you are sitting on a pile of money, at least on paper.

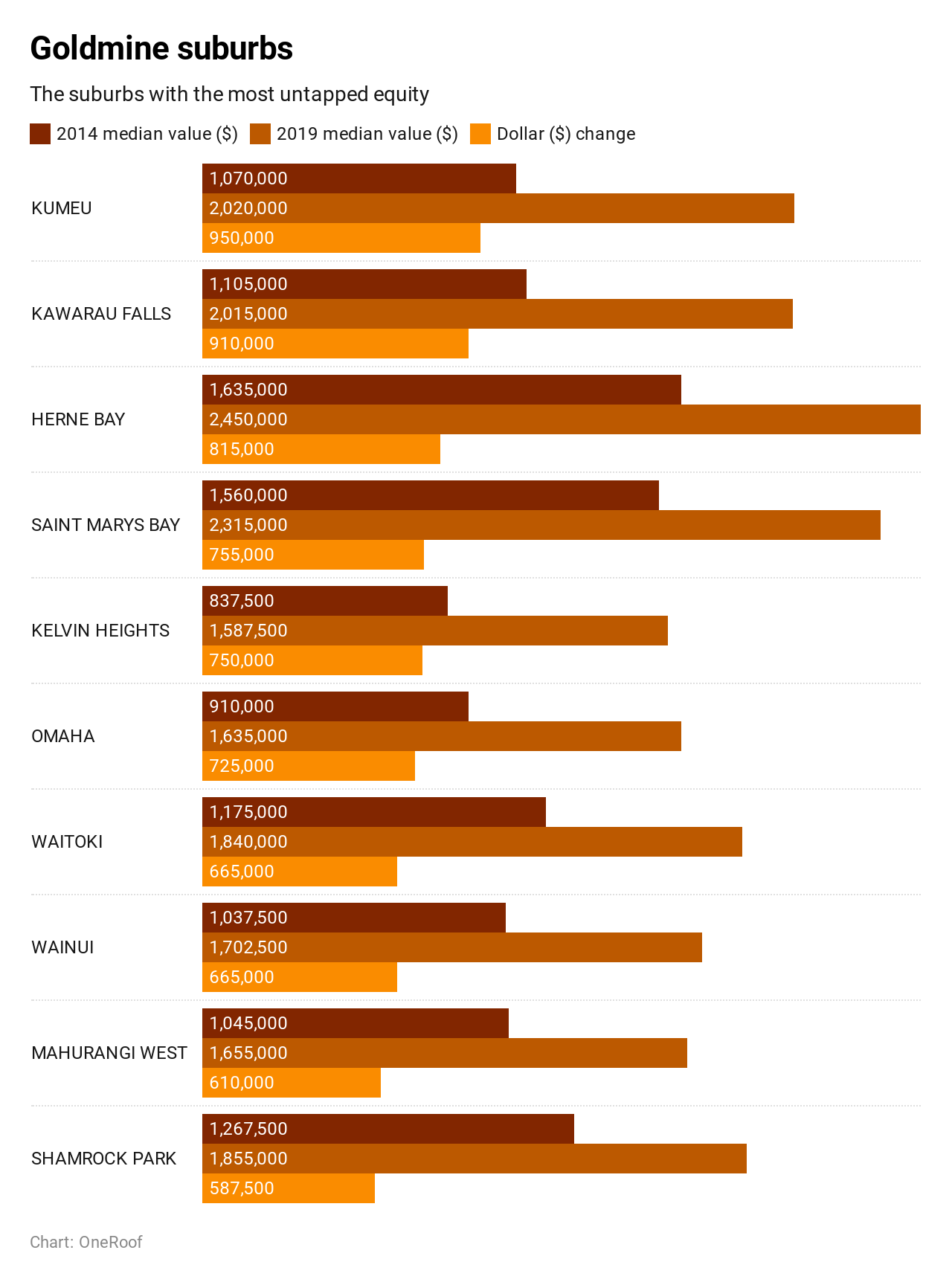

A couple of suburbs have seen close to a million dollars of median value growth on their homes in the last five years while others have made anything from tens of thousands of dollars at the lower end to hundreds of thousands of dollars.

OneRoof and data partner Valocity crunched the numbers for 2014 to 2019 to reveal nearly every suburb in the country has seen medium to big equity gains.

Whether people should capitalise on the untapped equity they have made during the frenzied housing market over the last five or so years is another matter.

Start your property search

Some say you’d be crazy not to use gains as leverage to get an investment property, upgrade to a bigger home or buy that bach, but others are more cautious, pointing out if your value has risen, everyone else’s has shot up, too.

