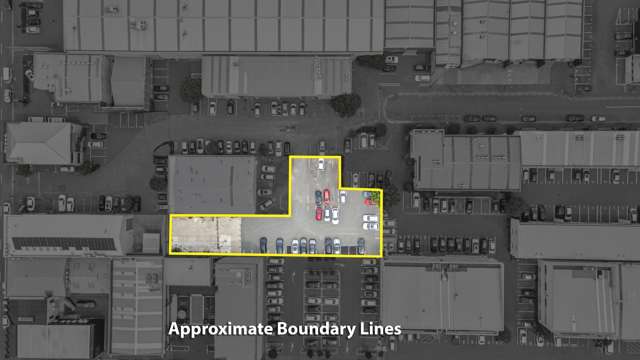

A distribution centre owned by T&G Global in Chirstchurch sold for $14.85 million, representing a yield of about 6.50 per cent. Photo / Supplied

The undeniably impressive cashflow and strong fundamentals of the Christchurch industrial property market are luring growing numbers of Auckland investors to look south.

With a further cut in the official cash rate tipped later this month, coupled with share market uncertainty as a result of Coronavirus, the spotlight is on investment vehicles offering more attractive returns.

Sam Staite, director of industrial sales and leasing for Colliers International in Christchurch, says investors are focusing on passive cashflow rather than speculating on capital gain. This is supported by robust market fundamentals.

Start your property search

“Labour costs are cheaper, living costs are lower, prime rental rates are about 30 per cent lower than Auckland, and transport rates for sending product north can be about a third of the cost compared to sending it south from Auckland.

“Those factors are all fuelling demand for our industrial stock. There is very little speculation in our investment market, and industrial investment is continuing to see record demand due to the fundamentals, which in our mind, is a far more robust investment strategy.

“We’re seeing returns of 5.50 per cent to 6.50 per cent in the Christchurch market, versus 4.0 per cent to 5.0 per cent in Auckland.”

Staite believes a key difference between the two markets is that Auckland is banking on population growth to buoy its rental rates while Christchurch boasts all the requisite investment criteria.

“What we’re seeing are companies starting to hold a lot more stock in Christchurch because of these fundamentals.

“For instance, a major distributor is currently building a new 6,500sq m warehouse in Hornby, almost doubling its current footprint.

“Another of our clients, a large clothing retailer, tells us that the associated costs of having their national distribution centre located in Christchurch saves, on average, $1 million per annum compared to if they were domiciled in Auckland.”

Staite cites two deals in the past 18 months to support his views on Christchurch yields – both properties were bought by Auckland investors.

The large purpose-built distribution centre owned by T&G Global, formerly known as Turners & Growers, sold for $14.85 million representing a yield of circa 6.50 per cent.

Another out of town investor recently purchased a well leased industrial building in Sockburn for $10.8 million for a 6.20 per cent return.

These compare with prime average yields of 4.9 per cent for Auckland industrial property in the final quarter of 2019 and secondary average yields of 5.7 per cent.

Industrial broker Ben Dwan, also of Colliers in Christchurch, says that when comparing buildings of a similar value and lease terms – in Christchurch and in Auckland – the southern city invariably comes out on top.

“If you’re investing $10 million into a comparable building with a yield differential of 2 per cent, the actual difference is $210,000 per annum in income, which means an additional $4,000 in your pocket each week.

“The feedback we’ve had from Auckland investors is that they traditionally invest in their home patch because they’re speculating on capital growth over cashflow. But that sentiment is changing, especially given that Christchurch offers capital growth and a good cash return.”

At the same time, Dwan agrees the two markets are quite different.

“Canterbury has a very strong agricultural outlook that feeds directly into the industrial sector. It’s all about the basics – food, water, shelter.

“Auckland is largely about consumption, distribution and supplying the high population base, Christchurch is about output and export and that drives the industrial market.”