This time last year the housing market in Queenstown Lakes was in a strong position. OneRoof figures for the first quarter of 2019 showed the median property value for the region was $981,000, up 5.1 percent on the year before, a testament to the region's enduring popularity amid a slowdown in the wider market.

A booming tourism sector kept house prices in Queenstown and neighbouring Wanaka buoyant even as buyers in other high-priced markets switched their attention to more affordable locations. The foreign buyer ban was a bump but it didn't stop growth, and at the start of 2020 the region was the country's most expensive place to buy a house and one of the most difficult to secure a rental property.

Now, the coronavirus has brought the region to a grinding halt. The ban on foreign arrivals and the lockdown have pushed Queenstown's tourism economy into uncertain territory, and experts are worried about the knock-on effect for the housing market.

A survey of real estate agents and mortgage brokers carried out during out the lockdown by economic commentator and former BNZ chief economist Tony Alexander highlighted some real areas of concern.

Start your property search

In his report released this week, Alexander wrote: "City-based salespeople are less concerned about prices falling than those in the regions. In the likes of Wanaka, expectations are high of some big declines in prices and rents as new buyers back away and many existing owners look to sell their high-priced properties to free up capital for their businesses."

Talking to OneRoof, Alexander says Wanaka is uniquely exposed and he expects downwards pressure on all property stock in Wanaka. Tourist numbers will drop which will impact local business and lead to an increase in debt.

“If they don’t have customers, they are going to close down and Wanaka is an expensive destination for domestic tourism,” Alexander says.

Oversupply of property

Adding to the pressures in the market will be the collapse of short-term letting in the region. The halt in international tourism will force owners of second homes that were being financed by profits made on Airbnb to reassess their position.

All of this will lead to an increase of homes being brought to market and a drop in house prices. “People are expecting an oversupply of property,” Alexander says.

This will have an impact on the rental sector, with Alexander predicting a contraction in the pool of rental properties in Wanaka due to seasonal workers and international visitors on work visas leaving to look for work elsewhere or returning home.

The holiday home market will also take a hit, Alexander says, adding that “aspirational purchasers” always fall away during recessions. “Who can justify buying a holiday home on the coast or by the lake while their business is going under?”

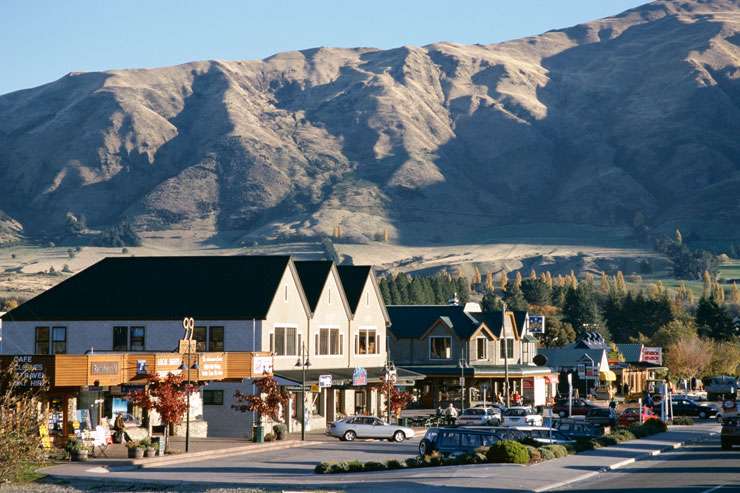

Wanaka's economy and housing market relies on tourism, and the coronavirus has caused widespread disruption to the tourism sector. Photo / Getty Images

Alexander says that long-term locals of Wanaka and Queenstown will be prepared for what comes next. “Most people there have seen versions of this before and know the prices will eventually come back up, but it’ll just take longer than usual for foreign tourist to come back,” he says.

Quentin Landreth, director of First National Wanaka, says long-time property owners in the region will be able to wait out the disruption. "People living in homes that have been passed down two or three generations are not kicking a fuss. Owners are pretty happy to ride through this,” he says.

Landreth believes those who are new to the investment market or have large debts are vulnerable. “Properties here are like gold and we’ve got a couple of home at the moment where the price has dropped $160,000 of a brand-new home so if they are down 15 percent then everyone would be mad not to buy them.”

Landreth says homeowners who let out their homes on Airbnb to pay off the mortgage are a small percentage of population. “Those people might have problems and turn [their holiday home] into a long-term rental as there might not be enough people to sell it to now.”

Pressure to sell

Guy Carter, director of Queenstown’s MortgageMe, says there’s a lot of uncertainty and hope amongst first home buyers in the region.

“There was very, very limited stock and now some people will feel the pressure to sell,” he says.

More stock and greater variety of stock means there will be more opportunities to enter the market. However, first home buyers will have lost about 20 percent of their KiwiSaver.

It’s Catch 22 for the first home buyers in Queenstown and Wanaka, Carter says. “There’s not a lot of low-value homes in Queenstown for first home purchasers but there’s going to be more homes in that affordable bracket of between $700,000 and $900,000. But income uncertainty has also increased - no matter if you are a hairdresser, a banker or a business owner."