It’s well-known that the residential property market in Greater Christchurch is currently pretty subdued. The number of sales is low around Waimakariri, Selwyn and Christchurch City, while values are patchy. Over the past year, they’ve dipped by 0.5 per cent in Christchurch City, stayed flat in Waimakariri, and edged up by 0.9 per cent in Selwyn.

By contrast, the national average value has risen by 7.6 per cent over the past 12 months. However, every cloud has a silver lining – and there are good reasons why Greater Christchurch could actually be considered the best-oiled market in the country.

The general flatness of property values in the area reflects the previous growth in new supply. Yes, there has been strong population growth in Waimakariri and Selwyn, while Christchurch City has also passed its pre-earthquake levels.

But new construction has kept pace and in Selwyn in particular it continues to hold up at very high levels. For four years now, annualised new dwelling consents have hovered at around 1,200 in Selwyn – in the decade to 2013, the average was half that figure.

Start your property search

However, rather than spinning it as Greater Christchurch having a weak and oversupplied housing market (which is the typical line taken by most analysts), you could alternatively say that this abundance of supply provides opportunities for all types of buyers and allows for a fluent and well-functioning market.

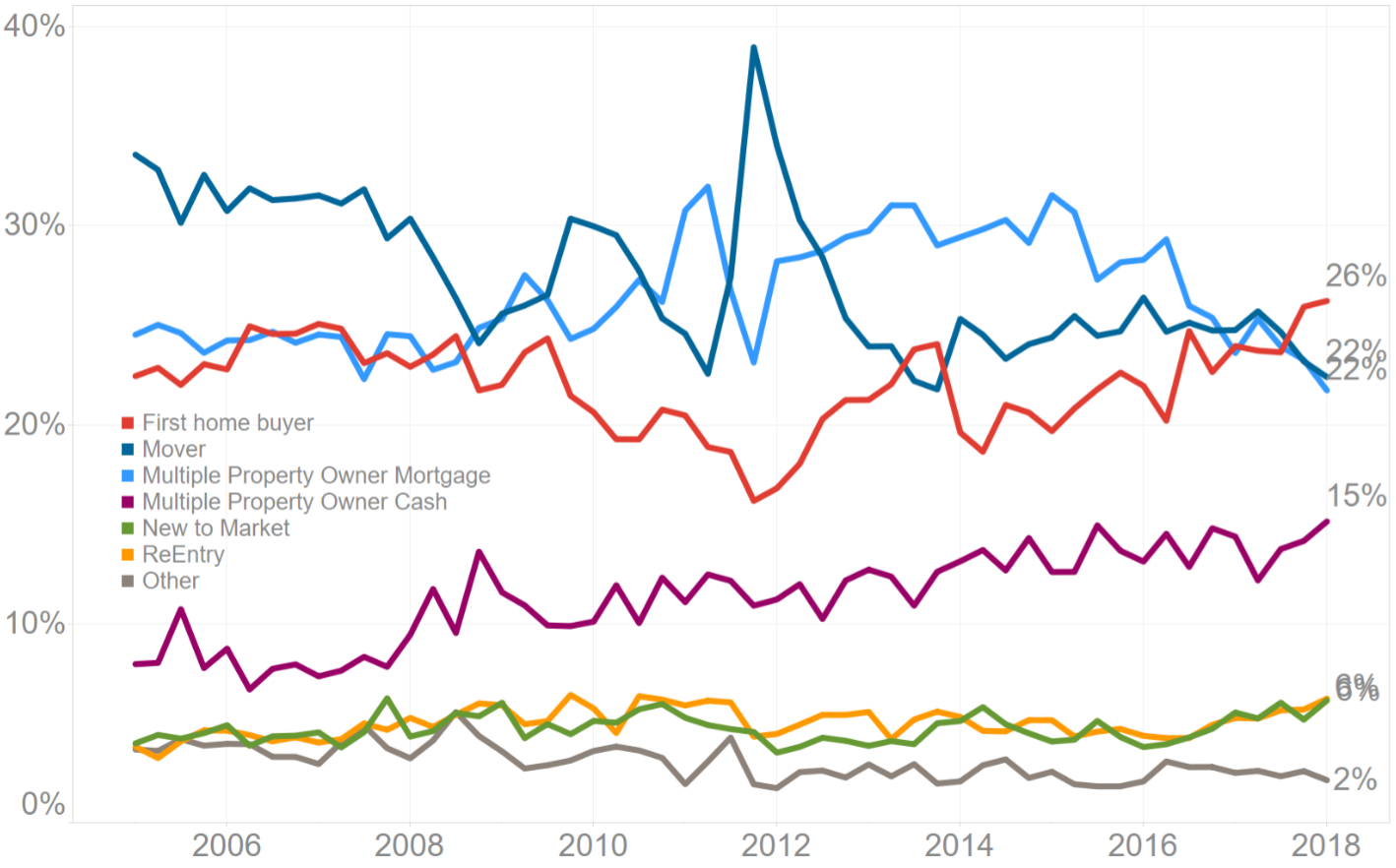

Certainly, our proprietary buyer classification data shows that Christchurch City is currently a great market for first-time buyers. At 26 per cent (NZ = 22 per cent), their share of property purchases is higher than it’s been since at least 2005 (albeit in a market where the level of activity for all buyer types is lower than normal).

Multiple property owners (e.g. investors) with a mortgage still make up a decent share of sales (22 per cent) in the city, but that figure has drifted lower recently, as it has for movers.

