The swift downward turn in New Zealand’s property market is getting attention from other parts of the world, although industry spokespeople say homeowners here should not worry too much about gloomy headlines from overseas.

Three recent reports have highlighted New Zealand, and Auckland and Wellington in particular, as dropping down various economic outlooks/rankings.

Knight Frank’s latest Global Residential Cities Index sees Auckland drop from No.24 to No.105 in the rankings.

Knight Frank picks out New Zealand’s biggest city as one to watch, noting that its price growth has dropped from 22.7% in the first three months of 2021 to 5.1% in the first three months of this year.

Start your property search

Auckland has also fallen hard in the latest Global Liveability Index, by the Economic Intelligence Unit.

Last year, the index, which “quantifies the challenges presented to an individual’s lifestyle in 173 cities”, placed Auckland and Wellington at the top of its rankings, but Auckland has tumbled from its No.1 spot to No.34 and Wellington dropped from No.4 to No.50.

The report’s authors say the relaxed Covid-19 restrictions in some parts of the world had led to big shifts across the index, adding that New Zealand scored highly in early 2021 when Covid vaccines were scarce because the country’s closed borders kept cases down and liveability high.

However, that changed as a more infectious Covid-19 wave struck late last year which made closed borders less of a defence and now New Zealand no longer has a Covid advantage over well-vaccinated European and Canadian cities.

The third report to give New Zealand a drubbing is from Bloomberg Economics. The report, which analysed the risks facing 19 OECD countries, put New Zealand at the top of its risk table, noting that the country’s “once-hot” housing market had turned cold, a strong sign that its economy was vulnerable.

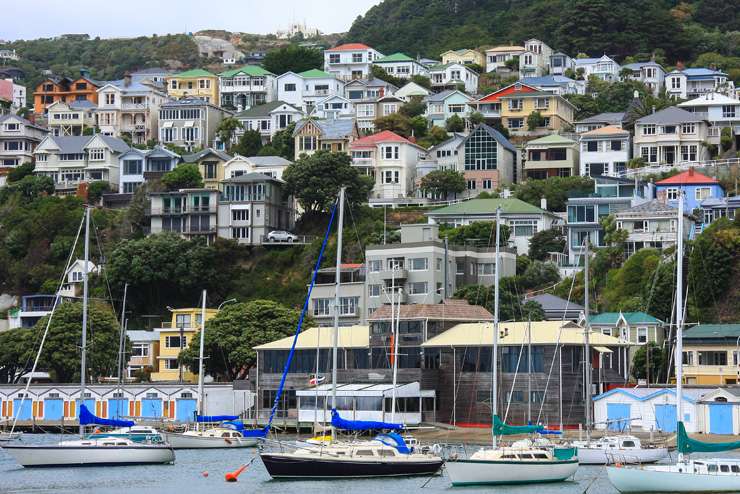

Wellington has dropped from No.4 to No.50 in the Global Liveability Index. Photo / Getty Images

The report, which was topped by the headline "The World’s Bubbliest Housing Markets Are Flashing Warning Signs", cites the Reserve Bank of New Zealand’s semi-annual Financial Stability Report saying the overall threat to the financial system is limited but a sharp decline in house prices is possible which could significantly reduce wealth and lead to a contraction in consumer spending.

Chris Farhi, head of insights at Knight Frank’s New Zealand partner, Bayleys, said the Global Residential Cities Index showed that Auckland and Wellington were ahead of the curve.

“In terms of the global rankings, the New Zealand housing market has faced a combo of tighter bank lending criteria, from the CCCFA changes in late 2021 to higher interest rates. This has calmed the market ahead of other countries, which largely explains the drop in the rankings for Auckland and Wellington,” he said.

“Other countries are facing similar inflationary pressures and we’re now seeing Australia, UK and United States starting up on their tightening cycles, too. That’s likely to calm the price growth in those markets too.”

