Adelaide-based Di Mauro Group has expanded its New Zealand retail portfolio with the $88.8 million acquisition of prominent Christchurch regional shopping centre The Palms, situated 4km northeast of the CBD.

CBRE’s Simon Rooney and Brent McGregor negotiated the off-market transaction on behalf of the AMP Capital Shopping Centre Fund in a deal which highlights ongoing domestic and Australian investor demand for New Zealand retail opportunities.

Rooney noted that three of the eight bidders for the asset were Australia-based, including the Di Mauro Group, which owns more than $1.4 billion in property assets across Australia and New Zealand, including the West City Shopping Centre in Auckland and the North City Shopping Centre in Wellington.

“New Zealand continues to gain traction as a retail investment destination, with offshore investors attracted by the country’s compelling investment fundamentals, including low retail supply per capita, ongoing strong population growth, robust retail turnover growth, low acquisition costs and an attractive yield profile,” Rooney said.

Start your property search

McGregor added, “Despite border closures and restrictions, investor interest in the New Zealand market remains high, with low interest rates enabling transactions to proceed. In the case of The Palms, the asset’s expansive and well-established total trade area population of 151,461 and significant retail spending capacity of $1.87 billion, together with the centre’s strong growth profile, were key investor drawcards.”

The 34,395sq m centre is anchored by leading retailers, including department store chain Farmers, Woolworths Group-owned supermarket chain Countdown and Reading Cinemas, providing an impressive major tenant weighted average lease expiry of 8.2 years.

Major, national and chain retailers occupy 80 per cent of the gross lettable area and account for 78 per cent of the total gross rental income.

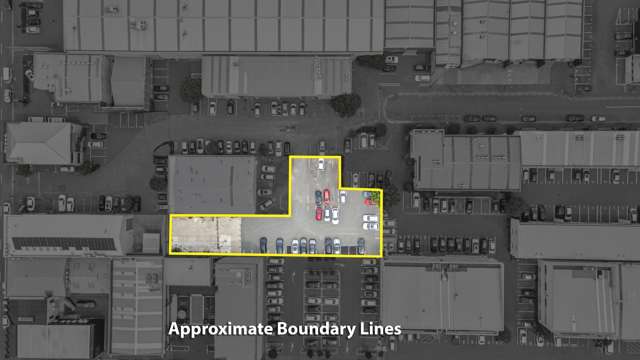

Rooney noted that the centre occupied a significant and under-utilised site, providing the opportunity for a future mixed-use value-add development schemes subject to the relevant planning approvals.

The asset is also set to benefit from robust retail spending growth in the catchment area, which is forecast to increase by 2.5 per cent a year to reach $2.85 billion by 2036.

- Article supplied by CBRE