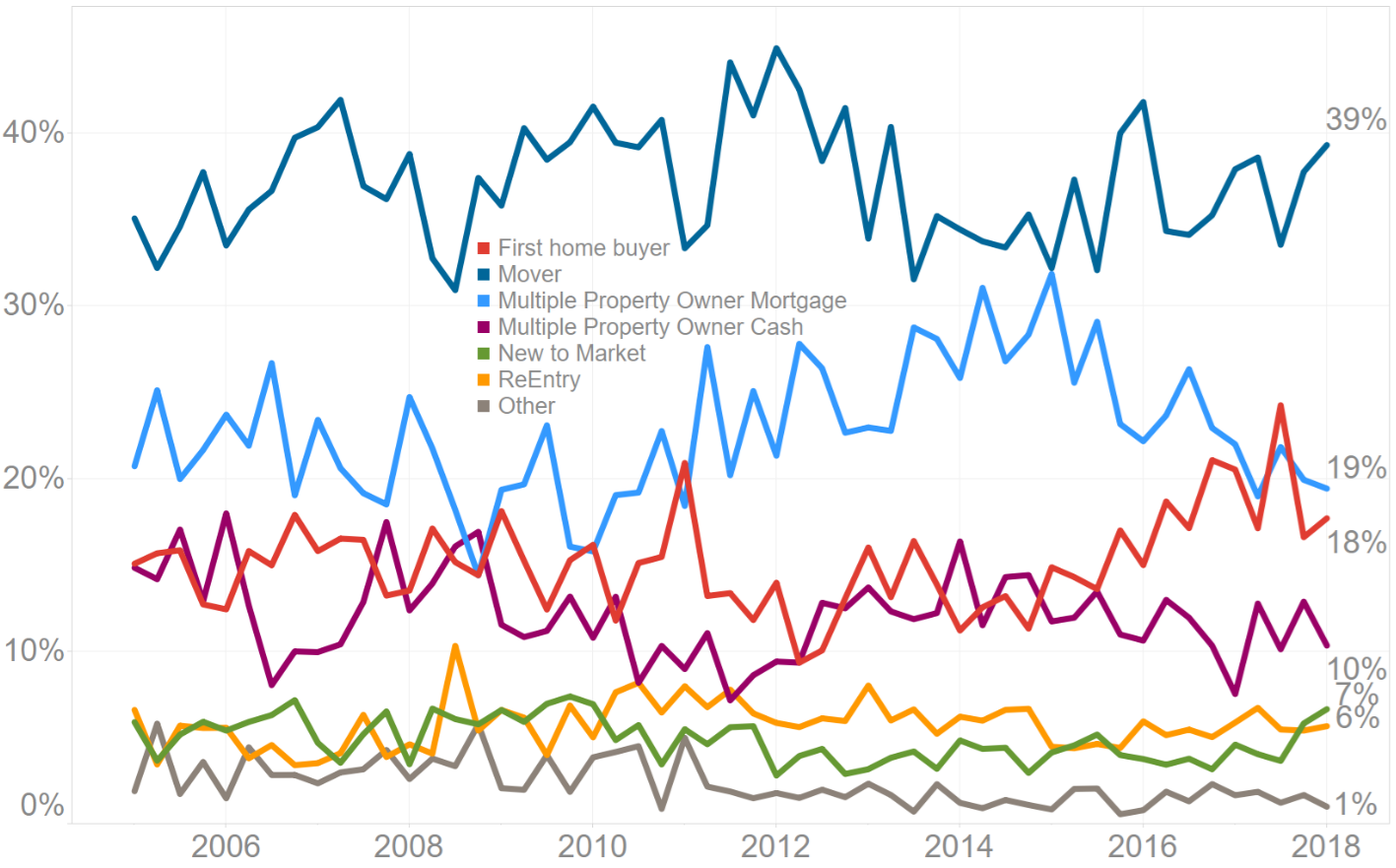

A different situation applies in Selwyn. There, first-time buyers are much less active, accounting for about 18 per cent of the market, similar to the share going to multiple property owners with a mortgage (19 per cent).

By contrast, Selwyn is a mover’s market, with this buyer group making up 39 per cent of sales in Q1 2018. Given that many of the recent new dwelling completions in Selwyn are larger and more expensive than is typically the case (partly because land is readily available and plots are relatively big), it’s no surprise that people who have already built some equity through their current property are more active in the area than first-time buyers. Note here too that Waimakariri is also a mover’s market.

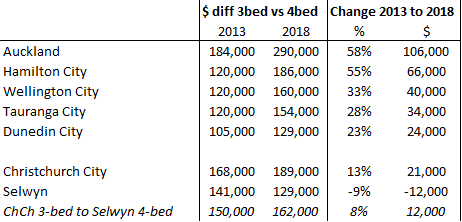

It becomes even clearer to see why Selwyn is a mover’s market when you consider that it has recently become easier to trade up from a three-bedroom (a typical target for a first-time buyer) to a four-bedroom property (potentially the ideal choice for a second property on the ladder).

In 2013, our figures showed that the price difference between a three-bedroom and four-bedroom property in Selwyn was $141,000. This has dropped over the past five years to $129,000. But not only that, it’s cheaper to move from a Christchurch three-bedroom property to a four-bedroom property in Selwyn ($162,000) than it is to trade-up within Christchurch ($189,000). A dig into other figures on our database shows that most upsizers in Selwyn have recently come from Christchurch.

To put all of this into practical terms, the data shows that new construction and a good selection of property available across different quality and price levels has allowed all buyers in Greater Christchurch to find their niche. For example, existing owners with a higher base of equity behind them have been able to trade up, often moving out of Christchurch to a bigger property in Selwyn. In turn, that has freed-up stock in the city for first-time buyers. It is worth noting here that the average property value in Christchurch City of around $493,000 is comfortably lower than Selwyn’s $550,000.

