The property market market in Auckland's North Shore went into the Covid-19 environment in its strongest position ever – with both February and March having the highest median prices on record at $1,155,000 and $1,125,000 respectively.

The lockdown hasn’t appeared to impact prices with April showing the third highest median price for the North Shore on record at $1,108,000. However, it is imperative to note, that it is still very early days and it will be a few months before we really understand the full impact of Covid-19 on the property market.

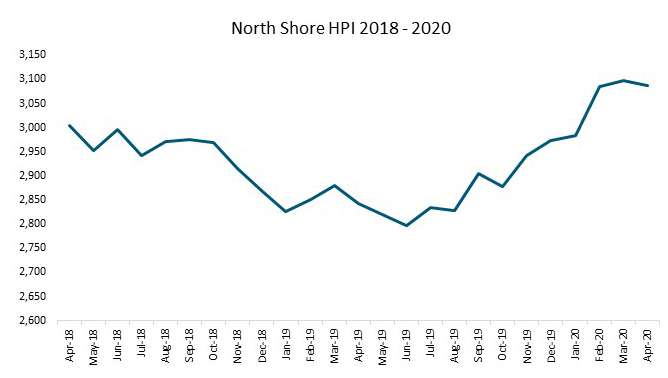

Looking at the breakdown of these sales, over the last three months nearly 60 percent of sales have fallen into the $1 million plus bracket. So, in order to understand whether it’s just that higher numbers of "more expensive" properties are being sold or whether the underlying value of the market is holding up, the Real Estate Institute of New Zealand uses a house price index that strips out changes in property size (e.g. bedrooms) to help understand how a market is performing. You can see from the graph below that the North Shore’s market has been performing well over the last few months. Again, time will tell how things are looking in the future.

Start your property search

Talking to a number of agents across the North Shore, the market has changed dramatically over the last few weeks. Initially people were quite concerned, especially when they were looking at what was happening in international markets. Some people went as far as pulling their property off the market, but these instances were few and far between. Most people just held tight and continued with their marketing campaigns, relying on the experience and expertise of their agent to guide them through the sales process with digital tours and online auctions.

Despite Auckland being made up of seven "territorial authorities", the North Shore actually saw just shy of a fifth of all properties (19 percent) sold in the Auckland region during lockdown – the highest percentage behind Auckland City on 32 percent.

However, now that we are in Level 2, people’s confidence is starting to return. Open homes over the weekend have been busy and the buyers that are visiting appear to be extremely motivated purchasers and we’re hearing examples of properties that hadn’t sold prior to lockdown now receiving multiple offers, suggesting there are good levels of confidence in the market.

We are also seeing a lot of investors active in the market. Some with bigger portfolios, particularly baby boomers with several rentals, are seeking to sell some or all of their portfolio and then younger investors are taking advantage of those opportunities.

First home buyers are starting to be more active in the market, particularly with the low OCR and the removal of LVRs which is making this an absolute opportune moment for those who have finance approved to purchase.

School zones are still extremely important with school age children and unsurprisingly properties with a bit more backyard space, extensive decking and office space are proving extremely popular at the moment. People are still quite conscious of how it felt to be locked up in their property for a number of weeks and are conscious that the Alert Levels could change again should the number of COVID cases start to spike again. Some agents are talking to families who have been living in Ponsonby or Grey Lynn and they’re now looking at areas such as Dairy Flat just to "get away from things" a little more.

One of the most important things any market wants is stability, and this is true of the property market too. Too many new listings can flood a market and not enough listings means that demand outstrips supply, pushing up house prices making it unaffordable for people to get onto the market – especially first home buyers or those who may be concerned about long term financial security.

Taking a look at listings over the past week, there is a steady level of new listings coming to the market across different suburbs covering the North Shore. This is important, as buyers need choice. Interestingly, there doesn’t seem to be a single sales method that is the preferred method at the moment, instead it’s a mix of negotiation, set prices and auctions. It will be interesting to see if this changes at all over the coming weeks.

Going forward, with increasing numbers of expats looking to return from overseas, good levels of buyer and seller confidence and stock levels still remaining relatively low, those who are hoping for a "bargain" may be disappointed. Our advice to people is to seek good advice and if you find a property you love and you can afford it, then don’t wait as you may be disappointed as someone else makes a good offer for the property.

- Bindi Norwell is Chief Executive at the Real Estate Institute of New Zealand