Combined with what has been an all-time low nationwide shortage of listings over the past year, the problem is if you sell you might not be able to find what you’re looking for and get stuck.

And while in some areas the equity gains are truly impressive, the situation may not be clear-cut.

For example, topping the list of biggest equity gain is Kumeu, in north-west Auckland, where median value growth soared to $950,000 in five years.

The median property price of $1.07m in 2014 almost doubled to $2.02m in Kumeu by 2019, but a local agent points out this fast-developing area is actually struggling because of infrastructure issues.

Second on the list of equity gain is at the other end of the country. In picturesque Kawarau Falls in Queenstown new apartments and other residential development near the new Hilton Hotel on Lake Wakatipu led to median value growth of $910,000, and in the residential suburb of Kelvin Heights, literally just down the road from Kawarau Falls, median growth values rose by $750,000.

Back in the north, the wealthy beach town of Omaha, on Auckland’s outer northern coastal edge, (where former Prime Minister John Key had a holiday home) rose $725,000, and posh Herne Bay in the inner city was up $815,000.

These are stand out areas but there is almost nowhere that did not see equity gains - that’s almost. A few suburbs, in Greymouth and around Christchurch, did not do so well, showing negative equity, but they are the exception, not the rule.

James Wilson, Valocity’s director of valuation innovation, says for Auckland some of the largest value growth has taken place on the outskirts of the super city, in suburbs such as Kumeu, Puhoi, Coatesville and Whitford.

“This is mostly fueled by a change in the nature and property use in these areas as they transition from lifestyle to urban property types.”

The lowest median time between the first two sales is occurring in areas of intense newer builds, such as, Flat Bush, Hobsonville, Takanini and Silverdale, which is to be expected as new areas are established.

Wilson says when the data was refined to focus only on established suburbs, the top five in Auckland

with the most value growth and the least churn time between sales were all, perhaps not surprisingly, coastal, sought-after areas - Kohimarama, Mission Bay, Herne Bay, Mairangi Bay and Omaha.

“This reveals that on paper homeowners in these locations have some of the greatest dollar equity in their homes generated during the last property boom, with the suburbs earning a median value of $49,000 per annum during this time.

“This makes sense given the high value nature of these locations, but when we narrow the scope of this analysis to areas with a median value of under $700,000, the top five areas of largest value growth and highest number of years between sales are Papatoetoe, Papakura, Clover Park, Eden Terrace and Wellsford.”

The lower value suburbs also have a shorter time between sales which Wilson says is because these areas are popular among first home buyers and investors who typically adopt shorter holding periods as they either upsize or sell on their investment.

The equity gains some home owners have made can be an entryway into something better by helping them invest, upgrade or renovate, or put money into a business, but for others the gains might not have much impact as the country struggles with the exponential property price growth that has taken place over the past 20 years.

Omaha

Omaha, with its median $725,000 equity gain in five years, has been described as Auckland’s The Hamptons - rich New Yorkers holiday at The Hamptons and rich Aucklanders own real estate at Omaha.

Di Balich, of Precision Real Estate, calls the beach retreat of “pretty swanky baches” Auckland’s Tuscany because of the vineyards all around.

Capital gains are merely a bonus around here so the super wealthy residents likely won’t care much about theirs as money is not the issue for these property owners.

Balich says a recent buyer had two multi-million dollar houses on Taumata Road to choose from who spent an extra $700,000 for the one with a better view of the beach, paying $7.2m for the property.

“Omaha’s like a little micro climate,” she says. While further development options are limited, there is a lot of what she calls the “Omaha shuffle” where people buy entry level then upsize and upsize closer and closer to the beach.

Wellsford

The outlook is more complex in this sub-$700,000 rural town on the main highway north, certainly for the locals. While equity gains of an average $220,000 in five years look great on paper, it’s not that simple, says Bayleys agent Andrew Rumble.

“People will say things like ‘hell, we paid $300,000 four years ago and now it’s worth $500,000 and it kind of gobsmacks them, but the downside of that is that it means ‘we can’t afford to move because if we sell it whatever we’re going to buy is now over-priced.’”

Like other towns, Wellsford locals also compete with downsizers coming to the country, or other outsiders from Auckland or Warkworth who use the town as a property stepping stone.

“The question I always ask is ‘let’s not worry about what your place is worth, tell me what your dream is, what you want to be doing in the next two or three years and if selling your place lets you do that, let’s do it. But if you are just selling your place to make money it probably isn’t going to work.’”

