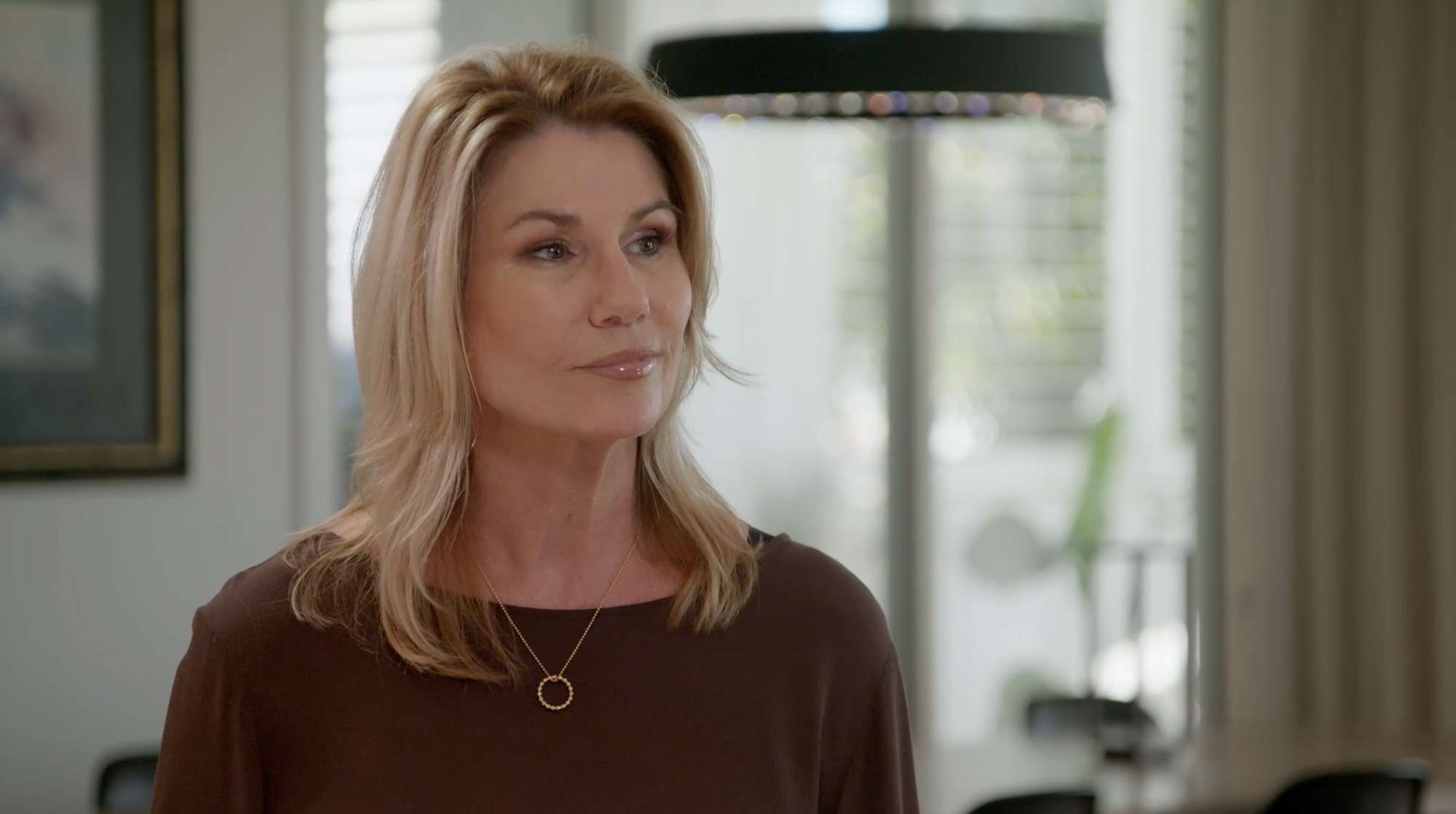

AA Insurance Location, Location, Location NZ host Jayne Kiely has a sobering story that every homeowner in the country can learn from.

When AA Insurance expert Tom checked in with Jayne on Episode four, she recounted her own personal experience with a house fire and home insurance.

“It’s great to finally meet you,” Tom says to Jayne as they meet for the first time. He goes on to ask “Most people probably don't know this, but you've got an interesting story. Do you mind sharing that with us?”

Jayne recounts her experience of having a fire in her own home, leading her to make a claim on her insurance. “It was back in 2004. We were renovating our home and we had a house fire. My husband and I weren't there at the time, but it was a major and it was pretty devastating. We didn't realise when we assessed the damage and made the list that we were grossly underinsured.”

Start your property search

“It's very sobering. It was a big wake-up call for a lot of our friends,” Jayne tells Tom. “It really trickled down, and so they all made sure that they had enough home and contents [insurance] to cover themselves in case the same thing happened to them. Because you just never think it's going to happen to you,” she says.

Don’t set and forget when it comes to home and contents insurance

Tom says he’s sorry that Jayne and her family had to go through that experience. “But as you said, it's really important to make sure that you are checking regularly, your sum insured for your home and your contents. It's not a set-and-forget thing that you just forget about for years.”

Tom highlights the importance of reviewing your insurance on a regular basis. If you do any work to your house that adds value, get in touch with your insurer to update your sum insured so you’re covered for that increase in value.

While speaking to Tom, Jayne shares with viewers a few lessons she learnt as a result of her experience. “Take a pad and pen, walk around your house and work out what everything would cost to replace and photograph it. Keep it separate from the house,” she says.

"That’s a really great tip", Tom replies. “Another tip that some people do use is actually going around and just filming your rooms, and so at least when you are putting a list together should anything happen that you've got a good record of what was in each room as well. That really helps too.”

What is a sum insured?

Sum insured is referred to in both home and contents insurance. From a contents perspective, sum insured is the total amount your contents are covered for. Online calculators can help you calculate the value of your contents and it’s important to regularly review your sum insured so you have enough cover to replace your belongings if you come to make a claim.

For home insurance, your sum insured is agreed to with your insurer when you first purchase your insurance, and each year upon renewal. Depending on your provider, it can be the maximum amount that your insurer will pay to rebuild your home. Your sum insured isn’t the market value of your property or how much you paid for your house; it’s based on the cost to rebuild your home and is unique to each individual property. There are several ways you can calculate your sum insured, including contacting an expert like a builder, architect or quantity surveyor. Alternatively, you can use the online Cordell Sum Sure Calculator which helps estimate typical building costs for standard residential houses.

Talk to your insurer before buying

Before you put an offer in, it’s a good idea to look at your options for home insurance, read the policy wording and, when you’re ready, get a home insurance quote. This way, you can understand the terms of the insurance cover and its cost so you can account for insurance premiums in your overall budget. A premium is the ongoing dollar amount that you pay for an insurance policy each year. There are many factors that can impact the amount of premium that insurers charge, such as what you’re insuring, its location, the sum insured and government levies and taxes. If you have any questions, get in touch with your insurer.

You can watch Episode four of AA Insurance Location, Location, Location NZ on TVNZ+

New episodes of AA Insurance Location, Location, Location NZ air Sundays 7.30pm on TVNZ 1 and TVNZ+

Need Home Insurance: We Have You Covered With Our Checklists