The premium buyers pay for brand-new homes could be about to shrink, new research suggest.

Analysis by property insights firm CoreLogic found that the median price of new-build homes was 6% higher than the price of existing homes.

However, the analysis suggests the price gap between new-builds and existing homes is closing.

CoreLogic chief economist Kelvin Davidson said higher interest rates, economic uncertainty and changes to investor rules all posed challenges for the new-build market.

Start your property search

Read more:

- Interest rate deductibility: How much money will landlords be saving each year?

Separate analysis by OneRoof shows there has been a significant uptick in discounting by developers, and Davidson said the strategy, deployed to secure sales, underscored uneasiness in the market.

“We know a few more builders are going into liquidation at a time when there is still a new-build premium,” he said.

“To some extent that suggests that the gap between new build and existing prices isn’t the key thing. If you’re a developer, your profit is more about how much it costs you to build it versus how much you can sell it for.

“Margins are squeezed at the moment because construction costs have gone up, interest rates have gone up and financing costs have gone up.”

New homes typically cost to more purchase than older ones, Davidson said, because buyers are getting a higher grade of home.

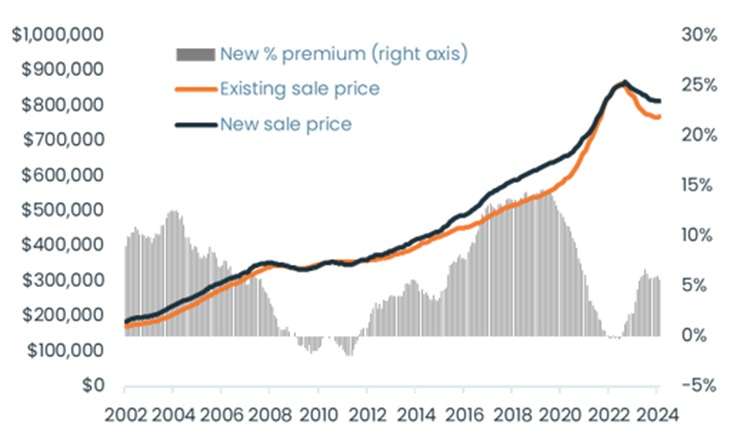

Over the past 20 years the premium for new build varied, from as high as 15% to as low as –2% (recorded in the aftermath of the GFC when the construction sector was in trouble and developers were heavily discounting prices to get pre-sales and homes off their books).

The chart shows the change in median prices of new builds and existing properties. Graph / CoreLogic

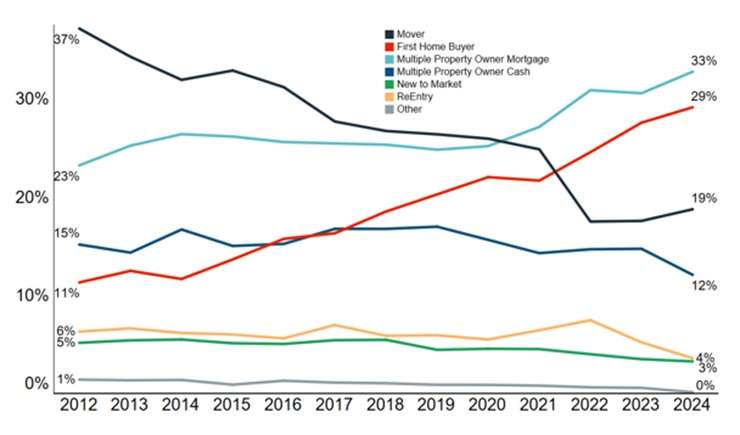

The chart shows the change in the percentage share of new-build property purchases in New Zealand. Graph / CoreLogic

Davidson noted the return of interest rate deductibility for all investment properties and the cutting of the bright-line test for second home sales from 10 years to two years would remove the tax advantages new-build homes had over existing homes.

However, the fact that LVR rules still favoured new builds could offset some of the drop off in demand. “LVRs have favoured new builds for a long time, so that’s probably been part of that longer-term trend,” Davidson said.

Davidson said another cushioning factor for pricing in the sector was the fall-off in consents, meaning less new build stock will be appearing on the market in coming years.

“Supply is falling, so the net impact on premiums probably isn’t that dramatic at the moment,” he said.

“To some extent, most builders are probably still fairly busy working through what was already approved. There’s always lags between what’s being approved and what’s actually being built. There was a big backlog built up previously. But the longer dwelling approvals stay soft the more that will flow through to actual hammers hitting nails.”

CoreLogic chief economist Kelvin Davidson: “Supply is falling, so the net impact on premiums probably isn't that dramatic at the moment.” Photo / Peter Meecham

Davidson said there were positives on the horizon for developers, with high migration figures likely to drive demand in the new home market - although not immediately. “At the moment, I think we’re seeing migration show up more in terms of rents rather than house prices. But as migrants have been in the country for longer periods of time, that demand filters out into buying property,” he said.

“We’re just at this unfortunate juncture again where the construction sector slows down, population growth continues, we need more houses, we’re not building enough houses, [and] shortages emerge. That’s the age-old thing.”

CoreLogic also found that the pace of construction cost rises in New Zealand had dropped below long-term averages.

CoreLogic’s latest Cordell Construction Cost Index recorded a 0.5% increase in the first quarter of the year, less than half the long-term quarterly average of 1.1%.

The annual change of 2.3% was well down on the peak of 10.4% recorded in Q4 2022 and is the lowest rate in almost eight years, the research suggested.

Construction costs spiked during 2022 due to lingering Covid-related supply chain issues as well as a building boom. Consents peaked that same year at 51,000 in May 2022.

“Supply chains have normalised and house-building activity has pulled back, easing the pressure on capacity and therefore cost growth,” the report said.

The fall in construction cost growth benefits both consumers and builders. “Flatter costs mean builders can price jobs more accurately, and consumers can be more confident that their final price won’t have spiralled by the time a job has been completed.”

Emmerson Irvine, building consultant at Classic Builders, said the narrowing of the gap was a positive. "Back through Covid, when people were going to auctions and not being able to secure an existing home, new builds became a great option. People did get sick of actually going to auctions and missing out. And that was a real driver.

"When stock of existing houses is low, it pushes the price up and makes the cost of a new build more attractive.

"Subsequent to Covid, though, the land price for new builds jumped up and building prices went up. And that's where the gap became a lot larger for a new build again.

"Builders across the country are sitting on stock of land. The narrowing gap will help with that for sure."

Irvine said that for their premium, new home buyers were getting 10-year warranties, less maintenance, and thanks to changes to the Building Code over the past 18 months: warmer, dryer, quieter, healthier homes.

"Going from R3.6 insulation in the ceiling to R7 is a pretty big jump. With thermally broken glazing there's no [heat] transfer between the aluminium from the outside to the inside. That'll have a really great effect when you're heating our home and keeping it cool in summer."

- Click here to find properties for sale

* This article was created in partnership with Classic Builders