Releasing equity in an Auckland home and selling up for the cheaper regions can seem like an attractive idea with tens of thousands of Aucklanders doing it during the pandemic, but is the grass really greener?

Real estate agents, economists and mortgage brokers agree selling up your Auckland property and moving to the regions can release equity and reduce financial strain, but those considering a move should carefully consider jobs, exactly where they want to live, what support networks they have and the reality of living in the regions, before taking the plunge.

EasyStreet Mortgages financial advisor Gareth Veale said many homeowners in Auckland could buy twice the property in the regions. Figures from OneRoof partner Valocity show Dunedin represents the best value with house prices 50 percent cheaper than in Auckland. Palmerston North followed closely behind at 48 percent cheaper. Christchurch and New Plymouth also represented good value at 41 percent and 42 percent cheaper than Auckland.

Start your property search

“It depends on the stage of life you are in. If you want to release equity and have a bit more financial freedom and you have a $2 million house in Auckland, you can sell and downsize or get a similar home for $1 million leaving you with $1 million to put into another property that can give you a return and provide growth,” said Veale.

He said people also needed to be prepared for the reality of the regions however, entering a new smaller community and less access to a lot of the things Aucklanders take for granted from high end restaurants to trips across to Waiheke.

Mark Keesom, Ray White Hamilton Principal, said agents were seeing a lot of Aucklanders showing interest in Waikato, with 40 percent of enquires for lifestyle properties coming from Aucklanders. Housing in Hamilton was 38 percent cheaper than Auckland according to Valocity figures.

Read more:

- The 35 cheapest city suburbs where buyers can still grab a bargain

- NZ's most popular beaches: Hot spots that command mega-millions

- Will homeowners be rewarded with a interest rate cut in 2024?

St Heliers homeowners Vaughan and Lisa Edge sent their home at 51A Edmonds Street to auction on December 13 and are moving to Cambridge.

“It’s time to get out of Auckland. We don’t want to keep working until we’re 65 and, while we’re very comfortable, we can’t continue having the lifestyle we enjoy and living in Auckland,” said Vaughan.

The couple were tired of battling Auckland’s traffic congestion and the population growth.

“If you want to go to Newmarket you have to plan for half a day. Cambridge reminds me of New Zealand in the 1980s and there are no traffic lights.”

Vaughan said he wasn’t worried about losing any potential further capital gains in the more expensive Auckland market.

“We built in 2013 and we have been through two property cycles. I think you must draw a line of when you do have enough. We could stay for another five years and another property cycle, but we have enough and we’re ready for a slower pace of life.”

The owners of this four-bedroom in Auckland's St Heliers put the property on the market for sale and are shifting to Cambridge. Photo / Supplied

Wayne Shum, senior research analyst at OneRoof's data partner, Valocity, said selling up in Auckland could be a good decision, but he cautioned people to test the water where they were wanting to live.

He said selling a three-bedroom house in Mangere Bridge or Onehunga at $1.1 to $1.2 million could see buyers get a four-bedroom standalone home on its own site in Christchurch or a lot more house in Hamilton for the money.

“If you have two or three kids it’s the question of, do you want a two- or three-bedroom house in Auckland or do you want a three- or four-bedroom house with a bit more land outside of Auckland?”

He said retirees could sell an Auckland house for $1.2 million and buy something in New Plymouth for $750,000 and have the balance to live on if employment and jobs was not a factor.

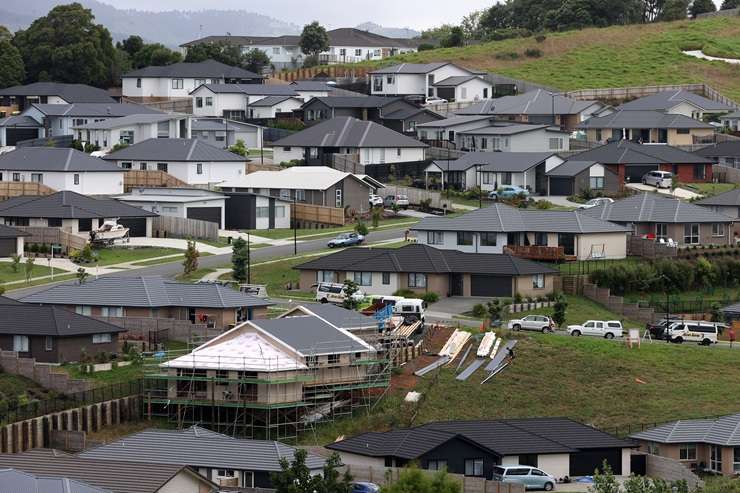

Moving from Auckland to smaller metros such as New Plymouth in retirement can be a boost for the bank account. Photo / Getty Images

“People do need to consider their family and support system before taking the leap,” said Shum.

Campbell Hastie, from Hastie Mortgages, advocated for renting before moving to explore potential value and the suburbs people want to live in and so people can be sure they really want to make the move.

Mortgage broker Evan Kaska from Vega mortgages moved from Warkworth to Matarangi on the Coromandel and is living with family until he and wife Toni buy a property.

“People are discovering that you can work remotely. I can still do mortgages from here and have been doing a lot of new builds in Invercargill. You don’t have the traffic, there are great schools, and the lifestyle is incomparable,” said Kaska.

He moved with Toni and their two children and while Toni was initially cautious, they now have no plans of returning.

“We are living with family until we buy here, but we kept our house in Warkworth which has essentially just become another suburb of Auckland,” said Kaska.

“We thought if it doesn’t work out, we’ll just go back. It didn’t take long for us to realise it was the right decision.”

Warkworth, on Auckland's northern fringe, is popular with buyers who don't need to commute. Photo / Fiona Goodall

LJ Hooker Dunedin, Principal Jason Hynes, said there has been noticeable lift in enquiries from all over the North Island.

“We attributed it to the fact Dunedin had such a great summer last year. The draw card of living in the North Island is the warmer weather and if you don’t have that you might as well head to Dunedin,” said Hynes.

For $1 million he says people can buy a recently built contemporary home on a decent block of land freehold. “A lot of people comment you don’t get much in Auckland for that same money.”

John Farrell has been in Wellington 35 years and is moving to Dunedin to be closer to his son and daughter in law and their three children.

Now separated, he said he couldn’t afford what he wanted to buy in Wellington and prices in Dunedin were around $200,000 cheaper.

“My children went to Otago University and I know the city reasonably well and I like it. It’s a good decision for me.”

- Click here to find properties for sale