Kumeu

Bob Howard, from Harcourts Kumeu-North West Auckland, also advises caution because despite having the largest median equity gain in the nation, the Kumeu property market is struggling.

When the first Unitary Plan came out six years ago swathes of land were earmarked for development so people went on selling and buying sprees, Howard explains.

But the rapid development led to major traffic problems so the council put the brakes on further development, meaning some of the people who bought are not getting their money back.

“The people that made the capital gain were the people that had the old orchards over the years and got in at the proposed plan change, the proposed future urban zoning, while it looked like it was going to go, but hasn’t.”

Housing is stable around the $1m to $1.1m mark but property is generally selling under CV, Howard says.

“We’ve got people that are renting out houses because they can’t get the price they want and they don’t want to take a loss on so they’re putting tenants in and waiting for the market to come right.”

There are quality homes in Kumeu, Howard says, but people who bought four years ago would be lucky to get their money back because of a drop in demand which he puts down to the traffic headaches.

Whangarei

“I don’t think it matters where you are in Northland, or the Whangarei region, everybody’s experienced considerable capital gain,” says Tony Grindle, general manager for Bayleys Whangarei.

Kamo, to the north of Whangarei, has had marked growth ($190,000 median value growth) not so much from the new builds in the area but from an overall increase in demand for housing.

“Whangarei’s going through a real boom period. We’re getting something in the vicinity of 6000 people moving in here every year.

“There’s money coming into town from central and local Government, there’s expats moving back to town, we’ve got overseas professionals that are coming back to the north.”

Suburbs that once weren’t popular, like Tikipunga ($160,000 equity gain), were now in demand, and any suburbs by the water, from Whangarei Heads ($285,000) to Tamaterau ($327,000), are always in demand.

Otangerei, the suburb with the lowest equity gain at $100,000 and where Whangarei’s lowest priced properties are, is popular with investors. The suburb had an average eight years between sales, which is a longer average than many other suburbs.

Grindle advises people thinking of selling to cash up first because there are more buyers than property in Whangarei. He also says people need to make sure they can replace what they already have.

“There’s no point selling if you’ve got nowhere to go to.”

Queenstown

Kawarau Falls, with the second biggest median value growth at $910,000, is a new suburb of million dollar apartments, says Adrian Snow from Professionals Queenstown, while Kelvin Heights down the road is a premium suburb popular with locals and one of the few which gets water views to scenic Queenstown Bay.

Queenstown has surged in popularity, and prices with it, to the point that post GFC in 2007/2008 the region was “almost recession-proof”.

While the homes are high value, Queenstown is an expensive place to live and Snow suspects most people have hefty mortgages. The turnover of properties is down significantly from the early 2000s when people tended to upgrade from suburb to suburb.

Moving costs are high, from agency fees to lawyers’ fees, and Snow also thinks people are buying substantial homes as their first homes so tend not to move as much - “they’ve really got there in one step as opposed to the two-step interim home process.”

Big rents saw an investor-driven growth spurt, many coming from Auckland, in 2016 and 2017.

“One of Queenstown’s curses as well, if you’re a resident, is that a residential purchaser is very often competing with an investor purchaser.”

Christchurch

Gains in Christchurch have not been so high and some suburbs have seen decreases in equity.

Justin Haley, from Bayleys Christchurch, says post-earthquake Christchurch is still heavily under-valued despite some periods of big growth.

“We’re not seeing the significant growth that Dunedin has received, or that Southland’s received, or Napier/Hastings.”

Suburbs with the most equity gains are Fendalton, with an average $132,000, Strowan ($107,500) and Merivale (95,000), all blue chip areas of consistent performance and turnover created by the good school zones, says Haley.

“Strowan is right around St Andrews College which is very, very popular through that area.”

Among the suburbs which had equity falls are Ferrymead (- $42,500) and Bexley (-$15,000).

Haley says Bexley, for example, was affected greatly by the impact of liquefaction from the earthquakes, so the negative equity no doubt reflects a land value component, and while Ferrymead was more of a puzzle low volume may skew the value.

“The earthquakes catered for diminished land value components and they probably saw a lot of payouts and that reflects in pricing.”

Christchurch is overdue a correction, however, Haley says.

“It’s a moving feast really but we are now so under-valued in comparison to the rest of the country it’s inevitable we must catch up.”

This means it’s a fantastic time to buy in Christchurch and not a bad time to sell either because of the strong first home buyer market and interest from investors from outside the city, Haley says.