James Wilson, head of valuations at Valocity, OneRoof’s data partner, said New Zealanders shouldn’t be overly worried, as global reports tended to be subjective and their rankings were generally volatile.

“You often see cities or countries jump around quarter on quarter or year on year,” he said. “It's a way to measure or rank different locations but does it necessarily mean that your city is worse than somewhere else, or better this quarter and worse the next quarter. It's just sort of a way to yardstick and group cities,” he said.

He said the reports’ findings may not be relevant to most Kiwi homeowners. “Was the fact that the last time the index was run and Auckland scored higher last time than it did this time impact you as a current homeowner?”

“The city that you bought your home and live in is still very much the city that it was on paper the day before the report was released.”

Valocity head of valuations James Wilson says the reports’ findings needn’t worry Kiwi homeowners too much. Photo / Fiona Goodall

He said that “all sorts” of economists and professionals were forecasting different outcomes for where the world would eventually land post-Covid; some of the forecasts may come true but some may not.

Wilson urged homeowners to look at how much their biggest asset had risen in value the last 12 to 24 months. “You are probably in a pretty good position already if you owned before the last wave of value growth came around,” he said.

Kelvin Davidson, chief economist for CoreLogic, said the reports’ findings weren’t surprising. “We know that house prices are falling. I don't think there's anything shocking in that,” he said.

“Any number of stats are coming out every day on the turn-around on the housing market so I don't think there's anything surprising if we're slipping down global tables because we know we've slowed.”

Davidson said that New Zealand had moved first on issues like inflation so was to some extent the “canary in the coalmine” and that was attracting overseas interest. “People are looking to New Zealand in terms of what’s happening - when you start pushing up interest rates sharply what happens to inflation? What happens to the economy? What happens to housing?”

Davidson argued the main impact of such reports was psychological. “If people see this kind of analysis and the stark headlines, then there's a self-fulfilling element here, ‘oh no, I'm scared, I'm going to run for the hills’, and that causes house prices to fall a bit more.”

Kiwibank chief economist Jarrod Kerr: “It’s important to get a feel for just how bad our problem is.” Photo / Fiona Goodall

There were stresses in the market, such as mortgage payments rising sharply and house prices still high in relation to incomes. But there were also buffers and reassuring factors, such as, low unemployment, which is a “huge” support for the property market, and serviceability tests meant theoretically people can service higher mortgage rates.

But in the end, when one person’s house price falls in this market, so does the one next door.

“Are you really worse off? It's perhaps not so obvious that you are worse off if you plan to move and you're getting a cheaper purchase, so you might sell for 10% less but you buy for 10% less. I think there are still more falls to come for a house prices but it needn't turn into a huge crash as long as unemployment is low.”

Kiwibank’s chief economist, Jarrod Kerr, said the reports’ findings were important, although mainly for “economists like me and journalists”.

“I think at the moment it's important because all central banks are tightening together and all central banks are trying to call inflation in their markets so it has been quite interesting how property markets around the world reacted in the post-Covid world,” he said.

“We saw central banks and governments throwing lots of money at it and we saw housing markets around the world taking off, and now we've got central banks in similar situations trying to cool housing markets, trying to cool inflation.”

While New Zealand is its own beast compared to what other countries are doing, what’s happening was worth watching, Kerr said.

“What's interesting is that New Zealand is very unaffordable compared to other countries and that's a problem we have developed over recent decades,” he said.

“It’s important to get a feel for just how bad our problem is. When I say bad, I mean our housing shortage - our housing shortage is pretty chronic and that's why we stick out on a lot of those metrics as being highly unaffordable.”

Kerr didn’t think the market is about to implode, however. “I think we're going to see further declines in house prices, for sure. There's no doubt the housing market is in retreat but a full implosion implies people defaulting and really, really bad things happening and I don't think we'll see that. We've got such a strong labour market, people aren't unemployed and aren't forced to sell.”