Unmet demand within the commercial property market, indicates that property asset values will continue increasing during the remainder of this year, says Richard Carr, senior research analyst for CBRE.

“Capital confidence in New Zealand is high and investors are branching out well beyond the traditional commercial investment avenues and are looking for more portfolio diversification,” Carr says.

“CBRE consistently talks about the ‘dry powder’ available for deployment into real estate around the world and our latest estimates have in excess of $100 billion available for investment into the Asia Pacific region, which includes New Zealand. Mega investors like Singaporean GIC, Canadian PSP and Blackstone have led the charge here with large scale confidence in New Zealand and the copycat effect is quite noticeable.”

Brent McGregor, who heads CBRE’s capital markets team in New Zealand, states that the last 12 months have seen an average of 6.1 offers per sales campaign - meaning that for every transaction that occurs, there are five bidders still looking for a deal.

Start your property search

“The average number of bids per deal is still stable to increasing,” McGregor says. “With the latest observation being that the locals have started to successfully compete with the historically more aggressive offshore bidders.”

Carr says the agency has witnessed an increasing demand from a range of investor groups. “This demand is coming from around the world, and not only for traditional office, retail and industrial assets. Local investors are particularly active and competitive in the commercial property market; this is not just high net worth private investors, but also syndication groups.

“Syndicators ramped up more than $440m of acquisitions last year and this trend has continued into 2019 with sustained demand for a range of commercial property assets in a variety of locations. Syndicators have usually been more focused on the Auckland market, but have recently been looking further afield to Wellington, Christchurch and Tauranga to source purchase opportunities.”

Carr says the low interest rate environment appears to be here to stay. “As a result, people are having to look further afield than the traditional term deposits; which is where increased syndication accessibility into the commercial property market offers leveraged distribution yields sitting between 6 per cent and 9 per cent.”

At this point in the cycle, Carr says that liquidity confidence – the ability to enter and, sometimes more importantly, exit a market – is helping investors to realise capital and find more purchasers when they want to sell.

He says the current weight of investment capital, has significantly improved liquidity levels across a variety of commercial property asset classes.

“Liquidity improvements have been gaining momentum for a few years and seem set to continue. This momentum continues to support vendors and purchasers alike as market activity and inquiry at strong levels supports commercial property transactions

“When capital demand is strong, relative returns drive investment decisions and influence liquidity. Buyers are constantly assessing the returns available in New Zealand versus other investment destinations and returns available here are weighted against competing returns and adjusted for specific market influences including gearing and hedging costs. Right now, all of New Zealand’s ingredients are delivering up a fairly compelling story which local and foreign buyers like.”

McGregor says that with considerable bid coverage and investor demand increasing from a range of purchaser types, sourcing quality investment opportunities is vital.

“CBRE has a range of investment properties available now with campaigns running for the sale of 48 Greys Avenue and 345 Queen St, both within the Auckland CBD.”

He says there have been strong inquiry levels for both properties. “These are two very different buying opportunities - one attracting ‘value add’ capital and the other ‘long lease’ capital, with minimal crossover on the inquiry lists.

The Greys Ave property comprises a six-level office building constructed in 1970s and refurbished in 2009 which is being marketed as a mortgagee sale by McGregor and Warren Hutt by deadline private treaty closing 4pm on Thursday July 4 - unless sold earlier.

“The building has a net letabble area of 6819sq m and occupies a high profile freehold site of 1650sq m,” Hutt says. “Typical floor plates are 895sq m in area and the property has 39 secure car parks located on two levels.”

He says the property is zoned City Centre under the part operative Auckland Unitary Plan and is surrounded by amenities including the upcoming Aotea City Rail Link (CRL) station.

McGregor says 48 Greys Avenue is a perfect example of a property presenting an opportunity to inject capital in order to add value. “It has a high land value component with significant redevelopment potential. Its flexible zoning permits a variety of uses including offices, accommodation, education, entertainment, hotels and retail. It is ideally located for redevelopment into hotel, apartments or student accommodation or alternatively upgrade for modern office use.”

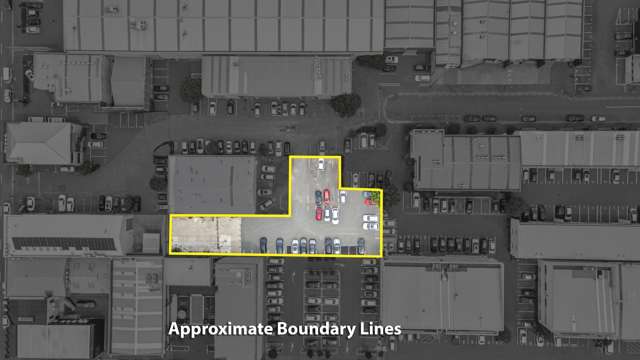

Nearby, McGregor, Hutt and colleague Mark Maginness, are marketing 345 Queen St for sale via a deadline private treaty process that closed at 4pm Thursday June 27.

“This six-level Auckland building, in the heart of the city’s tertiary education precinct, was offered as a sale and lease back opportunity with a long-term triple net lease,” Hutt says.

“On the market for the first time since its construction, this is an investment property that will take care of itself.”

Situated on an elevated 2032sq m site adjoining Myers Park, on the corner of Queen St and Mayoral Drive, the freehold property is owned and tenanted by ACG Pathways, a well-established private education provider that runs preschools, schools and vocational colleges at over 50 campuses across Australasia.

“It’s strategically located close to tertiary education providers including the University of Auckland and AUT’s city centre campus,” Hutt says.

Most of the levels in the building, with floor plates range from 850sq m to 1100sq m, are structured in a classroom style and are designed to maximise natural light.

Hutt says the current net annual passing income is $2.4m with the lease allowing for strong annual fixed rent growth of 3 per cent per annum.

He says the triple net lease and 20-year weighted average lease term (WALE) on 345 Queen St demonstrate a long lease opportunity with structured rental increases.

“Investment in an asset with such structural certainty will enable investors to increase the WALE of their portfolios, while also diversifying occupier exposure into the education sector. The education sector, in some ways, has very similar characteristics to government tenants with these assets being highly sought after. And, the stability given through long lease property can ensure an investor’s position as the economic cycle slows.”

Carr adds that another commercial property area that is catching the eye is the emerging Build-to-Rent (BTR) sector.

This is backed up by Tamba Carleton, CBRE’s Senior Research Analyst, who last week released CBRE’s Build-to-Rent: Who? What? Where? research report, which examines the shortcomings of the region’s current market, highlights who the early adopters of BTR product are, and where projects may be built across the Pacific region.

“Long a commercial development opportunity in the USA, we’re also seeing BTR in the UK and Australia; while the first multi-unit developments specifically intended to provide long-term rental housing are now emerging in New Zealand,” says Carr.

“The small existing stock of two developments offering 96 units at Uku Apartments at Hobsonville Point, and NZ Defence Force Housing at Whenuapai, represent the front end of a growth pipeline of 543 units in 12 developments, and significant future potential.

“Given the factors underpinning occupier demand and what from some aspects is a compelling investment rationale, we do expect BTR to become a growth sector in New Zealand.”