Heading into the second half of 2024, the Auckland commercial property market can be best described as steady-as-she-goes, says commercial manager of Barfoot & Thompson, John Urlich.

In the company’s recent Commercial Insite publication Urlich says, “Auckland’s commercial property market is currently influenced by various local and global factors. Historically, low-interest rates have driven investment, but with rates holding steady, investors are now more cautious, seeking properties with strong yields and value-add potential.”

Despite the challenges, Urlich acknowledges that within the office sector, tenant demand continues to concentrate on high-quality spaces in preferred locations, with refurbished turnkey options becoming increasingly popular. The scarcity of quality industrial land maintains robust demand for industrial building space, leading to industrial rental yields exceeding $200/m2 for new constructions.

Urlich suggests that although the prevailing market conditions favour occupiers, discerning investors may identify value in investing counter-cyclically.

Start your property search

Certainly, there are some excellent opportunities being put forward for investors, developers and owner-occupiers in the May issue of Commercial Insite with 40 plus properties on offer.

One of the standout opportunities has to be Shop 2 and Shop 3, 172 Kitchener, Milford. These fully leased properties are for sale separately or together and form two of four cross lease titles at this address. Together they and returning a net income of about $90,000 plus GST per annum.

Marketed by Nick Brown and Simon Farland, from Barfoot & Thompson Commercial, the combined cross lease titles give them a 42% share in 811m2 of land area and are being offered for sale by deadline private treaty closing Wednesday, June 19, unless they are sold prior.

“It’s all about location” says Brown.

“Milford’s main strip is one of the North Shore’s busiest retail hubs, comprising a quality blend of retail offerings that service the large catchment of affluent residents as well as capturing the constant flow of commuters between Takapuna and the Bays.”

Brown went on to elaborate that the key to Milford’s retail success is underpinned by excellent parking and access and the modest rents enjoyed by tenants compared to their counterparts in Takapuna.

“The two shops are currently leased to long standing tenants, House of Travel and Maxwells Drycleaning, and provide the savvy investor an extremely affordable entry into a blue chip commercial precinct whilst simultaneously allowing for a split risk income stream.”

The upside here has to be the zoning. Zoned Business Town Centre the unitary plan allows for future redevelopment potential for upwards of six stories, subject to council controls and approval.

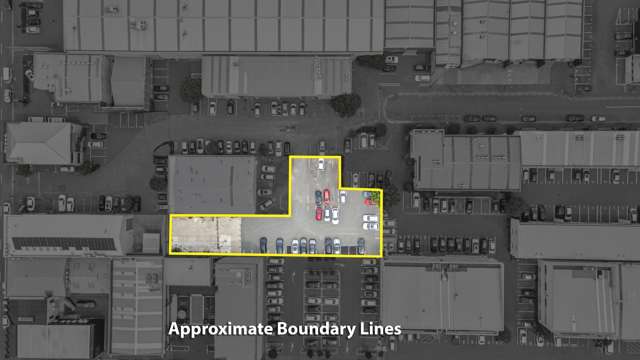

Another great prospect – also on the North Shore – is 53-55 Eban Ave, Hillcrest, a superb mixed-use property with a split income stream from five tenancies. The property is also marketed by Barfoot & Thompson Commercial’s Nick Brown and Simon Farland, and is for sale by deadline private treaty closing 4pm, Thursday, June 6, if not sold sooner.

“The key here” says Farland, “is the investor fundamentals. Multiple tenancies to reduce risk, conservative rentals, excellent location and a flat site of more or less 1,391m2.

“Benefiting from convenient access to the Northern Motorway, the wider North Shore and the CBD and surrounded by popular schools, sports clubs and numerous other daily amenities you couldn’t ask for a better location.”

According to Farland, Hillcrest is one of the North Shore’s most popular, central suburbs and a highly sought-after location for people from all walks of life. Consequentially he expects that this suburb will continue to see high demand and higher density residential development moving forward. This all bodes well for 53-55 Eban Ave, which is strategically positioned for re-development to a higher and better use in the future.

“Furthermore” Farland adds, “the Fee Simple Title is favourably zoned Business - Neighbourhood Centre.”

Described as the quintessential neighbourhood retail property, the site provides for great customer parking and the shops are all an ideal size for a versatile range of retail and service offerings that will always enjoy comparatively modest rents and the ability to service such a large surrounding catchment of affluent residents.

- Supplied by Barfoot & Thompson