First-home buyers are getting back into the housing market, despite many renters still feeling their property ownership dreams are out of reach.

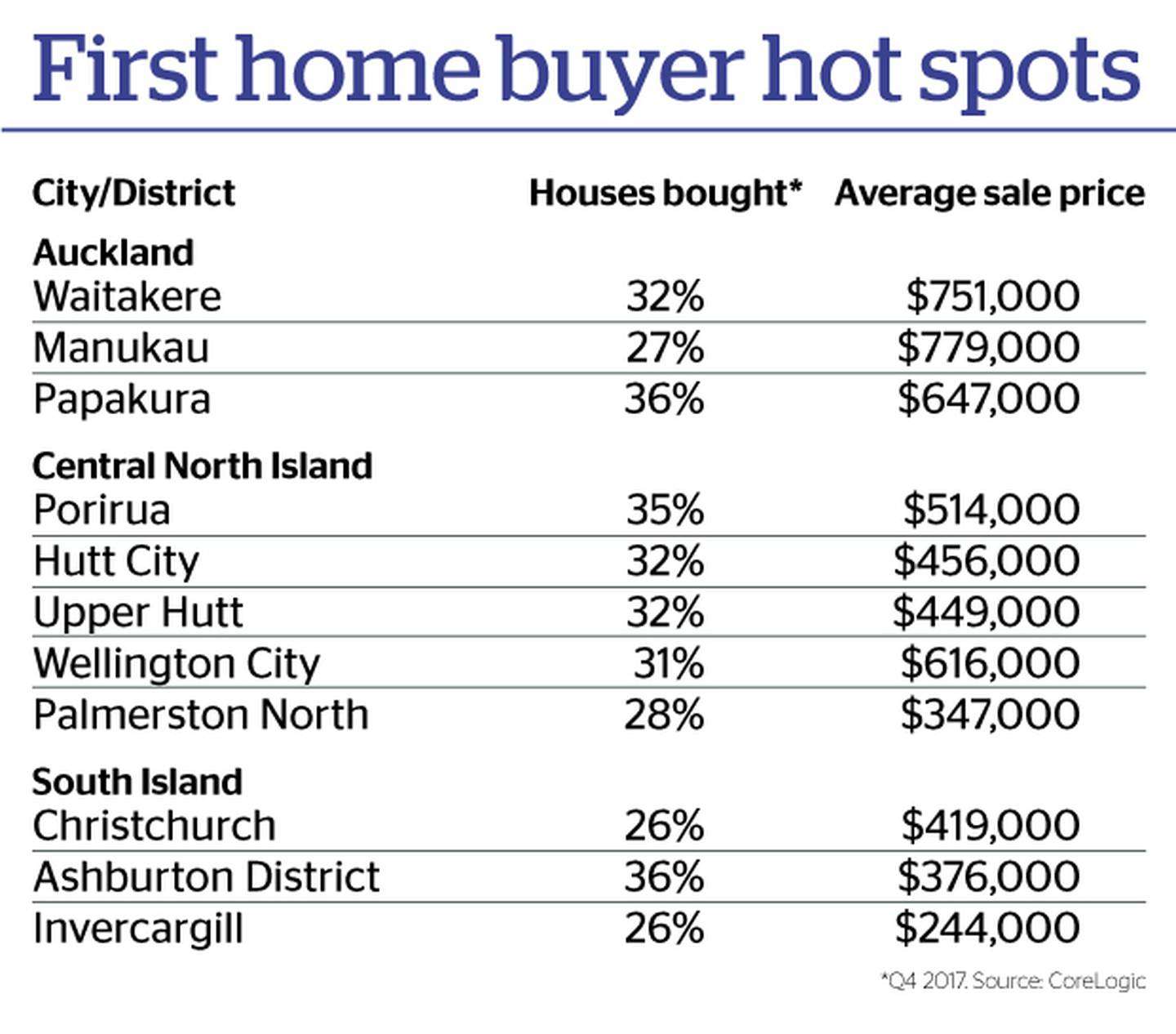

West Auckland is the hottest part of the country's biggest city for first-home buyers, who paid an average of $751,000 for their houses.

That's according to ANZ research, which found that first-home buyers made up a third of all property buyers in Waikatere during the last three months of 2017.

A third of properties sold in Papakura in that time also went to first-home buyers, who paid an average of $647,000.

Start your property search

ANZ, the country's largest bank, said that 22 per cent of property sales across New Zealand during the three months to December were to first-home buyers.

That's up from 17 per cent three years ago, when stricter loan-to-value restrictions were in force.

Those rules, which meant only 10 per cent of bank lending could be issued to buyers without a deposit of 20 per cent or more, have since been relaxed.

"Homeownership is the dream of most New Zealanders. We know it's been a real stretch for many first-home buyers to get their foot on the ladder – particularly in Auckland - so it's great to see more coming into the market," said ANZ managing director retail and business banking Antonia Watson.

Meanwhile, an ANZ survey of 1000 people found 39 per cent of those who didn't own a home thought one was out of reach.

"In Auckland, we've also seen the number of movers [property owners moving from one house to another] drop significantly – from 25 per cent to 22 per cent of the market," said Watson. "This is the lowest level since 2009 and could reflect that more Auckland homeowners are staying put in an uncertain market."

Watson said first-home buyers in Christchurch were at record levels, accounting for almost 26 per cent of the market.