Wellington

It’s no surprise Oriental Bay topped the list for Wellington’s equity gain, says Ann Curtis from Bayleys.

Oriental Bay, with gains of $475,000, has a limited number of properties, including a lot of apartments, and is a desirable area to live.

“People move into these areas and they don’t really move out unless they’ve got a reason, they’re being transferred or something like that.

“You’ll find a lot of these properties have been owned by the same person sometimes for 20 years.”

That’s because Oriental Bay, and nearby Roseneath ($377,500 equity gain), is so lovely, Curtis says.

“It’s just a lovely, relaxed lifestyle. I mean, to walk into the CBD, into the centre of town, it’s 20 minutes along the waterfront and you’ve got the bus stop also if you wanted and some little restaurants along the way.

“It’s just like relaxing and being on holiday really.”

Seatoun, on the east coast of the Miramar Peninsula, had the next-highest equity gain to Oriental Bay at $322,500.

This is a popular suburb now, Curtis says, and the film industry, which bases itself in the wider area, has driven up prices.

Dunedin

Dunedin has seen huge price growth over the last few years. The areas of highest equity gains are in the sought-after suburbs of Company Bay, Vauxhall, The Cove and Macandrews Bay, ranging from $277,500 to $230,000.

These habourside suburbs, almost linked together on the Otago Peninsula, have been sought after for a long time, says Joe Nidd of Nidd Realty.

“You can get property with great attributes, like excellent views and sun, a little further down the market in some of those suburbs which has been very appealing in recent times because some of the more traditionally-perceived suburbs have become incredibly expensive.”

The most expensive suburb in Dunedin is Maori Hill, which had a median value of $705,000 in 2019, with an average $227,500 in untapped equity.

The median value for Maori Hill - low by Auckland standards - is high for Dunedin but becoming more “normal by the day” in a city facing an influx of people and a shortage of land to develop.

“It blows us away the speed at which the sales prices are moving down here. We are constantly surprised and every time we think it’s an anomaly when a shock result happens and then the next month that’s become the norm.”

People with equity in their properties could consider spending on deferred maintenance, which is an issue not just in Dunedin but across the board, Nidd says.

“Often when people come to sell they haven’t done maintenance for five to 10 years, or substantial maintenance, and they suddenly find they need to do a big catch up which can be quite expensive.

“That new found equity may provide an opportunity to be proactive with maintenance where otherwise they may not have realised they had the ability to do so financially.”

Tauranga

The biggest equity gains in Tauranga have been in Tauriko ($450,000) and Pyes Pa ($290,000) and these areas also have the shortest ownership.

That’s because of the new subdivisons, says Simon Martin from Harcourts.

“We’ve got a subdivision called The Lakes in that area so you have a lot of sections being sold and properties being built on them and being sold with a house on them.”

Big growth areas otherwise are places that don’t have much land left to develop, such as the ever popular Mt Maunganui ($315,000).

If you have equity, Martin’s advice is to talk to a mortgage broker about how to increase your wealth position.

“It’s certainly something to consider, how that can be used. You can use it to put money towards another property, an investment property.”

Hawke's Bay

Simon Tremain, from Tremains real estate firm, says if you have equity why wouldn’t you use it to buy another house or an investment property.

The median price throughout regional New Zealand since the GFC of 2007/2008 didn’t change until late 2014 into 2015, he says, then anyone who owned a property and still owns it should have made anywhere from 60 to 80 per cent in equity.

In Hawke’s Bay the median price went from $275,000 to $520,000, and in the beach community of Waimarama, for example, which OneRoof figures show had the most equity gain ($335,000), the median value was up from $460,000 in 2014 to $795,000 in 2019.

“As more people have got money in their houses they go and buy beach houses, so they use it for lifestyle as well,” says Tremain.

Risk of recession

ANZ chief economist Sharon Zollner warns people contemplating capitalising on their untapped equity to maybe take a breath even though interest rates are at an all-time low because somewhere down the track there will be a recession (“there will be one, I just can’t tell you when”) and then some will panic because of the size of their mortgages.

With the coronavirus causing unrest, the near future is uncertain, too.

“You could imagine a scenario when mortgage rates and business banking rates are going up because global markets are in a tizzy and the Reserve Bank can’t do anything about it in terms of the official cash rates, and that’s not a happy scenario.

“That tightening of financial conditions in times of trouble, we haven’t really had that before but it is a risk, because we’ve never gone into a downturn with the Official Cash Rate at one per cent.”

On the other hand, everything might blow over and the housing market party continue for another few years.