So rather than being a market where the ‘mistake’ of too much construction has been made, you could actually say that the Greater Christchurch area is one of the best-functioning property markets in the country. Except for the apartments that would provide for central-city living in Christchurch (although these are reportedly on the way), there is plenty of stock available around the city and neighbouring districts to cater for all types of buyers.

In that context, flat or modestly falling house prices in the area shouldn’t always be thought of as a bad thing. After all, we all know that ever-rising prices in other parts of the country in many cases have simply transferred wealth from the younger generation (often renting, would-be homeowners) to the older cohort. And that affects existing home-owners too – for example, a 10 per cent rise in values across the market means that owners of first homes have to raise a larger amount in dollar terms to take the next step up to the second rung of the property ladder.

Thinking more generally, this just reinforces yet again the importance of ramping up the supply of new properties in other parts of the country, most critically Auckland, to allow for a free and easy flow of buyers between the different segments of the market. Clearly, rampant and out-of-control new construction is not desirable and would undermine property values as well as create financial stability risks, whether that is Greater Christchurch, Auckland, or anywhere else. But what the Greater Christchurch experience does illustrate is that an orderly increase in the housing supply can deliver very positive outcomes.

- Kelvin Davidson is Senior Research Analyst at CoreLogic

This story was originally published at corelogic.co.nz and is republished with permission.